The Japanese Yen Plummets against Dollar and Pound, More Losses Possible

Image © Adobe Stock

- GBP/JPY spot: 143.65, +0.60%

- Bank transfer rates (indicative): 138.63-139.64

- FX specialist transfer rates (indicative): -141.00-142.37 >> More information

The big eye-opener on global foreign exchange markets at the mid-week stage is the sharp and decisive decline in value in the Japanese Yen, a currency that is not known for its firework displays and there are suggestions by a number of analysts that further losses are possible.

The Yen appears to have fallen victim to a combination of fears the Japanese economy could be about to enter a recession, a sharp improvement in global investor appetite and a technical breakdown in the market.

"The ghost of deflation is once again hovering in Japan," says Thu Lan Nguyen, a foreign exchange analyst at Commerzbank. "Following the sales tax hike which had already put pressure on the economy during the last quarter, it is now feared that the effects of the corona virus might have caused the second quarter of negative growth."

The Yen proved relatively resillient in the face of Monday's data release that showed the economy shrank 6.3% year-on-year in the final quarter of 2019, with the market instead opting to focus on the global picture that has been relatively supportive of the safe-haven Yen which tends to benefit when global investor sentiment sours.

However, it appears that something has suddenly snapped in the market's assessment of the curency.

The Dollar-to-Yen exchange rate (USD/JPY) shot higher in the mid-week session by 1.14% to quote at 111.15; this is the lead Yen pair to keep an eye on, as moves here will dictate moves in other Yen exchange rates.

The Pound-to-Yen exchange rate (GBP/JPY) is up 0.60% at 143.71, which is quite telling as the Pound was one of the day's laggards, losing ground against the majority of the world's major currencies.

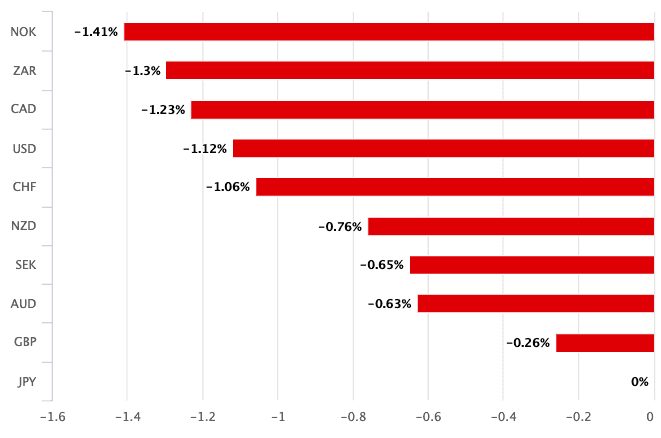

Above: The Yen's performance on Feb. 19

So what is behind the decisive move in the Yen?

"The yen is completely falling apart today, and while we think it’s safe to say some of the early moves today were risk-on driven, we’d argue there’s some “sell everything Japan” vibes in the marketplace today following a Bloomberg report that said Japan could become the largest hotspot for coronavirus infections outside of China," says Erik Bregar, Head of FX Strategy at Exchange Bank of Canada.

While the Yen has long benefited from safe-haven flows, the kind that you would expect the coronavirus outbreak to generate, there were always questions being asked as to whether the Yen was in fact the best safe-haven option. After all, Japan's proximity and trade exposure to China please it at risk of any significant deterioration in the virus outbreak.

While the coronavirus story familiar to anyone giving even a cursory glance at global financial markets, it still doesn't quite make sense that the market has suddenly decided now is the time to punish the Yen.

John Hardy, Head of FX Strategy at Saxo Bank says the drop in value says the explanation for the move is likely to be more technical in nature.

"It is about as straightforward as it gets - a tight range in a very quiet market followed by an explosive move higher through a major resistance level - classic momentum move and the softness in safe haven fixed income later in the day brings a bit of fundamental support as well," says Hardy.

For Hardy the move is therefore technical and what's more, further gains are likely as if often the case when a break-out of this kind occurs.

"USD/JPY has ripped higher in move that looks particularly jolting because of the extremely compressed daily range before the break. If the move holds into the close, the pair is looking at a new 200-day high close and potential for an extension higher," says Hardy who eyes a target at 114.50.

We would therefore not be surprised if one of the foreign exchange market's theme for the remainder of the week is more Yen weakness.