Pound-to-Dollar Rate in the Week Ahead: Recovery Losing Momentum After Meeting 50-day MA

Image © Nazli Sart, Adobe Stock

- GBP/USD has pulled having encountered a tough resistance point

- Extension of young up-trend now in doubt

- Main release for Pound is sector PMIs whilst for Dollar Payrolls are the main data print

The Pound-to-Dollar exchange rate has stalled in its recovery despite an improvement in the outlook for Brexit deal talks.

Negotiators said good progress was being made at a press briefing on Friday following another week of negotiations, allowing the Pound to end the week on a high against the Euro, although it remained under pressure versus the Dollar which appeared to strengthen on safety flows as trade war fears re-emerged.

Indeed, for GBP/USD direction looks to be highly dependent on what the Big Dollar decides to do.

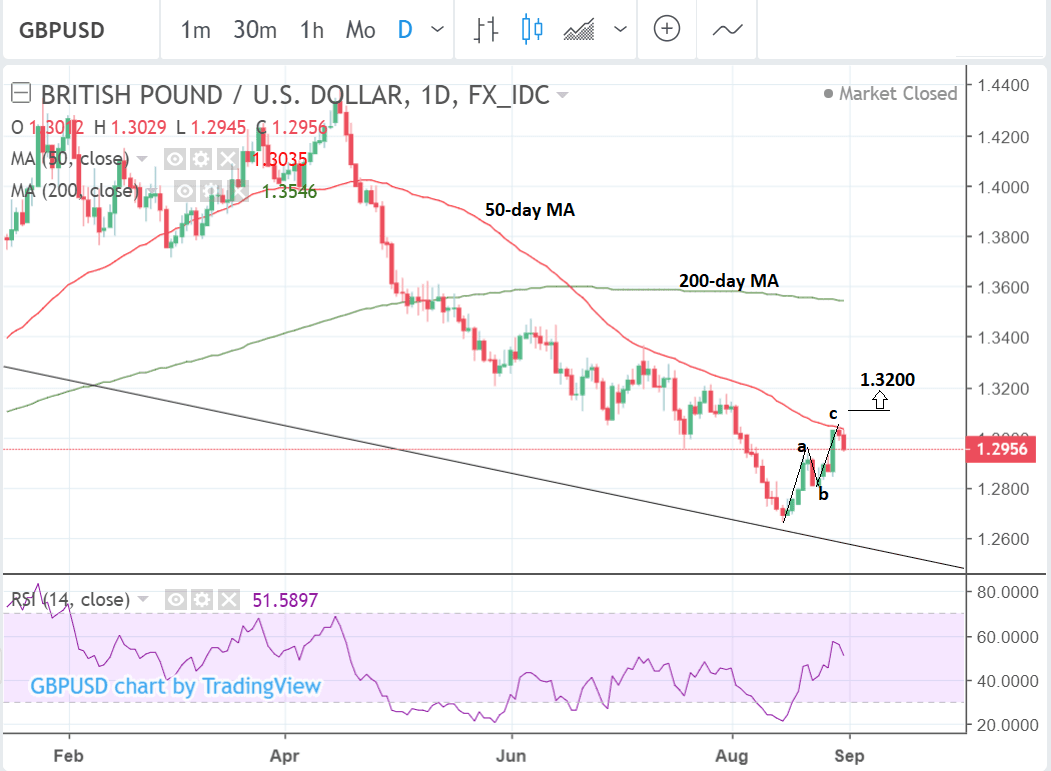

GBP/USD recovered to highs of 1.3043 after rebounding from the 1.2662 lows established on the 15th of August.

The pair stalled after touching the 50-day MA, however, and has since pulled back down to the 1.2950s.

During its recovery the pair has formed what looks very much like a three-wave ABC correction of the dominant downtrend. This suggests the downtrend may still be intact and the pair could resume going lower from here on in.

A view of the 4-hr bar chart, however, advises different and suggests the short-term trend may now be 'up' rather than 'down'.

A rotation in peak and trough progression higher is clear on this chart which is used by many analysts to establish the direction of the short-term trend. Whilst I would not say it is definitively bullish, it does support the case.

In our view the 50-day MA is a game-changer - with a clear break and close above it supporting the potential for a reversal in the trend, as well as establishing two higher highs and lows on the daily chart; but a failure to break above it, leading to a probable decline back down to the 1.26 lows, if not lower.

For confirmation of such a break we would want to see a move above the 1.3100 level, as things stand, with an initial target at 1.3200, although the monthly pivot at 1.3155 may also pose substantial resistance too, and is likely to lead to a temporary pull-back en route higher.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Dollar: What to Watch

Non-Farm Payrolls (NFPs) is the main release for the US Dollar in the week ahead. It is forecast to show a 190k rise in jobs in the US in August against 157k recorded in July.

Average earnings will be released at the same time. Wages are as important to the Dollar as the headline payrolls' figure. A rise of 0.2% is forecast but a higher-than-expected result would be bullish for USD, and vice versa for lower. Higher wages mean higher consumption and growth usually, which is good news for the greenback.

The other key release for the Dollar is manufacturing and non-manufacturing sector data from the Institute of Supply Managers (ISM).

Manufacturing ISM is expected to come out at 57.6 in August, which is below the 58.1 result in the previous month of July, when it is released on Monday at 15.00 B.S.T.

Non-manufacturing ISM is expected to show a rise to 56.5 from 55.7 when it is released on Thursday at 15.00.

A result over 50 is indicative of expansion and below of contraction.

ISM surveys ask supply managers about their view of activity in their sector and collate the responses in a gauge. A higher-than-expected result would be positive for the Dollar and vice-versa for lower.

Other key data for the Dollar includes the trade balance on Wednesday as well as a lot of commentary from Federal Reserve officials all through the week.

ADP Employment Change which provides an alternative payrolls figure to NFPs is out on Thursday but it is not a reliable indicator of what NFPs will be.

Durable goods orders are also out on Thursday and oil data including an OPEC meeting kicking off on Monday also pepper the econ calendar in the week ahead.

The Dollar may also gain a boost if Trump goes through with slapping the extra 25% tariffs on $200bn more goods from China which looks increasingly to be the case.

Disappointing progress in NAFTA negotiations with Canada also means risk from that source. If geopolitical trade-risks continue to escalate it will benefit the USD which tends to rise from safety flows in these situations as well as lower supply due to expectations of less imports.

The Pound this Week: The Calendar Heats up Again

Beware, politicians return to work from their summer holidays; cue the inevitable bickering on what Brexit should look like.

Therefore headline risks rise again and Sterling might prove sensitive to any notable developments. Of course, politics is impossible to call so we will be watching for the unexpected.

The calendar does however have some economic releases to watch as the new month commences.

The main releases to watch in the week ahead are manufacturing, construction and services Purchasing Manager Indices (PMI) data for August.

PMI's provide relevant, timely, data which often provides a reliable guide to future, broader, economic trends.

Manufacturing PMI is expected to slip from a 3-month low of 54.0 in July down to 53.8 in August when it is released at 9.30 B.S.T on Monday, September 3.

Manufacturing PMI has been in decline recently and further greater-than-expected weakness could weigh on Sterling, but as long as it remains above 50 - the level which differentiates expansion from contraction - it is unlikely to heavily influence the exchange rate.

Image courtesy of tradingeconomics

The construction PMI is less significant than the other two but it is released at the same time on Tuesday and is forecast to fall to 54.9 in August from 55.8 in July.

Services PMI is the most important release of the three as this sector accounts for over 80% of the UK's economy - economists are forecast a rise to 53.8 in August from 53.5 previously, when it is out at 9.30 on Wednesday. It is showing a more resilient if volatile progression.

Image courtesy of tradingeconomics.

Another key release for the Pound in the week ahead is the British Retail Consortium (BRC) retail sales monitor, which provides a useful leading indicator for broader high-street sales.

Halifax house price data for August is forecast to show a -0.2% fall compared to July but a 3.9% rise compared to August last year, when it is released on Friday at 8.30.

Although fluctuations in house prices can alert economists to the onset of deeper economic malaise with repercussions for Sterling, they have remained resilient of late and continue to rise overall.

Image courtesy of tradingeconomics.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here