US Dollar: Narrow Republican Victory in Ohio Underlines 2018 Political Threat to the Greenback

- Written by: James Skinner

-USD edges higher but Ohio result underlines Autumn political threat.

-Narrow heartland victory raises spectre of Republican midterm defeat.

-November loss to scupper Trump agenda, raise odds of impeachment.

© The White House

The US Dollar edged higher in thin August markets Wednesday but a narrow victory for Republican Troy Balderson over Democrat Danny O'Connor in Ohio's special election underlines the extent of the threat that domestic politics could pose to a resurgent greenback during the months ahead.

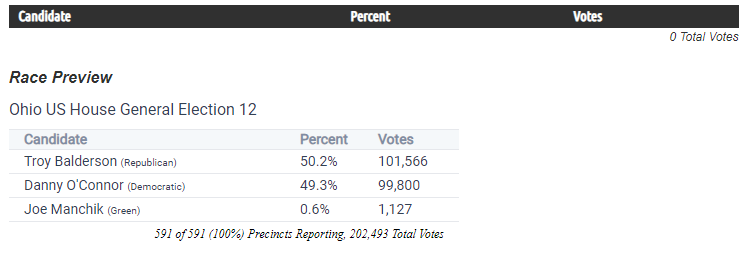

At the time of writing Balderson appeared to have won the contest in Ohio, a state that hasn't elected a Democrat since the 1980s and where President Donald Trump won the 2016 election with a double-digit lead, by a narrow margin. Balderson had 50.2% of the votes, to O'Connor's 49.3%.

However, the narrow victory underlines the fierce contest ahead in the November midterm elections when all 435 seats in the House of Representatives will be up for grabs, as well as 35 of the 100 seats in the Senate. This will give the opposition Democratic Party an opportunity to retake Congress and, potentially, to impeach President Trump.

"A margin of 0.5% or less triggers an automatic recount in Ohio. Whichever way this result goes is another sign of how plausible it now is for the Republicans to lose the House in November. This has no US dollar implications for now, but greater political uncertainty may well increasingly weigh on the dollar as we move toward November and potentially beyond," says Derek Halpenny, European head of global markets research at MUFG.

Above: Ohio special election result. Source: Decision Desk HQ.

Loss of congressional control would place this year's tax reforms, a signature policy of the Trump administration, under threat and would almost certainly make a "tax reform 2.0" all but impossible to achieve. The tax cuts are credited with lifting US economic growth to a four year high during the second quarter, and have been a material factor in the positive narrative built around the greenback over recent months.

"The most likely outcome of the midterm elections is legislative gridlock, although a second round of tax cuts would be unlikely even if the Republicans narrowly maintain control of both Houses of Congress," says Andrew Hunter, a US economist at Capital Economics. "With the recent tax cuts and boost to discretionary spending set to push the Federal budget deficit above 5% of GDP, the bigger priority for many Republicans now is cutting non-defence Federal spending."

A Democrat victory in November would also raise the odds of an outright impeachment of the President, leading to increased political uncertainty that could ultimately undermine the Dollar's recently-reasserted supremacy over other currencies. The Dollar index has converted a 4% 2018 loss into a 3.1% gain during the four months since early April, due mainly to economic growth that has been far superior to that anywhere else in the developed world.

Above: US Dollar performance against basket of currencies in 2018.

“Today, the voters of Ohio’s 12th District elected a true conservative committed to pro-growth policies that have already brought new jobs and economic confidence to the state under President Trump’s leadership," says Ronna McDaniel, chair of the Republican National Committee. "With President Trump’s support that helped lead him to victory, Troy Balderson’s win tonight is another example of the so-called ‘blue wave’ being nothing but a ripple.”

Voters went to the polls in Ohio, Michigan, Kansas, Washington, and Missouri. All besides the Ohio special election were primary ballots to determine candidates for the midterms in November. Even the Ohio seat will be up for grabs again when the November ballot comes around.

Wednesday's vote was always going to be seen as a key test of support for President Trump, but particularly after he himself flew to Ohio at the weekend to lead a raucous rally that sought to drum up grassroots support for Balderson. Balderson had been flagging in opinion polls until the weekend.

"It is not clear how markets would take a GOP loss in November and whether it would change Trump’s course of policy action is debatable. However, it would certainly weaken him and leave him more vulnerable to losing the protection the Republicans currently afford him. That, at the very least, would create uncertainty and raise the prospect of a turn in fortunes of the dollar," says MUFG's Halpenny.

The US Dollar index was quoted 0.08% higher at 95.26 during noon trading Wednesday and is up 3.2% in 2018. The Pound-to-Dollar rate was 0.54% lower at 1.2875 and has fallen 4.6% this year while the Euro-to-Dollar rate was 0.08% lower at 1.1594 and is down 3.3% in 2018.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Impeachment: Following in Clinton's Footsteps?

There are 435 seats in the House of Representatives, with 236 in Republican hands, 193 held by the Democrats and six vacancies.

A net gain of 22 seats in the November midterm elections would be enough to hand control of the chamber to the Democrats.

This would open the door for some hardline opposition members, as well as anti-Trumpers within the Republican Party, to impeach Trump because the constitution gives the House sole power to impeach a president.

A simple House majority is required to impeach, although the subsequent trial has to be carried out in the Senate and requires a total of 67 out of 100 votes to determine guilt.

"House Democrats could launch new investigations into Trump and even begin impeachment proceedings, particularly if the Mueller probe results in more charges against members of the President’s inner circle. But those efforts would flounder without a two-thirds majority in the Senate," says Capital Economics' Hunter.

Opposition politicians and broad swathes of the US media have regularly pondered aloud the prospects of impeachment ever since the November 2016 election.

Many held up a special counsel investigation into alleged collusion between the Russian state and the Trump campaign ahead of the 2016 election as likely to yield grounds for the President to be ousted.

Now, almost 18 months in, the probe has produced a series of indictments unrelated to the original purpose but failed to find evidence of collusion by the President or his campaign.

Advocates of impeachment have now turned to a similarly long-lived complaint based on an alleged breach of the foreign and domestic emoluments clause in the US constitution.

The clause states; “No Person holding any Office of Profit or Trust under them [the United States], shall, without the Consent of the Congress, accept of any present, Emolument, Office, or Title, of any kind whatever, from any King, Prince, or foreign State.”

It is alleged the President's ownership of the Trump International Hotel in Washington, and the hotel itself often hosting foreign and domestic officials visiting the capital, places Trump in breach of the constitution.

The hotel opened in September 2016 following a $200 million renovation and has since become popular with visitors.

The District of Columbia and State of Maryland, both the strongest of Democratic Party heartlands, have sued President Trump in a Maryland court.

They are alleging the President is in breach of the constitution because of the hotels' use by domestic and foreign dignatories.

The case is ongoing but a victory for the plaintiffs would almost certainly provide ammunition to the opposition, and elements of the Republican Party, in their quest to have Trump removed from the White House.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here