Turkish Lira Tumbles to Historic Low after US Sanctions Government Ministers

- USD/TRY falls to record low of 5.09 after US imposes sanctions.

- Lira already weak after central bank loses battle against inflation.

- Turkey's debt a major financial stability risk as currency weakens.

Image © Adobe Stock

The Turkish Lira fell to its lowest level in history on Thursday after the White House said the US will impose sanctions on two ministers of the Turkish government thought to be involved in the detention of Pastor Andrew Brunson, who is being held in Turkey on terrorism charges.

Above: USD/TRY exchange rate shown at daily intervals.

"The President has been closely following the ongoing situation in Turkey involving Pastor Andrew Brunson. We’ve seen no evidence that Pastor Brunson has done anything wrong, and we believe he is a victim of unfair and unjust detention by the government of Turkey," says Sarah Sanders, White House press secretary, in a briefing. "At the President’s direction, the Department of Treasury is sanctioning Turkey’s Minister of Justice and Minister of Interior, both of whom played leading roles in the arrest and detention of Pastor Brunson."

Brunson is alleged to have provided help to an exiled Turkish cleric, Fethullah Gulen, who is accused of being behind a failed coup attempt that cost 250 lives in 2016 and has reportedly seen tens of thousands of people arrested. Brunson faces a prison sentence of up to 30-years if convicted of the charges he faces.

The USD/TRY rate has already risen from below 4.0 per Dollar to over 5 in 2018, reflecting a loss of more than a fifth of its value, due to a combination of out-of-control inflation and doubts about the independence of the central bank.

Turkish inflation shot up to 15.4% in June, from 12.5% in May, but President Erdogan's meddling in the Bank of Turkey's (BOT) decision-making has prevented it from taking sufficient action to contain runaway price pressures.

Erdogan has repeatedly sought to keep interest rates low in order to bolster economic growth, rather than allowing the central bank to raise rates, which would stabilise the currency and stem the rise of inflation.

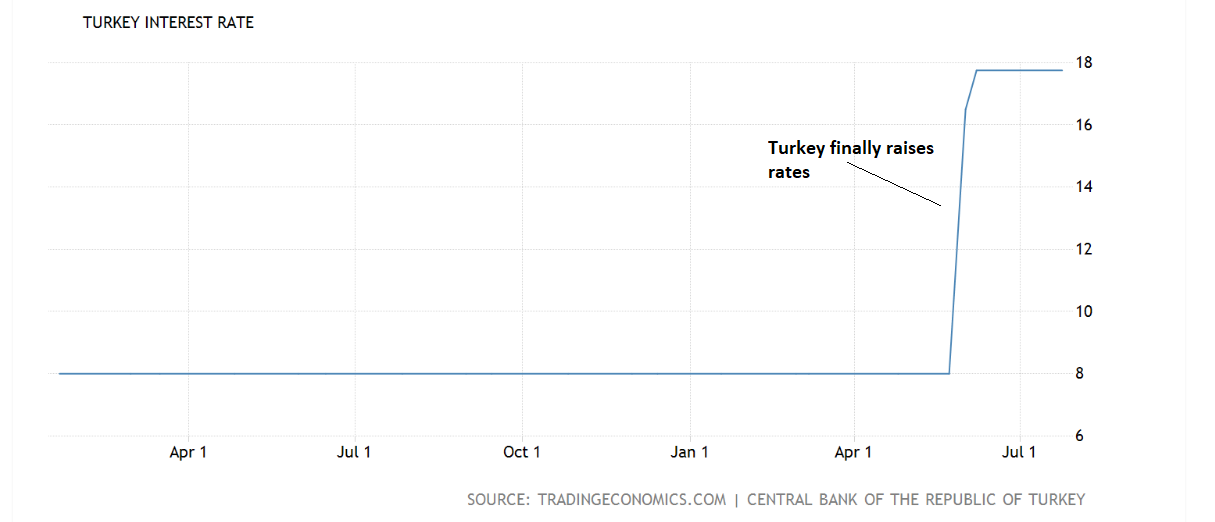

Although the main Turkish interest rate is now at 17.75%, the Bank took its time before raising it and has been heavily criticised by analysts for doing too little too late.

Above. Turkish One Week Repo Rate - the main Bank Rate.

"After months of inaction in the face of double-digit price growth, the central bank boosted borrowing costs by 500 basis points starting in April -- but the move came too late," says Constantine Courcoulas and Tugce Ozsoy, both reporters for Bloomberg News.

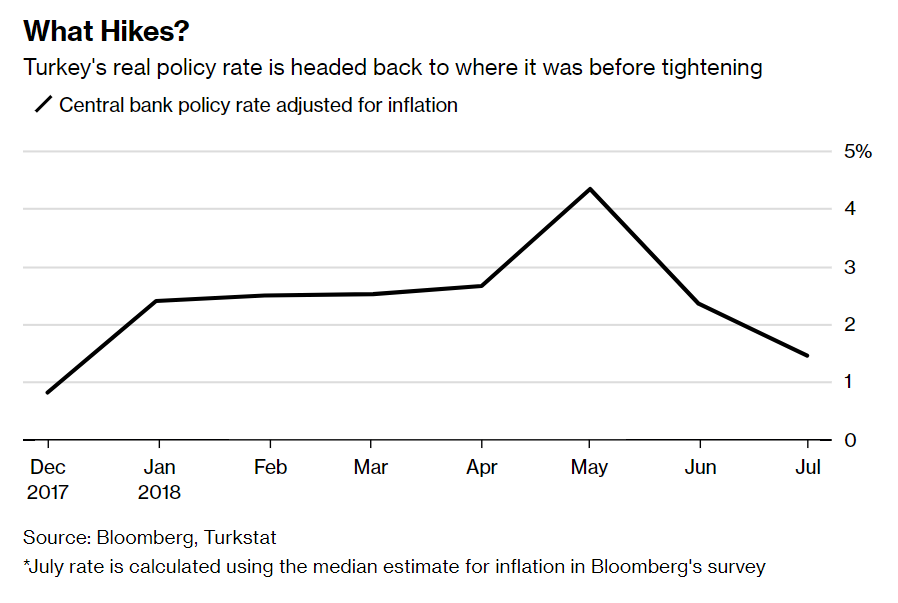

The situation is now so bad that Turkey's real interest rate, which is the normal interest rate minus the rate of inflation, is no different to what it was before the central bank raised rates. The one week repo rate that is currently at 17.75% began the 2018 year at just 8%.

Above: Bloomberg News graph showing Turkey's "real interest rate".

Inflation data out on Friday August 3 is forecast to show inflation rise at a rate of 16.3% according to a Bloomberg poll of economists, further exacerbating Turkey's problems. The weakening currency is expected to hit the Turkish economy hard given the country's heavy dependency on outside sources of funding which will now be more expensive to service.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here