Pound-to-Dollar Rate 5-Day Forecast: Downtrend Intact for Now, Trump's New Week Dollar Policy to Hog the Limelight

- Written by: Gary Howes

Image © Adobe Stock

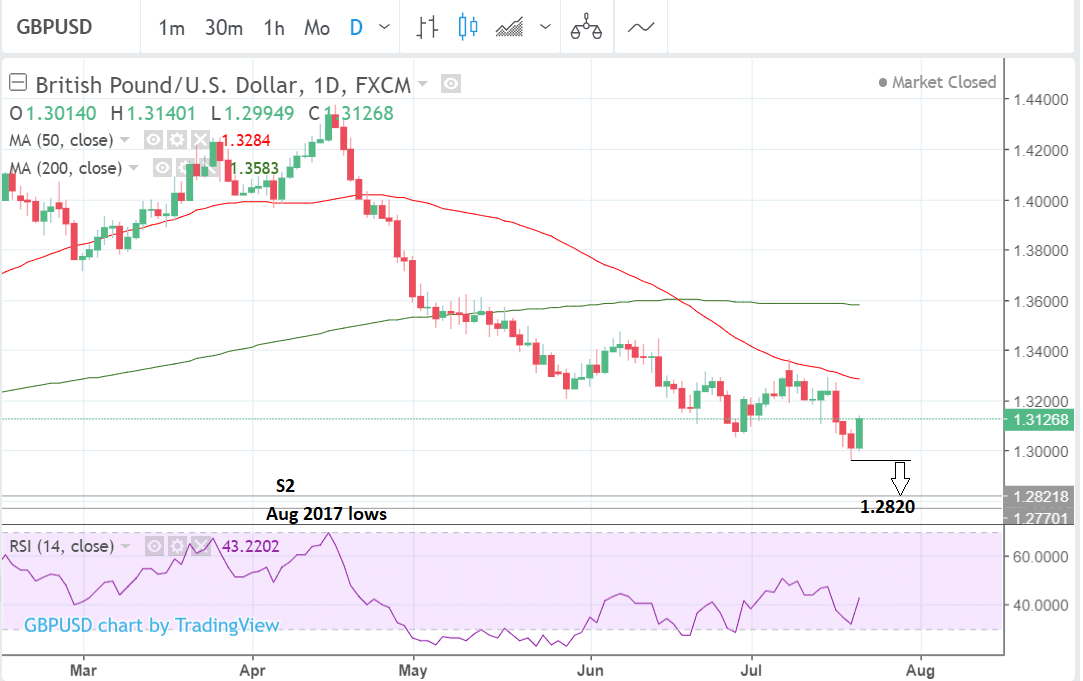

- GBP/USD rebounded strongly on Friday but one strong day doesn't change the trend

- A break below last week's lows would signal continued downside

- Donald Trump's new weak Dollar policy tipped to dominate in coming week

The Pound-to-Dollar rate rebounded strongly on Friday after President Donald Trump talked the Dollar down in a move widely touted as a strong signal that he will pursue a 'weak Dollar' policy.

But one strong day does not a trend make, and the pair remains in a technical downtrend which is likely to continue in the week ahead.

Technically the downtrend is intact and therefore we must maintain a bearish bias, despite Friday's recovery rally being strong and backed by a steep rise in momentum. Normally this is the way reversals start and so there is a chance the pair could eventually reverse trend however, tis too early to say for sure.

In the absence of more upside for confirmation - perhaps above the 1.3180 -1.3200 level, for example, we remain bears. Moreover Trump's rhetoric is backed up by only very limited powers vested in his office: he cannot directly interfere with US Federal Reserve policy on interest rates, the main lever of devaluation, or directly via intervention.

Thus it may be difficult for the talk to be backed up by action, and markets may carry on pushing the Dollar higher again if his comments prove ineffectual.

A break below the recent 1.2957 lows would be required for confirmation of an extension down to the next target at 1.2820, where the S2 monthly pivot is situated.

Pivots are used by traders to gauge the strength of the trend as well as overbought and oversold levels. They are often the site of reversals and the exchange usually stalls or bounces after it touches them, due to short-term traders fading the trend in expectation of a short-term pull-back. They thus make a useful level for a target.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Week Ahead for the Dollar

For the Dollar, we will be very interested in hearing what analysts and markets make of Donald Trump's attack on Dollar strength and the Federal Reserve's policy of raising interest rates.

The move is widely touted as part of a broader 'weak Dollar' policy Trump intends to pursue in order to boost US exports relative to imports. Following the comments, the Dollar sank sharply suggesting a degree of success.

However, it is widely known that 'jawboning' becomes increasingly ineffectual unless the threats are followed by material actions.

The US President has proven he does not follow the established rule books when it comes to international diplomacy and domestic politics therefore markets will continue to expect the unexpected. This will keep us on edge for further FX market volatility over coming days.

On the calendar, US GDP in the second quarter will be the highlight of the US economic calendar, when it is released on Friday, July 27 at 12.30 GMT.

Currently markets are forecasting a 4.1% rise in Q2 compared to Q1, which would be very strong, although Q1 was unusually weak. Nevertheless, such a strong rise would finally end the argument over whether Q1 was slow due to bad weather or deeper economic problems.

"The Trump administration’s tax cuts at the start of the year are thought to have stimulated consumer and business spending, putting the US at the top of the growth league table among advanced economies," say brokers XM in a week-ahead briefing, adding:

"Given the strong gains for the US dollar in the past two weeks, a large miss in the data would come as a shock for the markets and could lead to a sharp sell-off. Similarly, a much stronger-than-expected figure would raise questions about the Fed’s “gradual” rate hike policy."

With a JP Morgan economist recently quoted as saying we should expect growth of circa 5.0% in Q2, the 4.1% currently expected may actually be a little on the low side, and there is potential for an upside surprise as much as a downside one, so more Dollar rises are a distinct possibility.

Another major release for the Dollar is Existing Home Sales on Monday, July 23 at 14.00.

Forecasters are expecting a 5.44m rise in June from 5.43m in May.

There may be an increased focus on the housing data after the large -12.3% surprise fall in housing starts registered last week.

June New Home Sales which are also scheduled for release next week, on Tuesday, at 14.00, could be even more susceptible to a slowdown than existing sales.

Analysts are already expecting a fall to 0.671m from 0.689m previously, no doubt reflecting the slow-down seen in 'starts' last week.

"The number of housing starts in the US fell by the most since Donald Trump was elected president, with the latest data undershooting market expectations by some margin and dragging Wall Street futures and Treasury yields lower," said the Financial Times of the poor data last week.

The reasons for the sudden drop were a shortage of labour, a rise in construction material costs, rising borrowing costs and sluggish wage growth which cannot keep apace with rising house prices.

Housing data is key because it seen as 'leading the economy' by many and is therefore an early warning system for broader based slowdowns.

Last week's housing starts fall brought it to a 9-month low from a historic peak reached in May.

Finally, Thursday, July 26 sees the release of Durable Goods Orders, which are orders of big price tag items. These are forecast to show a large 2.8% rise from -0.6% previously, although, the metric can be impacted by large aviation orders for airline jets etc, so require careful reading.

Goods Orders Non Defense Ex Air (MoM) (Jun), for example, which excludes a lot of these extremely large orders is expected to rise only 0.5% compared to 0.3% previously.

What's on the Calendar for the Pound this Week

While technical studies hint at more downside for Sterling, the picture is significantly more complicated than the charts imply and in our opinion there could be some relief for the Pound as market focus shifts to 1) Bank of England interest rate pricing and 2) thinning Brexit-related headlines.

The week ahead for UK data kicks off on Monday with a speech from Deputy Governor of the Bank of England Ben Broadbent to the Society of Professional Economists in London at 18:00 GMT.

Analysts will be listening out for any comments in relation to Broadbent's stance on hiking rates in August. Current probabilities favour a hike from 0.25% to 0.75%.

The Consortium of British Industry (CBI) Industrial Trends Survey is released at 11.00 GMT on Tuesday, July 24, and is forecast to come out at 10 from 13 previously.

The result is the balance between positive and negative survey answers. Data from the CBI often gives a timely indication of economic trends and is closely watched by the market.

Mortgage Approvals are due for release on Wednesday at 9.30 and forecast to show a rise of 39k in June from 39.4k in the previous month of May.

Friday sees the release of Nationwide Housing Prices in July, which are expected to show a 0.5% rise from June and a 2.0% rise since July 2017.

The other main driver of the Pound in the week ahead will be the ongoing debate over Brexit.

Sterling weakened last week as fears resurfaced of a hard Brexit following Brussels's mixed response to Theresa May's Chequer's proposal, which itself was a hard-won compromise.

EU Chief negotiator, Michel Barnier was overall positive about the plan which he said had elements that were "very useful" however he was concerned it undermined the "integrity of the European Union" as a free trade region.

The reaction was seen by many as a sign the EU would want further compromises.

Given the negative response from many Brexiteers over the current proposal further compromises are seen as unrealistic, hence markets started to price in a 'no deal' Brexit which ultimately reflected in a weaker Pound.

Barnier's most recent comments on the nature of the border with Ireland did show some signs the EU was willing to show flexibility on its previous backstop solution.

This kept the border between Northern and Southern Ireland open and for the 'de facto' actual border between the UK and EU to shift to between Northern Ireland and the rest of Britain via a set of "control points" across the Irish sea.

The EU's backstop has been seen as unacceptable to Ulster Unionists, Theresa May's allies in parliament, who demand Northern Ireland and the rest of the UK remain intact after Brexit, and to the wider Conservative party.

We believe there was something of a breakthrough on Friday following the EU General Affairs Council meeting when Barnier said the EU was in fact willing to search for a compromise on the question of the Irish border and revise its backstop.

A possibility of a no-deal has weighed on the Pound since the referendum and risks pushing the currency even lower in the week ahead. Likewise, relief is possible too, especially if Theresa May's proposal gains favour in Brussels.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here