U.S. Dollar "a Buy" says HSBC's Bloom

- 125 Million of the Richest Taxpayers is a "Thing of Beauty" for the Dollar

- The US Dollar is still in the FX market's driving seat says HSBC strategist

- EUR/USD could go down to 1.15

Image (C) Pound Sterling Live

The U.S. Dollar is still a buy, according to HSBC's head of currency strategy, David Bloom.

Bloom cites rising interest rates on short-term US debt as one of the key drivers since it is short rather than 10-year debt, which drives currency spot rates, he insists.

"Its all about rates today not rates in 10-years time," says Bloom in an interview with Bloomberg.

Some commentators allude to the main driver of the Dollar being the recent surge in 10-year yields owing to rising inflation expectations for the United States economy, however, yields have come back down from a peak of 3.12% to 2.92% at the time of writing and we are indeed seeing the Greenback pare gains.

Nevertheless the future still looks good for 'king Dollar' if you agree with Bloom's thesis that shorter maturity debt leads the spot rate more than 10-year.

That's not the only reason for backing the Dollar, however, as Bloom also sees a robust US economy as part of the cocktail of factors pushing the buck higher.

The US seems to be doing really well, and all others (countries) seem to be "failing", said Bloom, which was the reverse of what had been expected previously when analysts thought the US Dollar would lose ground in 2018 from 'RoW' short for 'Rest of the World' catching up with the US.

The US has 125 million of the richest taxpayers to back it up, which is a "thing of beauty" he says - an allusion, no doubt, to misgivings about the perilous state of the US's finances, after Trump's new tax cuts and spending plans materially widened the expected budget deficit for a country already $21 trillion in hock.

For the Euro, the Dollar's main counterpart, the future looks bleak as growth stutters in Europe and political schisms resurface, and Bloom forecasts EUR/USD to fall to 1.1500.

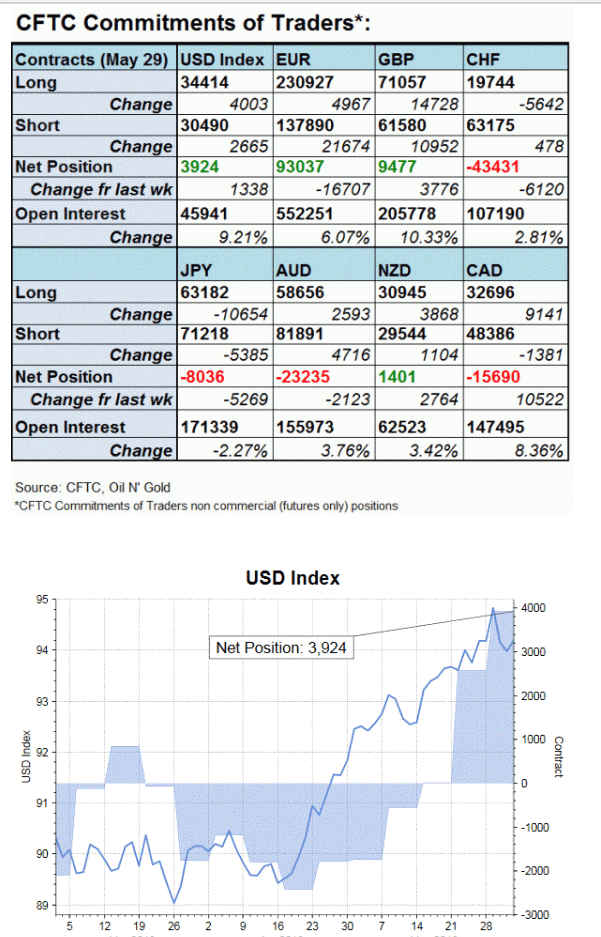

Professional traders appear to agree if CFTC data is anything to go by. The latest CFTC data shows large funds increased their bullish bets on the Dollar in the futures and derivatives market by 1338 contracts in the week ending May 29.

Speculators are now net positive USD by 3924 contracts.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.