Pound-to-Dollar Week Ahead: Next stop 1.3090

Image © Adobe Stock

The GBP/USD exchange rate is quoted at 1.3369 at the start of the new week, having advanced off 2018 lows at 1.3205 in the previous week.

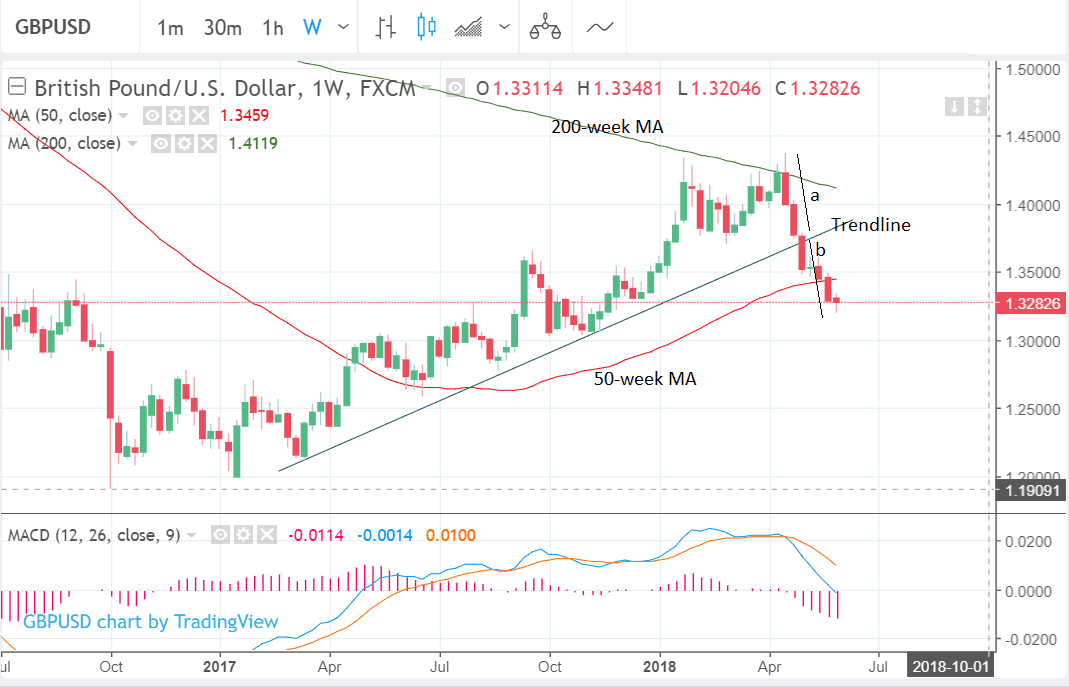

Despite the slight relief, it appears the move down from the April 17 highs continues to unfold and our previously detailed target at 1.3290 has been exceeded.

Although it has surpassed our target there is no suggestion from price action yet that the trend is in the process of reversing.

Investors should, however, be a little cautious of expecting more downside progression since the target was based on a tried and tested method of calculating the potential extension from a trendline break and since it has now been met there is a higher chance of a rebound.

The method uses the length of the move prior to the trendline as a guide to the downside expectation after the break. These are labeled as 'a' and 'b' on the chart above, which shows how the follow-through - b- is now roughly equal to the pre-trend down move - a.

Yet neither can we be too hasty in expecting a rebound now just because the pair has reached one technical target - very often the market will continue falling anyway.

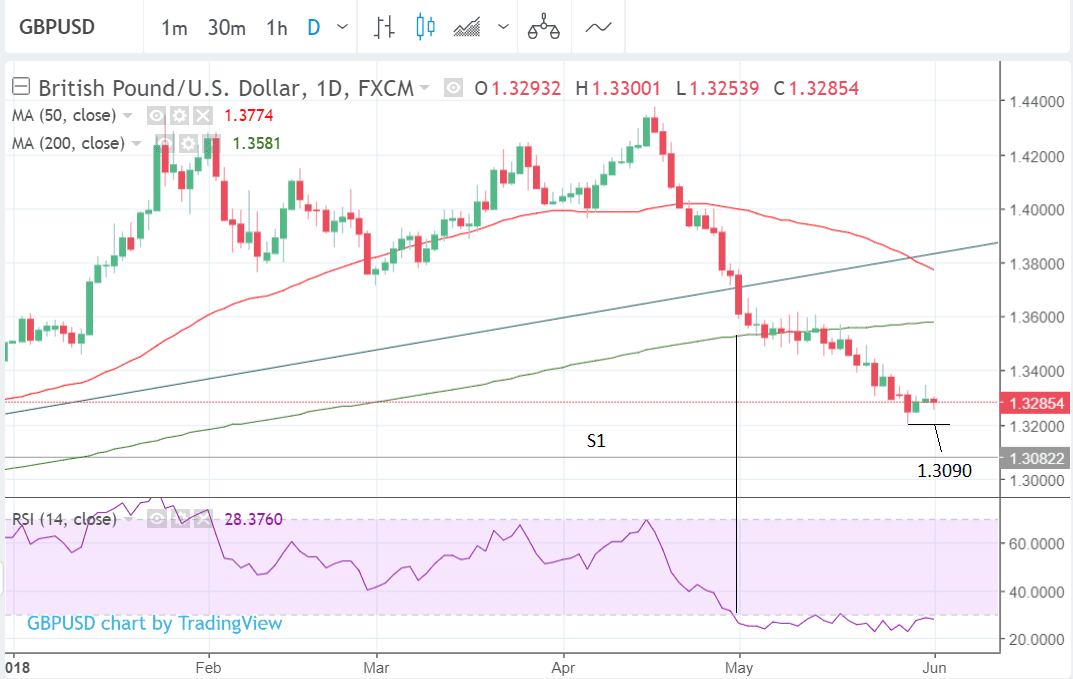

Looking at the daily chart above, we note that the RSI momentum indicator is in the oversold unshaded section which is an indicator not to open any new bearish positions as the exchange rate is now getting oversold, however, it is not necessarily an indication that the downtrend is over.

The market can and does often continue to fall despite the RSI being oversold. Note, for example, how the RSI actually first moved into oversold territory back at the very start of May when the exchange rate was up at 1.37 and has stayed there ever since, during which time it has continued falling regardless to the current 1.32s.

A move out of the oversold territory on the RSI daily, however, would change things materially and make us more outright bullish the pair.

Ideally, this would be accompanied by a strong recovery in the exchange rate itself, at a rate-of-change at least equal to if not greater than the prior descent.

As this does not seem to be the case yet, however, the bearish downtrend remains intact and the base-line expectation must be for it to continue.

We, therefore, forecast an extension of the downtrend conditional on a break below the 1.3200 level, to a downside target at 1.3090, where the S1 monthly pivot is situated, and expected to provide a robust obstacle.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Week Ahead: GBP

Monday, June 4: Construction PMI for May, consensus forecast is for 51.9, the previous month read at 52.5.

Typically the construction PMI is ignored by markets, but owing to the slowdown we saw at the start of the year, and a focus on future Bank of England policy, foreign exchange markets will be paying more attention to this release than normal.

They will be looking for a clear sign that growth in this sector - a sector that has struggled over recent months - is back. A beat on expectations could help Sterling, a miss will likely weigh on the currency.

Tuesday, June 5: Services PMI for May, consensus forecast is for 53.1, up on April's 52.8.

The services sector accounts for over 80% of UK economic activity and it is therefore no wonder this is likely to form the highlight for Sterling in the coming week.

Thursday, June 7: We get a slew of house price data which is unlikely to hurt or help Sterling. Nevertheless, surprises will catch some attention. The RICS house price balance is forecast to deliver a reading of -1% and the Halifax house price index is forecast to show a reading of 1% on a month-on-month basis.

Friday, June 8: Industrial and manufacturing production numbers are on the docket. Consensus forecasts for industrial production for April is at 3.1% on an annualised basis, up from the previous month's 2.9%.

Consensus forecasts for manufacturing production are for -0.2% for April on an annualised basis, down on the previous month's -0.1%.

With sentiment towards Sterling rather dreary on the economic front we would suggest the risk-reward ratio lies to the upside, as positive surprises tend to deliver the greatest impact when consensus is poor. In short, bad economic news is largely in the price of Sterling.

Week Ahead: USD

The US Dollar is the laggard at the start of the new week, coming in lower against the majority of the G10 despite the positives from the labour market report released ahead of the weekend.

A general 'risk-on' environment in global financial markets at the start of the new week appears to be undermining the typical safe-haven currencies such as the Dollar, yen and Swiss Franc.

"Despite the political turmoil around the globe, markets are mainly positive this morning. Asian stocks are higher and S&P500 futures are also slightly up. The US 10-year Treasury yield has moved above 2.9%. Some of the positive mood this morning may stem from the strong US jobs report Friday, which was strong in all directions," says Mikael Olai Milhøj, Senior Analyst with Danske Bank.

Jobs growth was higher than expected (223,000 versus 188,000 expected), the unemployment rate dropped to 3.8% from 3.9% and average hourly earnings rose 0.3% m/m (0.2% expected)

Looking ahead:

"This week, expect a reversion to US-centric cues and central bank watching. The fundamental picture underlying the broad USD – economic outperformance, yield differential arguments, and shifts in USD positioning – remains largely intact. One thing holding the USD back, though, is the still cautious rhetoric from the Fed regarding its rate hike path," says Terence Wu with OCBC Bank in Singapore.

The United States continues to enjoy impressive economic growth, and prices are expected to keep rising ensuring the Federal Reserve is liable to raise interest rates three times in 2018 and a further three times in 2019.

If the numbers increase, expect the Dollar to firm up, but this will only occur if the data continues to impress against expectations.

Monday, June 4: Watch the release of durable goods orders and factory orders for April, out at 15:00 B.S.T. Factory orders are forecast to read at -0.3%. These releases are second-tier in nature so we doubt they will deliver fireworks.

Tuesday, June 5: The ISM non-manufacturing PMI will catch markets attention at 15:00 B.S.T. Markets will be pricing the U.S. Dollar for a reading of 57.2, any disappointment might hurt the currency, and a beat will likely aid it higher.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.