Dollar Tipped to Rise on Next 'SOMA day', and that's this Thursday

- Written by: James Skinner

- US Dollar could see another leg higher Thursday, say Nordea Markets.

- Fed to shrink balance sheet by $28.5 billion, driving bond yields higher.

- Bond yields have been back in the Dollar's driving seat in April and May.

© Robert Cicchetti, Adobe Stock

The US Dollar rose across the board Tuesday as traders fled to safety amid the latest developments in Italian politics and strategists at Nordea Markets have suggested the greenback could rise even further as liquidity is sucked from the global financial system.

Indeed, their research suggests this Friday could be a good day for the Dollar as this is when the Federal Reserve takes another step towards normalising its balance sheet.

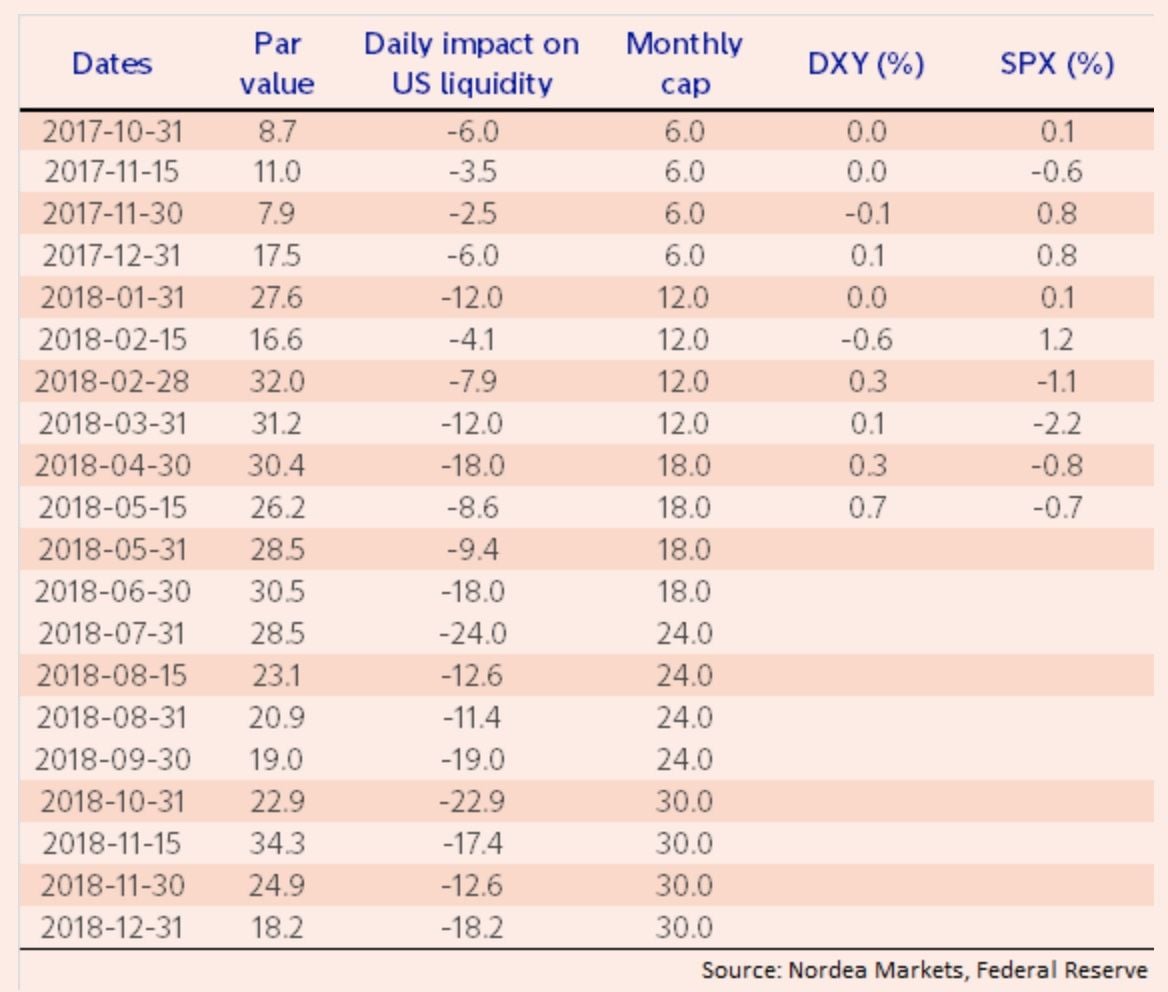

US policymakers said in June 2017 they would slowly begin to shrink the Federal Reserve balance sheet from October, starting at a rate of $6 billion per month and working up to a maximum of $30 billion per month, in order to unload the $4.5 trillion of different bonds aquired by the bank through its post-crisis quantitative easing programmes.

The amounts involved are growing larger by the month and May 31 is expected to see the Federal Reserve swallow $28.5 billion of liquidity that would otherwise have remained in the market, which Nordea says could have implications for the US Dollar later this week.

"For those interested in really short-term moves on financial markets, we like to point out that the three most recent redemptions have coincided with Dollar strength and weaker risk sentiment," says Martin Enlund, an FX strategist at Nordea Markets. "The next big redemption day is May 31, when 28.5bn comes due – a Sumo SOMA day!"

SOMA - System Open Market Account - is managed by the Federal Reserve and contains assets acquired through operations in the open market, notably through the period of 2008-2014 when the Fed bought significant amounts of US government debt to to ensure long-term interest rates remained low.

The Fed has been rolling over its holdings of debt on expiry date, however it is now in the process of letting the debt roll of its balance sheet and redeeming the full amount paid for the bonds, creating a demand for Dollars in the process.

Enlund says this redemption will remove a hefty bid from the bond market and flags that the last time this happened the US Dollar rose by 0.7% and the S&P500 stock market fell by 0.7%, appearing to suggest they may do the same again.

The Fed balance sheet had expanded from around $150 billion before the financial crisis to more than $4.5 trillion last year after three separate quantitative easing programmes saw it acquire trillions of Dollars in bonds. It used QE to force bond yields, which have a negative correlation with bond prices, lower as part of an effort to lift inflation and repair the labour market by stimulating economic activity.

However, with both US labour markets and inflation back at pre-crisis levels and growth picking up, policymakers are now faced with the task of "normalising" the balance sheet. Or "unprinting" all of the new money it created during the post-crisis years. To the extent that this pushes bond yields higher on the day, it could also support the US Dollar.

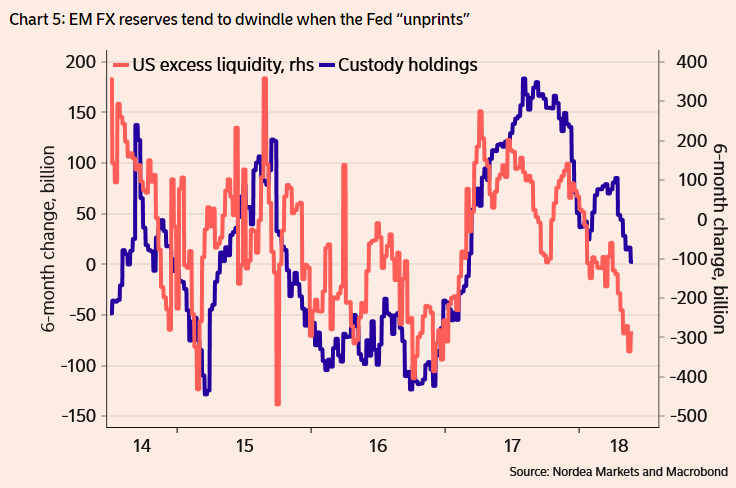

"Since mid-April, USTs in custody on behalf of foreign agents (a proxy of EM FX reserves) are down by some 70bn. A negative shift in US excess liquidity momentum has led to weaker EM FX reserve growth in the past: when the Fed “unprints” money, EM FX reserves tends to drop," Enlund adds, pointing to another potential source of Dollar upside.

Above: Nordea Markets graph showing excess liquidity and custody holdings.

The Fed "unprints" money when it does not reinvest cash proceeds from the bonds it holds that are falling due for maturity. In other words, the bank takes the bond money back from the US government and keeps it rather than reinvesting it elsewhere in the government bond market. This is otherwise called a "reduction of excess liquidity".

Enlund and the Nordea team say emerging market central banks have proven sensitive to the Fed's diminishing bid within the bond market, suggesting those other central banks sold a substantial amount of US government bonds in April because of the Federal Reserve continuing its exit from the bond market, which may have been behind US bond yields having reached multi-year highs at the end of April and again in May.

US 5, 10 and 30 year bond yields reached multi-year highs of 2.94%, 3.15% and 3.25% respectively in May, which shocked the US Dollar back into life and helped it convert a 3% 2018 loss into a 1.38% gain.

Whether or not it was the foreign central banks that caused US yields to push higher or a comination of central bank selling, the diminishing bid from the Fed and other factors, it's clear from commentary in recent weeks that the rise in yields drove the Dollar's resurgence in the last eight weeks. Nordea are now warning of another leg higher in both later this week.

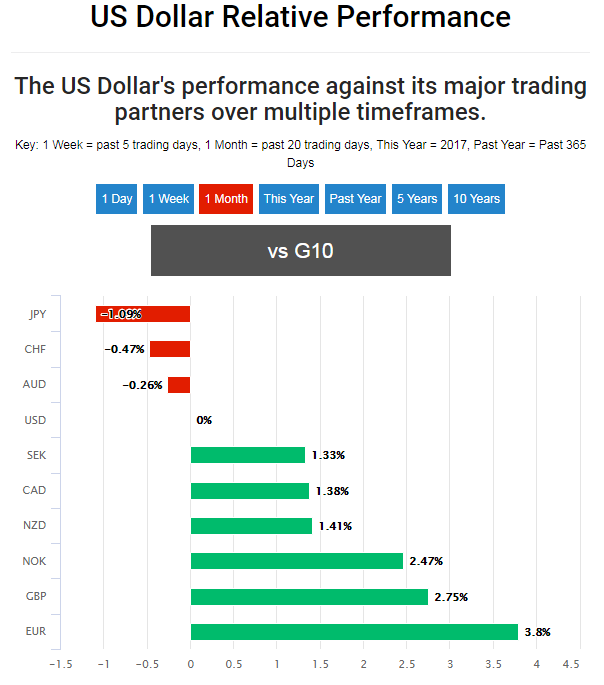

The US Dollar index was quoted 0.40% higher at 94.80 Tuesday amid broad gains for the greenback. The Pound-to-Dollar rate was 0.48% lower at 1.3246 and the Euro-to-Dollar rate was down 0.65% at 1.1548.

Above: US Dollar performance against G10 currencies.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here