Pound Nearing a Turning Point Against the Dollar say BNY Mellon

- Interest rate differentials last supportive of GBP/USD since 1984

- 200 day moving average looms above, could cap gains

- Scarcity could drive US Dollar recovery

Pound Sterling might have reached a turning point against the Dollar, according to Simon Derrick, chief currency strategist at BNY Mellon.

The primary engine of currency trends, interest rates, are favouring the Dollar to strengthen versus the Pound, because interest rates are higher in the US than in the UK, and this is a draw for foreign investor capital flows.

The yield on government bonds - that is the interest paid on money loaned to the exchequer - is a common measure of interest rates used by market professionals, and this has been widening.

"The 10-year yield gap between US and UK government paper stands at its least supportive level for GBP since late 1984 (when GBP was trading around USD 1.24)," says Derrick.

Given GBP/USD now stands at 1.40 it suggests the pair is way too high and due a correction.

It is not the only indicator. CFTC data is also showing GBP longs at their highest level since July 2014 which in layman's terms means a very high number of speculators have purchased bets that the Pound will rise, the highest number since the summer of 2014.

Although this may sound like a positive for the Pound, it is often not always the case - in the world of finance extremes are normally a warning sign of a reversal, especially when it comes to speculative bets.

Another potential red flag for the Pound is waving from the options derivatives market, which is showing the cost of call options (bullish bets on the Pound) is falling, a sign of falling demand and therefore bearish.

"The options market highlights quite how benign the collective view remains about GBP currently. Both six-month and 12-month ATM forward implied volatility in GBP/USD are trading close to 200 bps below the 10-year average," says Derrick.

Technically Challenged?

Added to these we see other reasons to be bearish GBP/USD, such as the technical fact that the exchange rate is trading just underneath the 200-week moving average at 1.4256 (see below).

This roughly equates with the exchange rate's peak level this year and provides a natural ceiling level on the chart, through which it will be difficult for the exchange rate to break.

Trending prices often stall, pull-back or even sometimes reverse at the level of large moving averages like the 200-week, because it is used by large speculators, fund managers and retail traders alike as a decision-making tool and is therefore subject to an increased level of volatility.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Less Dollars to Go Around = a Stronger Dollar?

From a fundamental perspective, there is less upside potential since the Brexit transition deal was approved with the good news now largely seen in the price of Sterling. To a certain extent, this now limits the impact of Brexit as a driver on the exchange rate for a while, despite the outlying loose-end of Irish border risk.

There is also an improving narrative on the Dollar's outlook to be aware of.

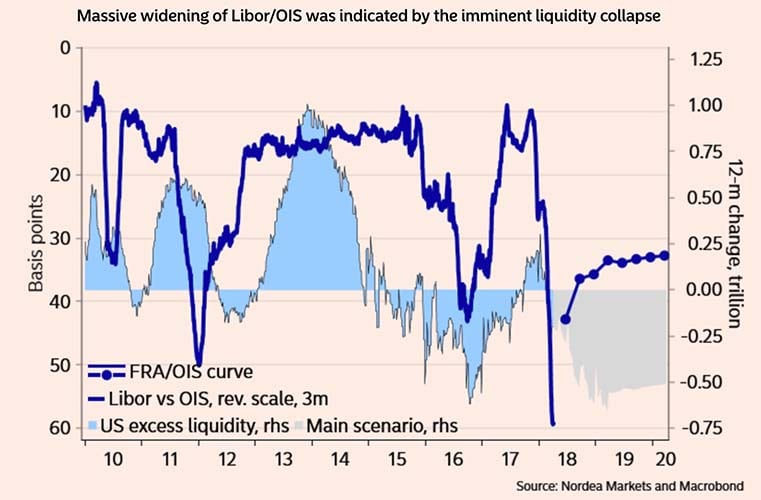

A major potential driver of a stronger USD is emerging 'Dollar scarcity' on global markets, which is reflected in a rapid rise in borrowing costs within the interbank lending market (known as LIBOR).

Normally LIBOR rises when inflation expectations do, so as to compensate lenders for inflation erosion, however, Over Night Index Swaps, a common gauge used by market professionals to access future inflation expectations has remained steady, whilst LIBOR alone has risen.

The spread is now gruesomely wide - borrowing is not expensive because of inflation but because of the scarcity of USDs in the system.

Why is the USD so scarce now?

"The recent and massive widening of Libor/OIS spreads was also indicated by the coming collapse of US excess liquidity in Q2 and Q3 due to Fed’s shrinking balance sheet and rebuilding of the Treasury’s general cash account," says Martin Enlund, an analyst with Nordea Markets.

Only a few months ago, the amount of dollars in the system had increased by 250bn over a 12-month period. But, acccording to Nordea Markets, the latest data point shows a liquidity drainage of 200bn vs a year ago, "and this liquidity drainage will accelerate (to -600bn) in the coming 12 months on our forecast," says Enlund.

"Fewer dollars ought to imply a costlier dollar," adds the analyst.

And with the Fed looking to continue raising interest rates and whittle down its balance sheet further, the situation is only likely to be exacerbated.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.