Pound in 0.6% Dip vs. Rampant US Dollar, Month- and Quarter-End Flows Cited

- Written by: Gary Howes

- Pre-Easter rollercoaster continues

- Dollar finds fundamental backing from stronger-than-forecast GDP data

The Dollar was seen to be the best-performing global currency in the mid-week trading session with markets shifting positions in the run up to the quarter- and month-end close.

The US Dollar index - a measure of the greenback’s value against a basket of major currencies - is seen trading 6% higher at 89.90 thanks to a 0.73% rise in the USD/JPY and a 0.5% rise in the EUR/USD which takes it to 1.2342.

The GBP/USD exchange rate is seen suffering a 0.6% decline to reach 1.4096.

The Dollar, "firmed within narrow ranges as month-end and quarter-end flows drove overall moves in global markets," says Omer Esiner with CommonwealthFX, a foreign exchange brokerage in New York. "With the Dollar having fallen over most of the first quarter, investors looked to take some profits early ahead of the long Easter weekend. As such, the Dollar enjoyed a mild tailwind heading into the second half of the holiday-shortened week."

The Dollar earlier largely ignored the third and final revision to US fourth quarter GDP which was revised up to 2.9% (annualised), firmly above the second revision of 2.5% and better than the consensus forecast for 2.7%.

Esiner notes all the subcomponents of the report, including consumer spending, business investment and the change in business inventories were higher than the last estimate.

And while this data is clearly a rear-view mirror’s look at the state of the economy, it does nevertheless highlight stronger momentum for the economy as 2018 started.

Concerning the outlook, it must be remembered that the Greenback remains in a protracted downtrend against the majority of currencies, and there is little reason to believe that ultimately the downtrend will not resume in line with overall long-term momentum.

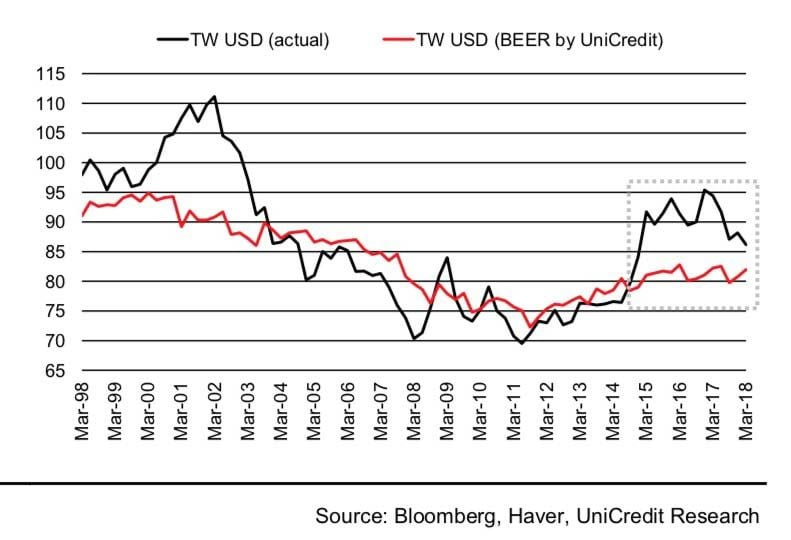

"Empirical evidence suggests that USD-downturns are long and quite pronounced. In the eighties, the USD experienced a strong decline (around 40%) that lasted from 1985 to 1990. Though of course the underlying reason was the Plaza Accord, a similar multi-year decline occurred in the early 2000’s with the TW USD losing nearly 35% between 2002 and 2007," says Vasileios Gkionakis, Co-Head of Strategy Research & Head of FX Strategy Research

with UniCredit Bank in London.

UniCredit believe a large part of the recent Dollar depreciation can be attributed to this: global growth (outside the US) is clearly being re-priced higher; "because the US was the recipient of plentiful inflows in previous years, investors are now seeking opportunities elsewhere – especially since the US cycle is at a very mature stage and US asset prices are quite stretched."

"This process is likely to remain in place for the next few quarters, putting more pressure on the Dollar," says Gkionakis.

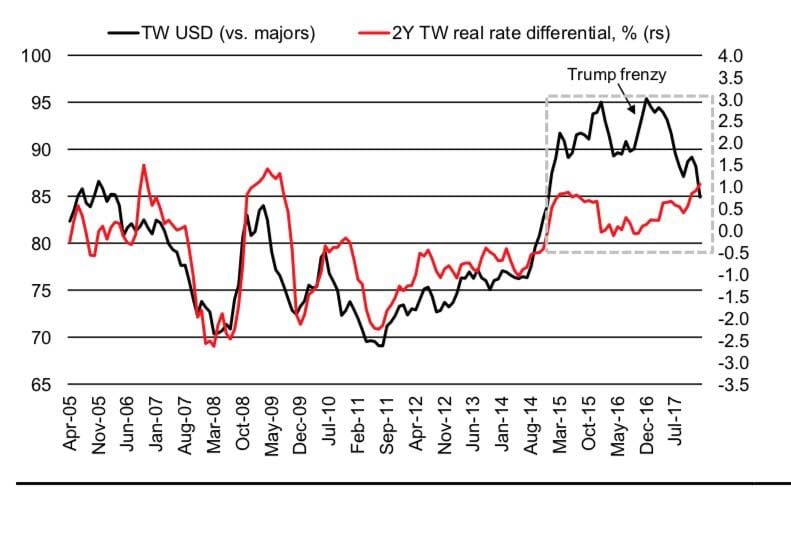

Above: The trade weighted Dollar is closer in line with real rate differentials i.e. a fundamentally more realistic valuation.

Above: The Dollar is approaching long-term fair value

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.