US Dollar Buying seen at Month-End Leaving Pound-to-Dollar Rate Exposed Today Warn Analysts

Image © Adobe Stock

On February 28 it is worth remembering fund managers in the world's financial centres will be rebalancing their currency hedges which creates a month-end flow of capital that can often move currency markets.

On the final day of February, the Pound-to-Dollar exchange rate is seen at 1.3894, having been as high as 1.4277 earlier in the month while the Euro-to-Dollar exchange rate is seen at 1.2204, having been as high as 1.2507 earlier in the month.

The Dollar has enjoyed a recovery in February and we are hearing from a couple of analysts that the end of February is likely to be supportive of the US Dollar.

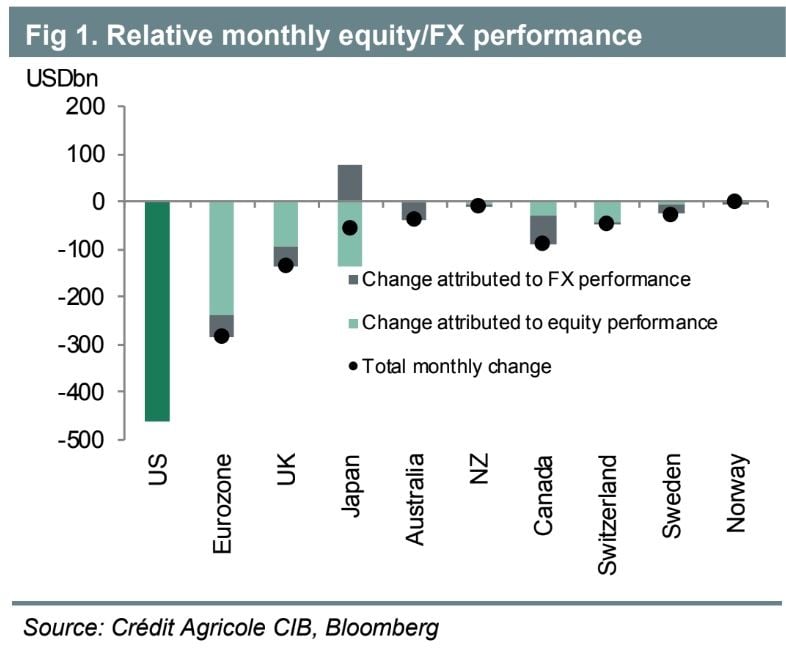

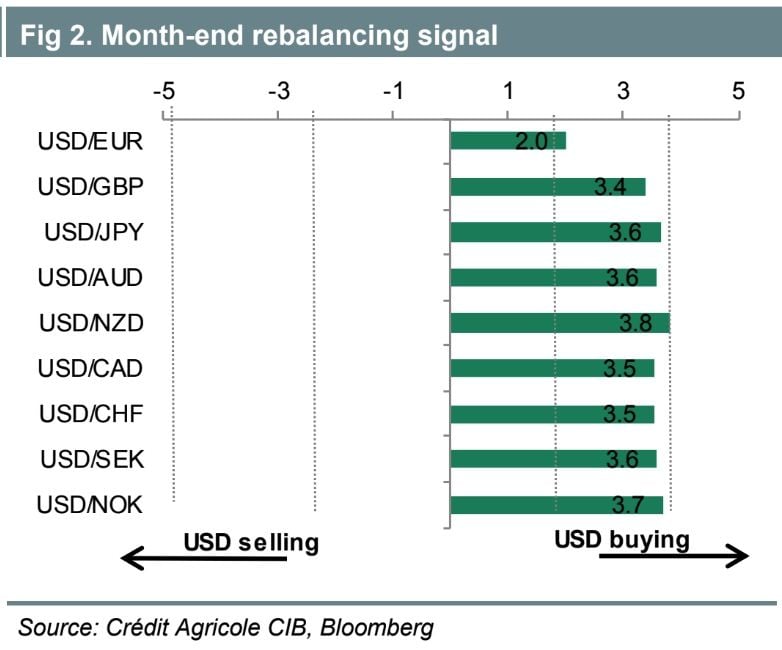

"The move in FX combined with the underperformance of US equities seen over the past month (when adjusted for market capitalisation) suggests month-end portfolio-rebalancing flows are likely to be USD buying across the board, with a more modest USD buy signal against EUR," says Jennifer Has at Crédit Agricole in London.

Global stock markets suffered as sizeable sell-off earlier in February amidst a bout of risk-aversion centred on US markets.

While market risk sentiment has since stabilised and equity markets have recovered, stocks are still lower on the month.

The USD has meanwhile recovered this month against other G10 currencies, with the exception of the JPY.

Crédit Agricole's month-end flow model is based on the concept that global portfolio managers have set benchmarks for currency hedge ratios and, as the value of their assets within their portfolio changes over the course of the month, portfolio managers will need to re-hedge their currency exposure, so that their currency benchmarks are maintained.

"Typically, these FX rebalancing flows are seen at the end of the month and usually their impact is felt most near the 4pm London fix on the last trading day of the month," says Hau.

Barclays say their passive rebalancing model at month-end points to Dollar buying against the major peers. "The signal is strong against the JPY, moderate against CAD, AUD and GBP, and weak versus the EUR," says Juan Prada at Barclays in New York.

"The underperformance of US assets and European equities drove the model to generate Dollar buying signals against peers, with a weak signal vs. EUR. The strengthening of the JPY amid risk aversion, and the relative better performance of Japan bond markets, produce a strong Dollar buying against JPY," adds Prada.

Analyst Kristjan Kasikov with Citi in London - the world's largest foreign exchange dealer - says with both US equities and bonds lower on the month, international investors probably need to buy USD today in order to reduce their outstanding stock of FX hedges on US assets.

"The final estimate of month-end FX hedge rebalancing needs continues to point to USD buying today, 28 February. However, the signal strength has weakened somewhat relative to the preliminary results published last week and now falls short of one historical standard deviation," says Kasikov.

Furthermore, although equities in the Euro-Zone, UK and Switzerland have also performed poorly, the imbalance of our assumed portfolio allocations and hedge ratios means that estimated net USD buying by European investors still dominates foreigners’ needs to buy EUR, GBP and CHF."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.