The US Dollar is Not Yet Ripe For a Reversal, Says Westpac

The US Dollar is not as oversold as it looks compared to similar episodes historically.

After depreciating heavily at the end of 2017 and starting the new year in the same fashion investors may be wondering whether the US Dollar isn't getting a little undervalued.

The answer from currency experts asking the same question at Australian bank Westpac, is negative: the US Dollar is not in any way exceptionally undervalued, at least according to historical norms.

"In short, neither undervaluation versus yield spreads nor comparisons with past Fed hike cycles suggest that the USD is at an extreme undervaluation and ripe for a major reversal," says Westpac analyst Richard Franulovich.

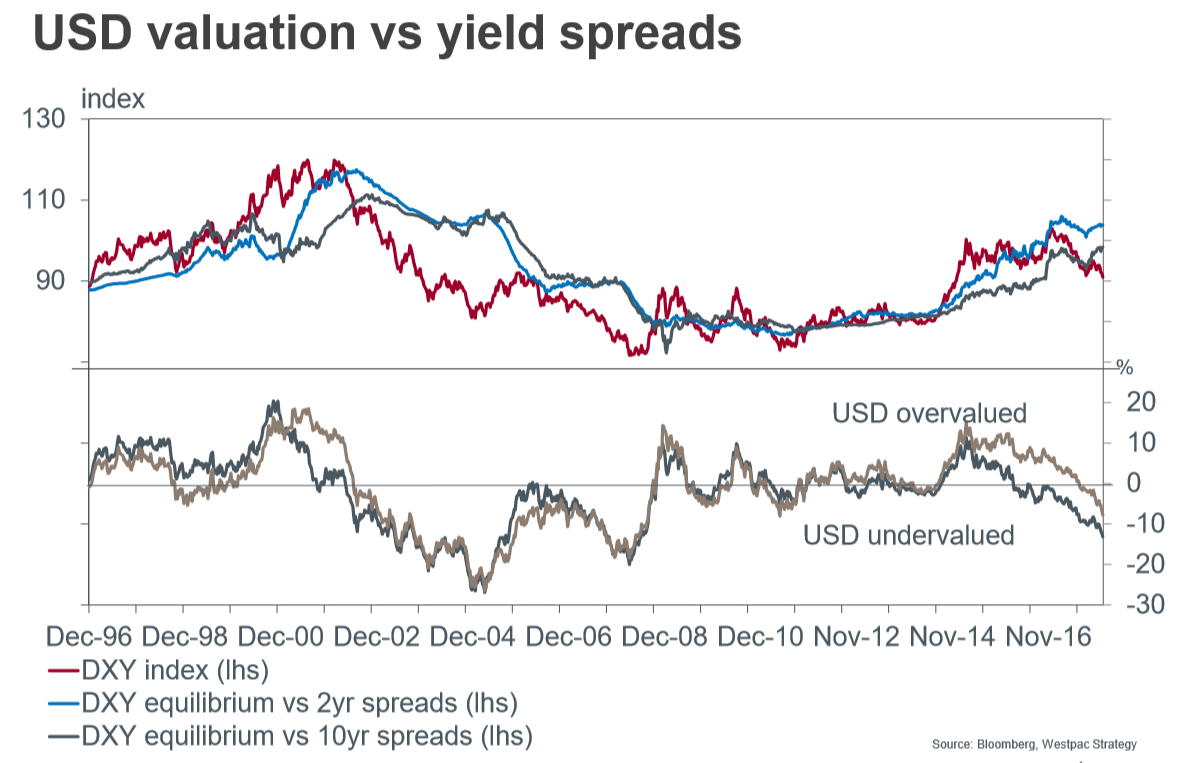

Whilst it is true that US treasury bond yields, which are normally highly correlated with Dollar, have decoupled and risen without the US Dollar, the divergence is not as big as it was in 2005, for example, when the US Dollar was 20% undervalued compared to yields.

This is shown in the chart below which shows the US Dollar index currently about 10% undervalued compared to 2 and 5-year yields.

Another way of looking at the US Dollar is in relation to the US central bank, the Federal Reserve's decision-making on interest rates.

The US Dollar is normally very sensitive to interest rates because rising interest rates attract greater flows of foreign capital due to their promise of higher yields, yet, exceptionally, in the case of the most recent hiking cycle, the Dollar has not risen as much as would be expected based on previous similar episodes.

"On average the broad USD has typically appreciated by about 8% two years into the last five Fed hike cycles. Against that the broad USD has depreciated by almost 2% in the two years since this tightening cycle began. The USD thus seems to be lagging trends that typically prevail during Fed tightening cycles," says Franulovich.

A case could, therefore, be made for the US Dollar now rising in a lagged effort to make up for the poor performance over the last two years, however, this is probably not the case as Franulovich ventures an explanation that rationalises the Dollar's poor performance.

The explanation is that the US Dollar appreciated more than usual in the two years prior to the beginning of the Fed's rate hiking cycle and therefore is probably simply discounting some of that exaggerated strength in the period immediately after the beginning of the cycle, when it could historically normally make the most gains.

The chart below offers a comparison of how the USD has performed over several Federal Reserve rate-hiking cycles.

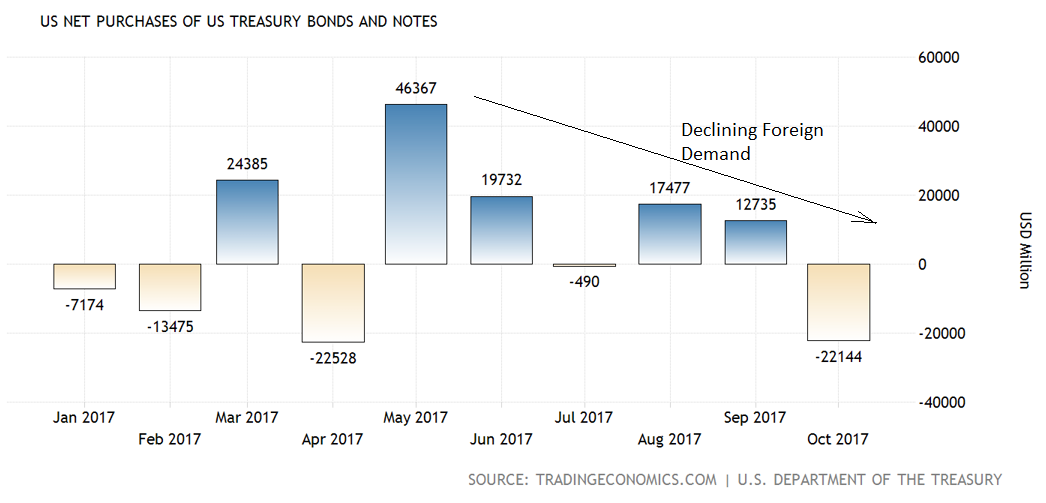

One possible explanation for the US Dollar decoupling from US treasury bond (UST) yields, may be changes in investor perceptions about the outlook for the bond market.

An increasingly common view amongst bond market participants is that bonds are sliding into long-term decline and this may be putting off foreign buyers who normally make up a substantial component of the UST market.

This, in turn, could be reducing portfolio flows and offsetting the posititve effect of higher yields.

The chart below seems to point to the possibility this might be the case as it shows a decline in foreign UST demand most recently, and a net deficit compared to US demand for non-US bonds.

(Image courtesy of tradingeconomics.com)

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.