US Dollar Boost from Tax Reform now Unlikely say Analysts

Analysis suggests one of the major drivers of currency appreciation in Trump's new tax reforms may not have the impact predicted.

From the perspective of the Dollar, one of the most important provisions in Donald Trump's tax reform legislation may be the part which deals with the repatriation of offshore earnings.

The accepted view has always been that this could be a major source of strength for the Dollar as billions of Dollars worth of corporate cash flood back into the United States.

Companies have squirrelled away an estimated 3.5 trillion Dollars offshore, mostly by simply not bringing money back to the US which they have earned overseas, opting instead to keep it abroad in order to avoid paying US corporation tax.

The US corporation tax rate currently stands at 35% and Trump wants to encourage more repatriation by offering either a tax holiday, or a lower tax rate on repatriated profits, so that the money can be put to use creating wealth in the US, rather than languishing with the 'lotus eaters'.

It had been thought that if they were successful in encouraging the backflow of money stashed abroad, it could be a major source of demand for the Dollar, which would rise strongly on the back of this new source of inflows.

Historically, for example, the Dollar rose after President Bush offered a tax holiday on repatriated earnings when he passed the Homeland Investment Act (HIA) in 2004.

Yet although repatriation flows rose from an average $20bn per quarter to a record high of $150bn in Q4 2005, it is quite difficult to determine the exact extent to which it contributed to the Dollar's rise over that period.

This is largely because at the same time, the Federal Reserve was also raising interest rates, which is another very strong positive driver for the Dollar.

Staying with the historical example, it is in some ways easier to quantify the impact of rising interest rates on the Dollar rather than the impact of repatriation flows.

US Treasury bond yields, for example, tend to rise at the same time as the Dollar when interest rates are the primary driver behind the Dollar's rise.

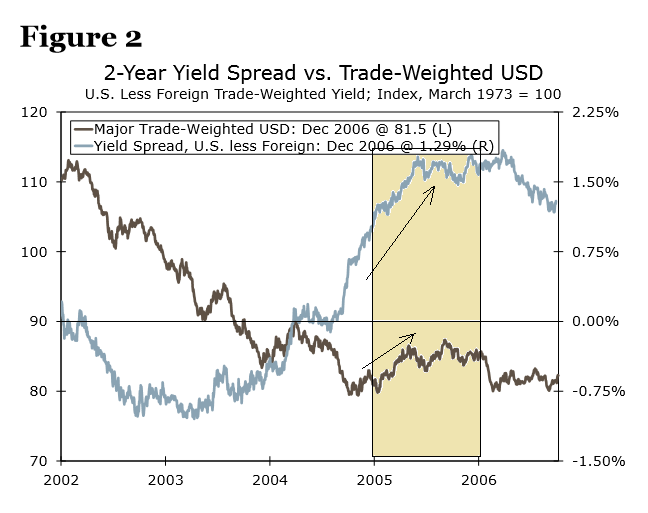

As can be seen in the chart below, both Treasury yields and the Dollar rose during 2005, suggesting the Dollar gains were mainly attributable to the Fed raising interest rates.

"The Federal Reserve was raising interest rates as part of a multi-year tightening cycle, a factor which likely had a more significant impact on currency markets. Indeed, as shown in Figure 2, the yield on the 2-year U.S. government bond was rising relative to yields on comparable bonds in foreign economies during that period, which probably was more of an impetus for Dollar strength in 2005," says Wells Fargo Currency Analyst Erik Nelson.

One reason for the surprising lack of impact of repatriation flows on the Dollar which this analysis seems to indicate, is that much of the repatriated earnings may already have been denominated in Dollars before they were transferred back into the US.

It is not possible to accurately quantify the share of the repatriated monies which were already denominated in Dollars and therefore had no extra impact on Dollar demand, however, cautions Nelson, after examining the data.

"To be sure, it is difficult to quantify how much of the Dollar’s rise during that period can be attributed to each of these two factors, or other factors. One particular consideration that must be made in that context is the currency composition of these flows," says Nelson.

According to Deutsche Bank, only 10% of overseas US company holdings are NOT in Dollars, suggesting 90% are already denominated in Dollars and the repatriation flows are likely to have a much lesser impact on the exchnage rate than previously thought.

Of the 3.5tr total assets overseas, only 1.5tr is stored in easily transferable liquid assets, and of these, only 10 % are in foreign currencies.

"Of this $1.5 trillion we estimate that only around 10%, or $150bn sits in non-dollar holdings. This estimate is based on a bottom-up analysis of company disclosures accounting for around half of S&P 500 cash," says Deutsche Bank analyst George Saravelos.

The data chimes with a similar analysis undertaken by J P Morgan on October, which also comes to the conclusion that repatriation is not likely to be a major driver of the Dollar because such a small share of the overseas earnings need to be exchanged.

"Dollar bulls may be disappointed if they're pinning their hopes on Republican proposals that could clear the way for U.S. companies to repatriate profits stashed overseas," says JPMorgan Chase & Co analyst Daniel Hui.

"Of the $2.2 trillion the bank estimates is available for repatriation, the actual flow back into dollars may be around $456 billion, given that much of the money is either already in the U.S. currency or is otherwise hedged or held in illiquid assets," according to the analyst.

There is also an important difference between the new tax reform proposals and previous ones.

The new proposals only call for mandatory "deemed" repatriation, which basically means only a share of profits need be repatriated, not the whole amount, as was the case in the previous tax holiday.

"There is no incentive to bring cash back immediately," notes Deutsche Bank's Saravelos.

While much of the focus has been on the impact of the corporation tax cut on the Dollar by way of repatriation flows, there are also doubts about the overall impact of the entire tax cutting agenda.

"We downgrade our assessment of the likely impact of any US tax cut on the Dollar. There is widespread skepticism on the extent to which a tax cut will provide direct economic stimulus, so what support there is for USD is likely to come from diluted channels such as pass through to higher equities," say Citi - the world's largest FX dealer in a note to institutional clients.

Citi say the problem for would-be Dollar bulls is that stocks are already rising and there has been a trend shift among international investors towards higher beta US assets. "This begs the question how much better it can get," say Citi.

Citi have recommended institutional clients go long on EUR/USD in 2018, partly as a result of this view.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.