ING Book Profit on Gutsy Bet Pound Sterling was Oversold Agianst the US Dollar

- Written by: Gary Howes

Foreign exchange strategists at ING Bank N.V. have been rewared for backing the Pound when it was down. But, they now see any further rises in GBP/USD as being generous.

The best performing currency of the week past was Sterling, which hit a 15 month high against its US counterpart amidst a sharp adjustment by investors who realised the UK currency is undervalued relative to the policy intentions of the Bank of England.

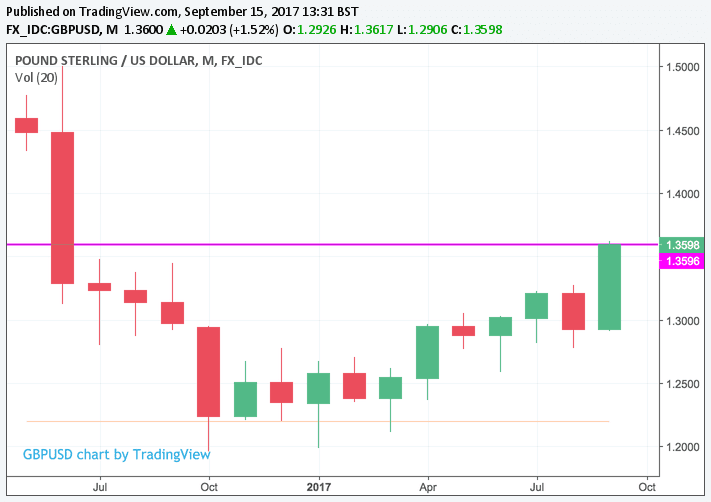

The Pound's ongoing rally against the US Dollar is now eating away at the levels lost during that infamous decline suffered following the EU referendum. The Pound-to-Dollar exchange rate (GBP/USD) recorded a high of 1.3615 on the inter-bank markets, a level last seen on June 23, 2016:

As the above chart suggests, there is a long distance to travel before the pre-referendum levels are attained once more so those hoping for levels in the mid-1.45s might have to exercise patience.

However, the rally has brought profit to those brave enough to buy into Sterling when it was suffering multi-year lows.

"The long GBP/USD recommendation we entered into the day after the June UK General Elections hit the 1.36 target today. We close the position with a 2.05% return, in turn generating an appealing 1:3.1 cost-return ratio," says Petr Krpata at ING in London.

"We had always felt that too much bad news was priced into GBP/USD and that at 1.2700 the cross was very cheap," adds Krpata.

ING looked for a correction higher on the basis of:

(a) too much bad political news priced into GBP and;

(b) our very constructive view on EUR/USD where we looked for a EUR/USD rally to 1.15 - which clearly materialised and exceeded expectations.

But what of the future?

"Looking ahead, even if one were to look through the near-term political risks, we think that the bulk of the BoE induced GBP rally (and the associated re-pricing) has largely occurred," says Krpata.

The analyst argues a ‘withdrawal of stimulus’ hiking cycle could, "at best, lift the UK rate curve a further 25-30bp higher in the near-term – which may only offer the pound a one-time boost. This story looks to have played out now following the post-Vlieghe move."

So entering the rally now might be a case of 'too little, too late'.

That is not to say momentum won't deliver further gains as often big moves enjoy decent follow-through action.

“The break above 1.3500 indicates that cable may be in a new bullish uptrend, with flows driven by interest rate expectations rather than concerns about Brexit," says Boris Schlossberg of BK Asset Management.

So while further advances are possible we would certainly expect the adjustment higher to fade.

Stay Safe

Longer-term, we would at this juncture suggest that those hoping for higher levels exercise some patience as the road will be choppy with many analysts still expecting a decent turn lower ahead of year-end.

Reclaiming such levels longer-term will most likely require the nerves surrounding Brexit to dissipate, and this is unlikely to occur until well into 2018 when the real details of the exit are hammered out.

With less than 18 months to go before Britain’s scheduled exit from the EU, and little concrete progress to date on post-Brexit trade, analyst Jane Foley at Rabobank sees downward pressure on the Pound renewing over the coming months.

“Consequently, we would be looking at a near-term recovery for Sterling as a selling opportunity,” says Foley suggesting Sterling will be especially vulnerable to the Euro.

Brexit negotiations not moving beyond the so-called financial settlement by year-end could be the catalyst for further losses.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.