Dollar Weakens In London As Fed Policy Outlook Clouds Further

- Written by: James Skinner

The short term debt ceiling deal complicates December's Fed meeting while the resignation of Stanley Fisher could have further reaching consequences for US monetary policy.

The US Dollar weakened against the G10 basket in London Thursday after the resignation of a Federal Reserve rate setter and a short term agreement on the debt ceiling were seen further clouding the outlook for Federal Reserve policy.

Stanley Fisher resigned from his position as vice chair of the Federal Reserve Wednesday citing personal reasons, removing a more hawkish member from the Federal Open Market Committee and creating another vacancy on the rate setting panel.

“Fischer’s resignation leaves the FOMC short of one of its more hawkish members, which is likely to reduce the likelihood of a rate hike in December,” says Barclays, in a morning note to foreign exchange clients.

Meanwhile, Democrat leaders agreed with President Trump and Republican officials to raise the US debt limit by a fraction and provide funding for the Hurricane Harvey relief effort in a move that effectively kicks the debt ceiling can down the road into the middle of December.

“Both sides have every intention of avoiding default in December and look forward to working together on the many issues before us,” Democrat Senate minority leader Chuck Schumer and House minority leader Nancy Pelosi said in a statement last night.

The Pound-to-US-Dollar rate rose by 0.14% for bids and offers to be accepted around the 1.3063 level, while the Euro-to-US-Dollar rate gained 0.20% to 1.1950.

EUR/USD price action came even in the face of a European Central Bank meeting that could see Mario Draghi and his governing council colleagues attempt to jawbone it lower.

Price Chart showing EUR/USD over 10 minute intervals. Source: Netdania

The US Dollar index fell 0.297% during early trading in London Thursday, to be quoted at 91.95, leaving it just 36 points off from a two and a half year low.

President Trump threatened lawmakers with a government shutdown in August if Senate Republicans couldn’t agree a bill that also provides funding for construction of the controversial Mexico border-wall to begin.

He could impose a government shutdown by refusing to sign any spending bill that comes to his desk without the provision.

A government shutdown would occur when the debt ceiling gets hit and lawmakers have not agreed to extend the limit. It is an emergency measure that allows the US Treasury to conserve cash in order to continue meeting sovereign debt payments.

Government shutdowns mean Federal workers are furloughed and many public services are withdrawn, so they are unpopular with voters.

A longer term debt ceiling agreement that has cross party support would make funding the president's border wall more difficult, although it remains unclear whether he is able to muster enough support for the measure within his own party to enable Republican lawmakers to pass a spending bill without Democrat support.

While the debt deal averts the need for a disruptive showdown in Washington during October, it has implications for Fed policy given that, if the central bank were to hike rates again in 2017, markets had the December meeting as the most likely candidate for an announcement.

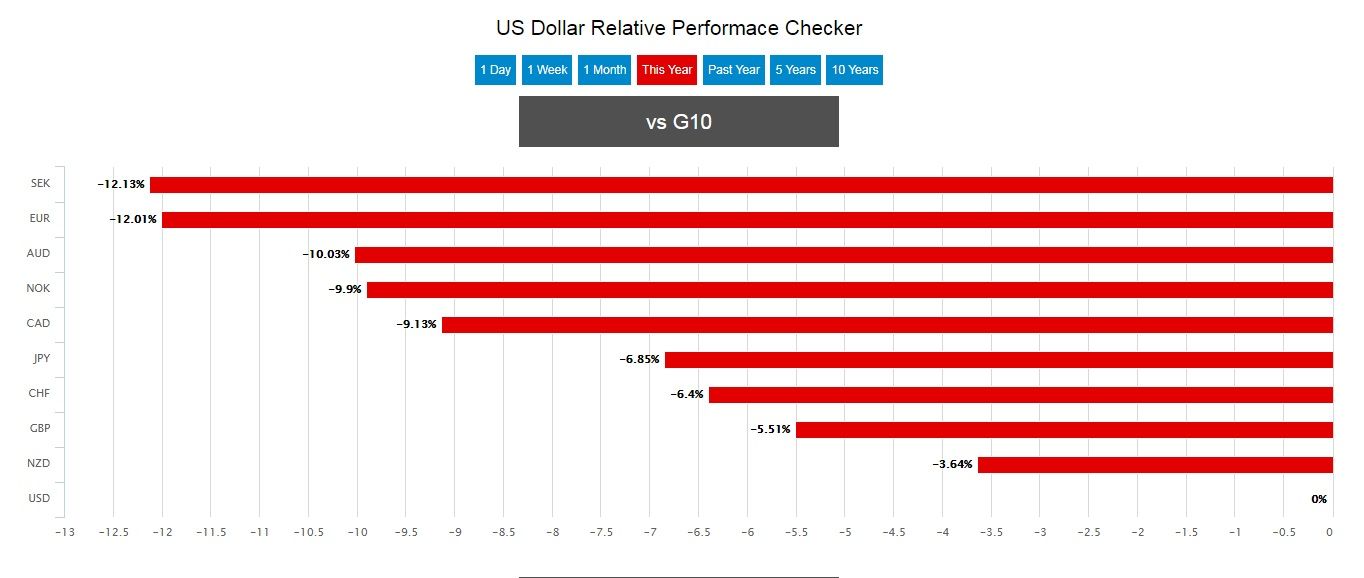

Graph showing the year to date performance of the US Dollar against the G10 basket. It has been the worst performing currency in the grouping. Source: Pound Sterling Live.

Fisher’s resignation comes into effect from mid-October, around nine months ahead of the June expiry of his current term, and could have far reaching consequences for US monetary policy and the Dollar, particularly in light of the fact that Janet Yellen’s term also expires in 2018 and it is an open question as to whether she will be reappointed.

“President Trump is likely to favour candidates who will help to maintain low rates and a weaker US dollar, such as Gary Cohn who is favoured to become the next Fed Chair,” says MUFG analyst Lee Hardman.