GBP/USD Might Have Peaked, Watch Trump Tax Plan for Surprises

Ahead of an important event for the US Dollar and global stock markets, we see the Pound to Dollar exchange rate (GBP/USD) consolidate in familar territory around 1.2824.

GBP/USD is seen staying stable in the narrow GBP/USD 1.27-1.2850 range.

Such consolidation typically occurs before a break-out move; but in which direction that move will be is the question.

We consider the arguments for a pop higher and for a pop lower.

The Dollar Could Slump on Trump’s Tax Plans

Market anticipation of some big tax cut announcements from US President Trump later today are running high.

We have seen US stock markets hit fresh highs and the Dollar move off its lows. The Dollar has been quite sluggish and has not matched the euphoria witnessed in stock markets.

Perhaps forex traders sense disappointment?

Today market focus will be on the expected announcement of Trump’s tax reform, with particular reference to the reduction of corporate tax: during the election campaign, Trump promised a cut from 35% to 15%.

As we approach President Trump’s 100 days in office - and the risk of a government shutdown - we are expected to hear about his "massive" tax plans.

Reports suggest that he plans to unveil tax cuts, including a 15% corporation tax rate, and a 10% repatriation tax on companies’ stockpile of overseas earnings.

These measures were discussed with Congressional leaders yesterday, some of whom may question whether the proposed fiscal measures are revenue-neutral.

Why Trump Could Struggle to Deliver

Standing in Donald Trump’s way is something that not even the finest in political spin can blow away - economic reality.

In particular, the fact that the US spends far more than it earns.

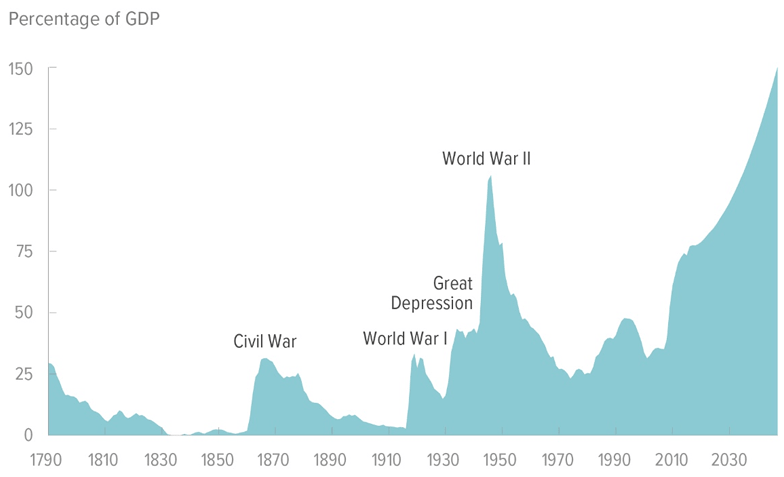

The Congressional Budget Office reports that, “at 77 percent of gross domestic product (GDP), federal debt held by the public is now at its highest level since shortly after World War II.”

Above: Are we in World War 3? The US debt pile suggests we are.

The CFO adds, “if current laws generally remained unchanged, the Congressional Budget Office projects, growing budget deficits would boost that debt sharply over the next 30 years; it would reach 150 percent of GDP in 2047. The prospect of such large and growing debt poses substantial risks for the nation and presents policymakers with significant challenges.”

The Tax Policy Center estimates that the proposed tax cuts from the new US administration would lower taxation revenues by USD6.2trn over 10 years which amounts to approximately 32% of current US GDP.

Taking into account added interest costs and macroeconomic effects, this estimate widens to USD7.0trn.

This is a whopping addition to the debt pile and unless it is financed it could bring US economic stability to its knees.

So the glaring questions is how will Donald Trump pay for what are incredibly expensive programmes?

If Trump fails to deliver we would expect the recent rally in stocks to unwind. Maybe he can say the right words today; but the longer-term reality of the US spending problem will push against him.

Indeed, this is the central scenario maintained at HSBC who have, as reported here, cut their forecasts for the US Dollar.

HSBC believe Trump simply won’t be able to deliver on the promises of his campaign and financial markets must readjust.

For them, this means a lower US Dollar profile.

Based on the above assumptions, there is therefore reason to suggest the Pound to Dollar exchange rate could jump higher out of its recent range.

Of course, if Trump does deliver then the US Dollar could push higher and bring an end to Sterling’s recent period of appreciation.

"If the 'specific governing principles' today offer more detail than the market expects, this may provide some support for the USD in the short term. However, the uncertainty surrounding any of these details would be huge," says a note on the matter from UniCredit who have reiterated they maintain a bearish stance on the USD.

Why a Peak Could be in Place for GBP/USD

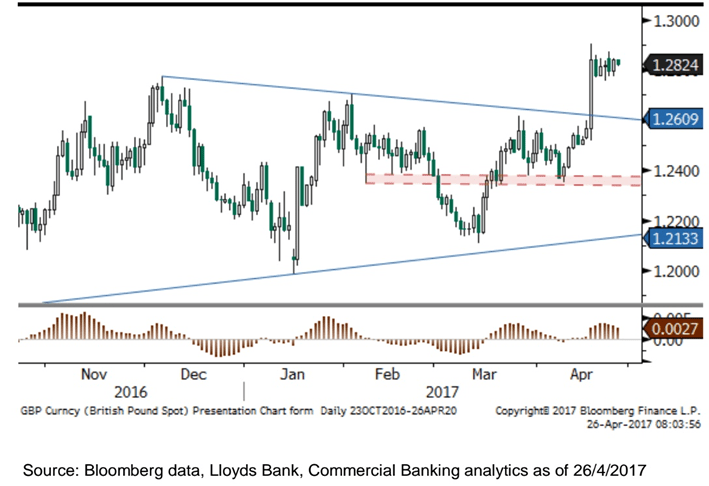

While Trump and the fundamental backdrop he provides to the Dollar offer the potential for big moves, technical studies suggest Pound Sterling might have already peaked against the US Dollar.

The exchange rate is seen holding the “flag” resistance at 1.2845 according to Robin Wilkin, a technical analyst at Lloyds Bank.

“While support at 1.2755/25 holds, this consolidation phase is seen as corrective ahead of a test of resistance around 1.3000,” says Wilkin in a briefing to clients dated April 26.

Lloyds believe that the GBP/USD exchange rate is in the last phase of the gains from the March lows and the upside is limited.

Only a run through 1.3070/1.3100 will question this scenario in the short term and risk an expansion of the range towards 1.3500.

Meanwhile, a decline through 1.2725 and then 1.2600 will suggest that a peak is in place.