The GBP/USD Extends Journey Downward, US Fed Expectations Key to End-of-Week Performance

GBP/USD is moving lower as Pound Sterling continues its trek lower with any boost conferred by the Chancellor’s budget speech on Wednesday quickly unravelling.

At the time of writing the GBP/USD exchange rate is quoted at 1.2165, down from the week's open at 1.2290.

One explanation for the Pounds subsequent weakness is the lack of provision for fiscal stimulus in the 2017 budget annunced mid-week which most commentators have deemed to be budget-neutral i.e. increases in spending have been met with increases in taxation in other quarters.

The impact on the UK's economic growth trajectory is likely to be netural with the Chancellor opting for fiscal discipline and holding the recent boost to his coffers as a reserve incase economic performance takes a dip over coming months.

When looking at the event through the prism of foreign exchange the budget-neutral stance of the UK contrasts to the sort of policies being promulgated in the US by the Trump administration.

Assuming growth stalls as the Office for Budget Responsibility forecasts in 2018 and 2019, this will leave more work for the Bank of England to do using its monetary policy tools.

Any increase in support from the Bank would be negative for the Pound as it increases the supply of money to the economy, lowering the unit-value of Sterling.

This could push GBP/USD down even further, and what we may be witnessing at the moment is the start of such a protracted downtrend.

If there is a hope for Sterling, then it is that the Dollar has already priced-in all the good news concerning Trump's spending and taxation plans, and there isn’t higher for it to go.

Nevertheless, the pressure there may be on the BoE to keep monetary policy accommodative, even as inflation is rising, is likely to hammer Sterling lower regardless of the Dollar’s own position.

US Employment Data Ahead

The Dollar surged higher on Wednesday following strong labour data, which showed 298k jobs were added to the economy in February.

The lack of follow-through on Thursday has been put down to the fact there is now a nearly 100% probability of a rate increase at the Federal Reserve’s March 15 meeting, which means a rate hike is now fully priced in.

With a rate rise next week now already baked into the value of the Dollar what will matter now are expectations regarding a June interest rate - currently priced in at 50%.

Should Friday's non-farm payroll release beat expectations we could see the probability for a March rate rise increase, and with it the value of the USD.

Expectations for job growth have increased to 200K from 175K with investors positioning for a strong number.

"The absolute amount of payroll growth will be important but revisions to past reports, average hourly earnings, the unemployment rate and the labor participation rate are all significant. If average hourly earnings rise less than expected or the unemployment rate holds steady, any initial Dollar rally on the back of greater job growth could fade quickly," says Kathy Lien at BK Asset Management in New York.

Markets too Conservative on Interest Rate Expectations?

The CME's FedWatch tool shows that Fed Funds Futures traders think it's more likely than not that the Federal Reserve will be able to raise interest rates three times this year, making it the first time in years that the Fed has not been far more optimistic than the market as a whole.

In assessing whether the increased interest rate expectations currently built into the Dollar are warranted, analyst Mathew Weller at Faraday Research markets might actually be too conservative about the future trajectory of interest rates.

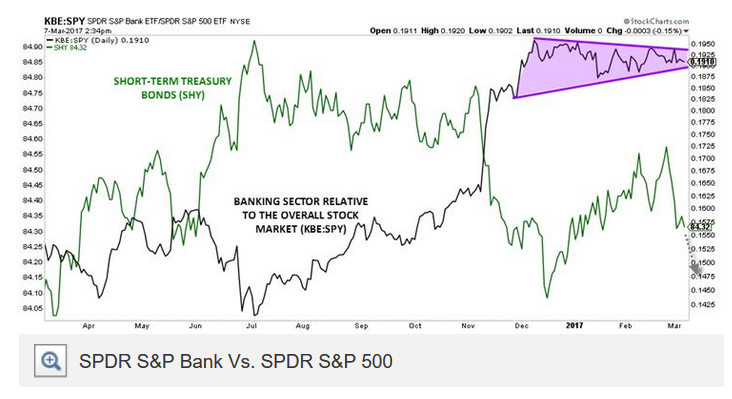

He notes, for example, how banking stocks tend to be an early indicator of higher interest rate expectations as they provide banks with more profitability.

“Certain sectors of the stock market tend to be closely correlated with the outlook for interest rates. For instance, banking stocks tend to make money on the "net interest margin" between their liabilities (checking and savings accounts, CDs, etc) and their assets (mortgages issued, car loans, etc). This margin tends to rise with the general level of interest rates, so outperformance of the banking sector (NYSE:KBE) relative to the broader market can provide an indication of stock market investors' outlook for interest rates,” says Weller.

Weller highlights not just how much higher banking stocks are relative to the market as a whole, but also how they are coiling in a triangle formation which looks poised to breakout to the upside.

All REIT?

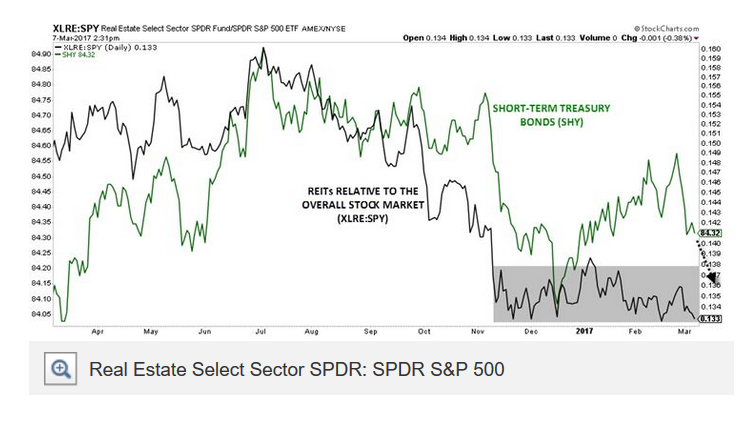

Another strong intermarket relationship which supports the view interest rates might be rising even faster and higher than expected is the relative performance of REITS (Real Estate Investment Trusts) to the S&P.

Investor tend to use REITS when interest rates are low because they are a special type of dividend stock (they are obliged to pay holders an annual dividend) and so tend to yield more than pure interest, as Weller explains:

“Because REITs are legally obligated to pay out a high proportion of their earnings as dividends, they tend to have higher yields than other stocks. The appeal of these high yields waxes and wanes depending on where stock investors think interest rates are headed. Right now, the weak relative performance of REITs suggest that short-term interest rates could be heading higher.”

Whilst the relative performances do look a little stretched and could narrow, which would signal interest rates were not going higher as quickly, the fact the over and underperformance exist, and as long as it remains, the path of rates will be higher.

And if foreign exchange markets catch onto the view that US interest rates are likely to rise faster than they are currently expecting we would expect the Dollar to move higher as it plays catch-up.

In short, the trend of a stronger Dollar looks set to remain with us for some time yet.