GBP/USD Outlook: UBS, Credit Suisse, Lloyds Bank Short-Term Views

GBP/USD was the second-best performing G10 currency pair on the first day of the new week having risen some 0.90% to reach 1.2482.

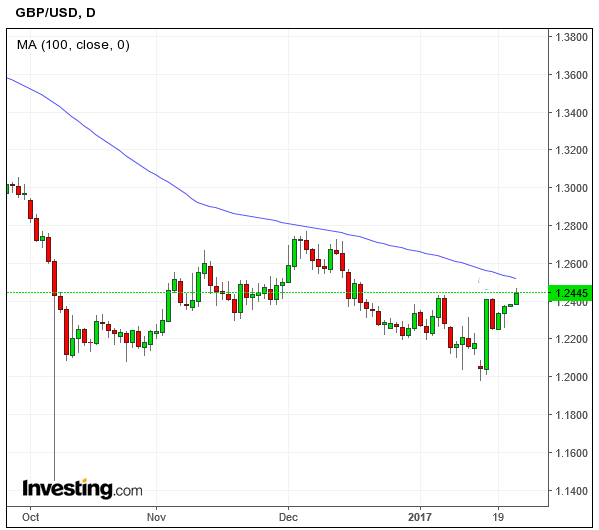

The currency has broken out of a technical downtrend, as noted here, but while the short-term trend may have improved big questions remain over whether the strength can extend meaningfully.

Indeed, on Tuesday 24 January we have however seen a retracement of some of those gains with the pair quoted at 1.2471.

But, the technical significance of recent gains has seen strategist David Sneddon at Credit Suisse turn from negative to positive on Sterling-Dollar.

In a note to clients Sneddon observes:

"GBPUSD has started the week on the front foot and has broken up through key near-term resistance at 1.2409/21 – the January high, 200-day average and the falling trendline from the August last year. This establishes a bigger base and opens up a more extended recovery to 1.2549 next, then 1.2721/29 with the bigger obstacle seen at 1.2776, the high from December last year."

Previously Sneddon had said only above key resistance at 1.2407/45 would the pair set a new base.

Sneddon is in support of moves to 1.2465, then 1.2424/06, then 1.2373/70.

"A break below 1.2261/53 is needed to ease immediate upside pressure," says Sneddon.

UBS – Buy Dips

Technical strategists at UBS are by contrast a little more bullish.

“I think it's just a matter of time until this will trade higher," says analyst Gary Hardcombe at UBS.

Hardcombe is looking to buy dips towards 1.2360-70 with a stop loss set at 1.2300 to protect against the trend turning.

UBS do have an upside target at the 100-day moving average at 1.2525.

Lloyds – Bull Momentum

Technical strategists at Lloyds Bank Commercial Banking meanwhile see the exchange rate heading to range highs.

“We broke through the 1.2475 resistance region yesterday which supports our view of a move back to test the range highs (current range is loosely 1.20-1.28). That said, we expect the market to remain volatile in this process,” says analyst Robin Wilkin.

Wilkin believes that only a break below 1.2250 would, “negate this new bull momentum dynamic.”

Overall the exchange rate remains trapped in a 1.20-1.28 medium-term range.

Longer-term, however, further declines cannot be discounted.

“Long term, we believe the decline that started back in 2007 at 2.1160 is close to completing with the move under 1.30. While it is unclear that 1.1491 was the major base, 1.15-1.08 is our ideal ultra-long term basing region,” says Wilkin.