The US Dollar is Still Going Higher, EUR/USD to Fall towards 0.95 say ABN Amro

The US Dollar been the worst-performing G10 currency of 2017 so far.

The Dollar has struggled against major rivals since the so-called Trump-trade - which characterised global markets since Donald Trump's election victory - stalled at the turn of the year.

In the current environment, the US Dollar is driven by cyclical factors and upside in the US Dollar goes hand-in-hand with a rise in equities, cyclical bonds, higher official rates, higher US Treasury yields and higher real rates.

Markets had been bidding the Dollar higher in anticipation of higher spending and lower taxes under the new administration which had driven up inflation expectations.

On Friday January 20 the Dollar took another leg down after Trump’s inauguration speech which was thick on protectionist trade talk but was thin on mention of infrastructure spending.

"Dollar weakness is the driving force in the markets this morning as the greenback retreats after the first few days of Donald Trump in the White House. So far the new president has stoked protectionism but offered little detail on the good stuff – pro-growth infrastructure spending, stimulus etc. That’s ensuring the dollar starts the week on the back foot," says Neil Wilson, Senior Market Analyst at ETX Capital.

But the Dollar is Still Going Up

Yet this is not the end of the road for the Dollar, according to ABN Amro’s Roy Teo and Georgette Boele who have told clients the cyclical Dollar uptrend is not yet done.

"We expect the US dollar to rise as long as the market perception is alive that the Trump Administration will be positive for US economic growth without too sharp a rise in inflation," say the analysts.

“We remain positive on the US Dollar (USD) given our view that the Fed is likely to raise interest rates more aggressively (75bps) than what is priced in by financial markets (50bps),” they add in a recent research note.

Currently, the Fed has set US interest rates at 50-75%.

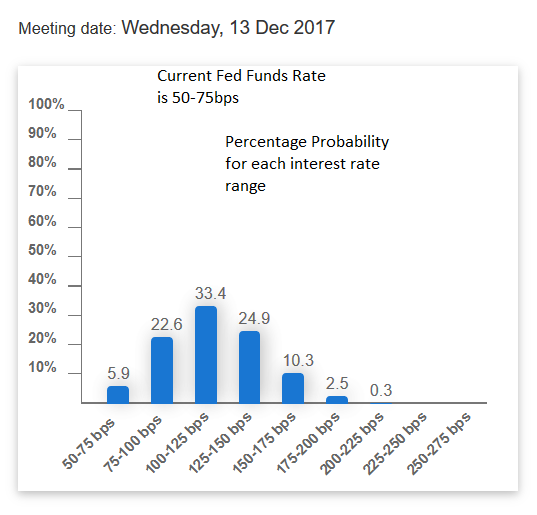

The market thinks they will probably go up to 1.00-1.25% in December 2017 (see chart below), but Teo and Boele think they will go up even higher to 1.25-1.50% instead.

Higher interest rates will strengthen the Dollar as they will attract more inbound investment.

ABN Amro’s analysts also point to the Dollar’s sensitivity to Janet Yellen’s remarks that more rate hikes would not come as a surprise:

“Weakness in the Dollar came to a halt after Fed Chair Janet Yellen indicated that the Fed is likely to increase the Fed Funds rate a few times a year until by the end of 2019 to around longer run neutral rate of 3%."

According to the Fed’s own criteria, the economy is now operating at full employment, which is an Unemployment Rate of 4.75% or less.

This is a further sign that the Fed is unlikely to delay raise interest rates.

“She warned that raising interest rates too late could risk a nasty surprise down the road – either too much inflation, financial stability or both. In short, we see the recent correction (lower) dollar as healthy and an opportunity for investors to position for USD strength,” say the analysts.

Teo and Boele supply further evidence from options markets to support their bullish forecast.

“This is reinforced by the fact that demand in the currency options market to hedge against weakness in the USD has reversed,” conclude the ABN Amro analysts.

ABN Amro expect the EUR to weaken further versus the US dollar driven by eurozone political uncertainty and monetary policy divergence across the Atlantic.

"We expect EUR/USD to break below parity and to reach 0.95 over the next 6 months," says Boele.

ABN Amro have however increased their year-end EUR/USD forecast from 0.95 to 1.00.

Boele now expects ECB tapering expectations to have a more dominant role in driving EUR/USD towards the end of 2017.

She also now expect that the impact of Fed rate hikes on EUR/USD will start to wane in Q4 as financial markets will probably have fully priced them in by that time.

This should push EUR/USD higher towards party again in the fourth quarter of 2017.