July Payrolls Not Enough to Sway Many Analysts From December Interest Rate Call

Most analysts still expect the next rate hike in December despite the strong labour market.

July payrolls rose a magnificent quarter of a million, dispelling fears the US economy had stalled after May’s shockingly poor 24k result.

The 255k increase in men and women gainfully employed, roundly beat forecasts of 180k, and led some economist to consider plausible the view that the Fed might bring forward to September the time when they would consider raising interest rates.

Barclays Bank’s economist Jesse Hurwitz, for example,is one of those who now sees September as credible:

“The July jobs report should boost Fed policy committee members’ confidence in the outlook, especially following the unexpected weakness in second-quarter gross domestic product.” He was reported as saying by MarketWatch’s Gregg Rob.

Hurwitz added:

“We continue to expect the Fed to hike rates at its September meeting, and we look to Chairwoman [Janet] Yellen’s appearance at the Jackson Hole Symposium on August 26 for confirmation of this view.”

Yet other supporters of a September move from the Fed are few and far between.

CIMC Markets analyst Jeremy Stretch does not think the Fed will opt for a rate hike in September, however, he admits that his colleagues in the CIMC economics department do, nevertheless, he and his analyst colleagues remain set on December.

“In the context of the labour data we would highlight the comment from our colleagues in CIBC Capital Markets Economics who noted that July’s (NFP) print is a ‘better indicator of underlying momentum.’ They also noted the ‘strong readings almost across the board for the data FOMC members are watching closely.’” Remarked stretch in a recent note, adding:

“Labour market resilience has re-opened the debate about a September hike. While we would not view the debate about a September Fed move as being credible, we cannot ignore the uptick in implied rates, for September from 18% prior to non-farms to 26% and from 37% to 47% for December. We would expect that the uptick in implied rates should keep the USD relatively well supported, albeit the DXY failed to breach the 200-day MAV despite NFP.”

Analysts at Citi are also still hanging onto December as the most likely month for a rate rise, as external risks and November Presidential Election weigh on hopes of an earlier rate hike:

“We expect the Fed to wait for more data in order to confirm US economic outlook despite strong July job data. Together with external economic uncertainty and US Presidential election in November, we continue to expect the Fed not to hike rates until December.” The said in a recent note.

Whilst the Fed has cut rates several times in the two months prior to an election they have, according to research from advisory service GailForler Group, only hiked rates once out of a possible five times in the two months prior to an election, however, the sample data is very small.

“The Fed’s reluctance to raise rates as Election Day approaches is further evidenced by the Fed’s behavior in 1988 and 1996. In 1988, the economy was booming, and our Fed Diffusion Index was hovering between 60 and 75 percent.1 In response, the Fed hiked rates in May, June, July and August, yet paused in September and October before raising rates again at each of the subsequent three FOMC meetings after the election.

“In late 1996, the economy was again booming and our Fed Diffusion Index reached 70 percent in September and October, pointing to a rate increase, but the Fed did not raise rates until after the election in 1997. Table 1 highlights the Fed’s hesitancy to raise rates in election years as Election Day approaches.” Commented Bernadette Kilroy Martin of GailFosler Group

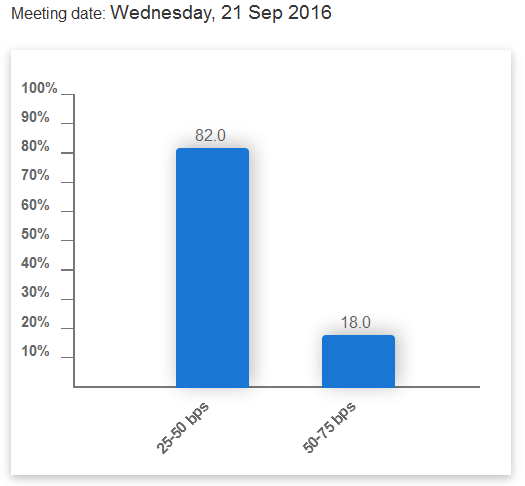

What Fed Fund Futures say about the probability of a September versus December hike

One quick and dirty method of calculating probabilities for future central bank policy moves is to consult Fed Funds Futures Prices released by the CME group, which produce a percentage chance outcome of whether the Federal Reserve will raise interest rates or cut them by 0.25% (same as 25 basis points or bps).

Currently Fed Funds futures are pricing in an 18% probability of a 25bps rise in September (see second pic below), a 19.3% probability of a rate rise in November and a 39.7% probability of a rise in December (see pic below), with an additional 6.7% probability of a 50 bps increase then.