China Dumps 2 BN US Dollars Onto the FX Markets a Day

China is releasing significant sums of US dollars onto the market in a move that ensures the currency is unlikely to appreciate.

Surely the US dollar should be higher - particularly with the US Federal Reserve mere months away from a pro-USD interest rate rise?

Answering the question of why the US dollar is not stronger is Sweden’s Handelsbanken Capital Markets who suggest China are holding the USD back.

Importantly analysts are forecasting the Greenback to remain under pressure through the remainder of 2015 as the Chinese continue to whittle away their foreign exchange reserves.

Chinese FX reserves are decreasing at a sizeable pace as the country frees up Yuan to fund government spending in order to fight the slowdown in economic growth.

China's foreign exchange reserves fell to 3.56 trillion U.S. dollars at the end of August, down 93.9 billion U.S. dollars, marking the fourth consecutive month of falling forex reserves, according to PBOC data.

As dollars are sold so the value of the dollar must fall - the impressive dollar rally that characterised the start of 2015 remains in slumber.

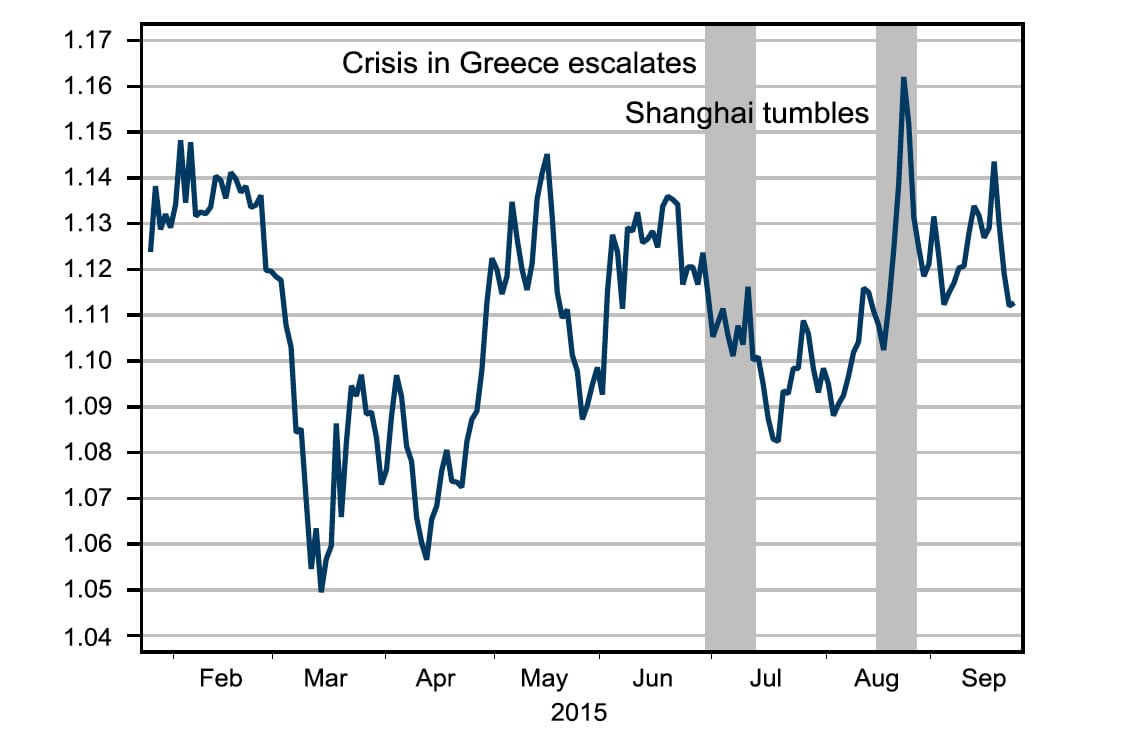

Despite getting closer to the advent of US interest rate rises (seen as the reason for the impressive dollar rally) the USD has simply been unable to find traction, as shown by the performance of the dollar index:

Is China responsible for a lack of traction in the USD?

According to Handelsbanken’s estimates sizeable amounts of US dollars are being sold.

Analyst Pierre Carlsson says:

“Since the beginning of the year until August, Chinese reserves have decreased by around USD 220bn. On top of that the current account balance has shown a surplus of roughly another USD 200bn.

“If we calculate on a 75 percent USD weight (the dollar is dominating the current account flows), we get a very rough guess of around USD 315bn that the Chinese central bank has sold from January to August this year.

“That is close to USD 2bn every day.”

Such a supply of dollars into the markets will without doubt have an impact on exchange rates, perceivably keeping any rallies in the USD limited as Chinese reserve managers capitalise on any strength.

Treasuries Feel the Heat

From a fixed income perspective Handelsbanken argue this sell-off is also showing in the spread between the US swap rate and US treasuries, which in the 10-year segment are now trading at around zero.

“A lot of the Chinese reserves have been placed in US treasuries and it is hard to come up with any other, reasonable explanation to this pricing situation,” says Carlsson.

Chinese Public Spending and a Soft US Dollar

There is pressure for a weaker CNY stemming from capital outflows as China is opening up its capital controls.

This forces the Chinese authorities to intervene massively.

“At the same time they are constantly pushing up public spending in an effort to support their struggling GDP growth, so the yuans they buy come to use in ever-growing public spending,” says Carlsson.

Taking into account the comments coming from the Chinese government, Handelsbanken argue is not likely that the increase in public spending will decelerate sometime soon.

“Our conclusion is that this will remain a burden for the USD, at least until year-end,” forecasts Carlsson.

It is also suggested by the Swedish bank that this was one of the main reasons why the USD did not strengthen at the peak of the Greek crisis or when global equity markets fell, in combination with the Shanghai index dropping 27% in nine days.