Pound to Dollar Rate Firms on Easing U.S. Bond Yields

- Written by: Gary Howes

Photo by: U.S. Department of State (IIP Bureau).

A decline in U.S. bond yields has pressed the pause button on the Dollar's rally.

The Pound to Dollar exchange rate (GBP/USD) looks to make a second consecutive daily gain on Friday, helped by a slide in U.S. borrowing costs.

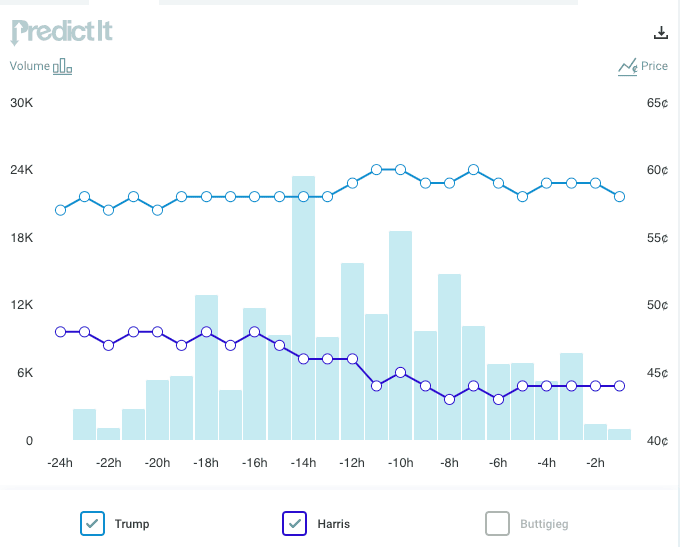

"The USD rally lost steam," says Jens Nærvig Pedersen, Director of FX and Rates Strategy at Danske Bank. "It could coincide with a small slip in the probability in betting markets of Donald Trump winning the Presidential election."

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Market odds of a Donald Trump victory have risen over the past two weeks, and with them, the Dollar.

This says it is betting market odds and not polling that is driving financial market sentiment. After all, analysis shows the betting market has a 75% hit rate of correctly calling the winner.

Trump's tariff hikes and tax cuts agenda is seen as inflationary and, therefore, supportive of higher-for-longer U.S. interest rates.

This is fundamentally bullish for the Dollar, and any retreat in Trump's odds of winning can weigh on the USD.

However, Danske's Pedersen says the pullback in U.S. bond yields and the Dollar may also simply be the market getting second thoughts on the sustainability of the recent sharp rise in U.S. rates.

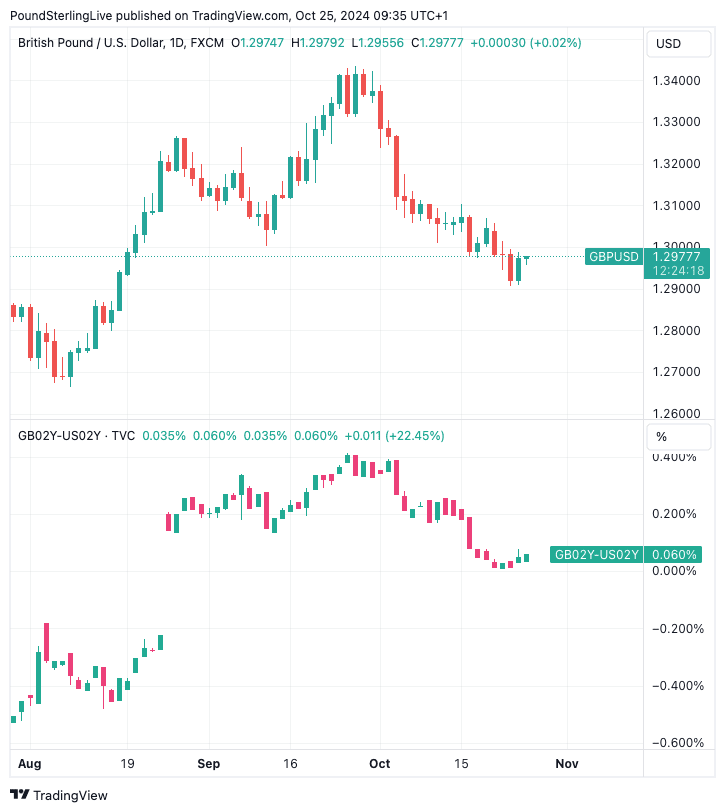

The above chart shows the GBP/USD exchange rate in the top panel, with the difference in the yield paid on the UK government's two-year debt and the U.S. government's two-year debt shown in the bottom panel.

October has seen U.S. bond yields rise quicker than those of the UK, which means the differential has fallen, dragging GBP/USD lower.

Going forward, if U.S. yields settle, so too could GBP/USD.

"This adjustment may be complete for now," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG Bank Ltd. "USD upside risks will possibly now be less about yields."

Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole, says although the 'Trump trade' is supporting the Dollar, we shouldn't forget the impact of upside surprises in U.S. economic data, which "boosted the USD rate appeal as investors reassessed their dovish Fed outlook."

At the start of October, the market expected the Federal Reserve to cut interest rates by an additional 75 basis points over the remainder of 2024. This was in the wake of the decision in September to cut rates by 50 basis points.

This has been whittled down, and just one more 25bp cut is now anticipated, which represents a significant reduction in expectations that has lifted the value of the Dollar.

"The message from yesterday’s preliminary PMI surveys, the jobless claims figures and the new home sales data was that the US economy is still growing at a respectable rate, far above the growth achieved by most developed countries. The Fed hawks are not 100% on board for another rate cut, but the market will have to wait for November 7 for further comments on monetary policy," says Achilleas Georgolopoulos, Market Analyst at Trading Point.

Looking ahead, Crédit Agricole says some Fed-related positives may now be in the price of the USD, however, the prospect of Donald Trump winning the U.S. election could keep the USD in demand in the near term.