Pound to Hit 1.28 vs. the Dollar? Inflation Could Do It

- Written by: Sam Coventry

Image © Adobe Images

The British Pound will come under pressure if UK services inflation lands below 5.2% on Wednesday.

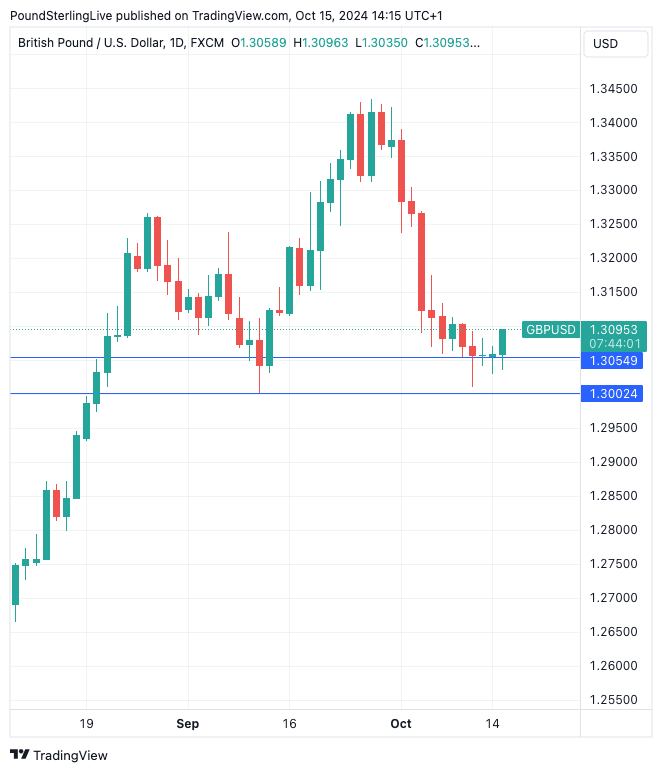

Ahead of the inflation figures, the Pound to Dollar exchange rate (GBP/USD) has found support at a key support level of 1.3054 and is putting in a decent daily bounce.

Gains come amidst a surge in U.S. stocks following some positive earnings from a number of big Wall Street names, suggesting the recent easing in expectations for Federal Reserve rate cuts is no impediment to the bulls.

The natural FX market reaction when risk 'is on' is to buy Dollars.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

However, for now, GBP/USD's rise is a counter-trend bounce, and the risks remain tilted to the downside as it could be too soon to call the end of the October selloff.

This is confirmed by analyst Robert Howard at Reuters, who thinks the midweek release of UK inflation is a particular risk to GBP/USD.

"Sterling might extend south towards 1.28 if UK inflation data comes in cooler than expected on Wednesday, as this would raise the risk of the Bank of England cutting interest rates twice before Christmas," he says in a note to clients.

UK inflation is expected to dip below 2.0% again, but this will be thanks to the decline in oil prices through to September.

Instead, the key driver of any FX market reaction will be on which side of 5.2% services inflation lands.

Should inflation come in below 5.2%, the Pound could come under pressure against the Dollar.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The data comes two weeks after Bank of England Governor Andrew Bailey surprised markets by saying the Bank could be more "activist" when considering interest rates cuts.

However, he qualified with the remark that any such shift would depend on the nature of the inflation data.

Markets now see a 50% chance of the Bank delivering consecutive 25 basis point rate cuts on Nov. 7 and Dec. 19. Pricing for December will rise in the event of a soft set of data, which would pressure the Pound.

"GBP/USD, which was last at 1.2800 in mid-August, plumbed a one-month low of 1.3011 last Thursday – a week after Bailey's dovish guidance hit the pound hard," says Howard.