GBP/USD Week Ahead Forecast: A Fair Level

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling's solid recovery late last week following the U.S. job report blowout offers a telling clue as to how this week's price action might pan out.

The Pound to Dollar exchange rate dropped like a stone after the release of yet another above-consensus jobs report, which kicked the favoured start date of the first rate cut at the Fed from July to September.

The extent of the move suggested a breakdown was underway in not only Pound-Dollar, but other Dollar-based exchange rates.

Yet, within a couple of hours, the Dollar ceded those gains and reinforced support under the Pound-Dollar, increasing our confidence that price action above 1.26 is more likely in the coming week than below it.

"We think 1.26 is a fair GBPUSD level for the time being, but our forecasts are tilted upward for later in the year—reaching 1.30 by year-end," says Thomas Flury, Strategist at UBS Switzerland AG.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

It is unclear why the Dollar failed to hold the gains: after all, the market's move to favour September over July is a significant one that is entirely consistent with Dollar strength.

Ian Shepherdson, Chairman and Chief Economist at Pantheon Macroeconomics, offers an insight, explaining "a real slowdown in job growth is coming".

He points out the NFIB survey’s hiring intentions measure and the increase in layoff announcements points to much slower payroll growth in the spring and early summer.

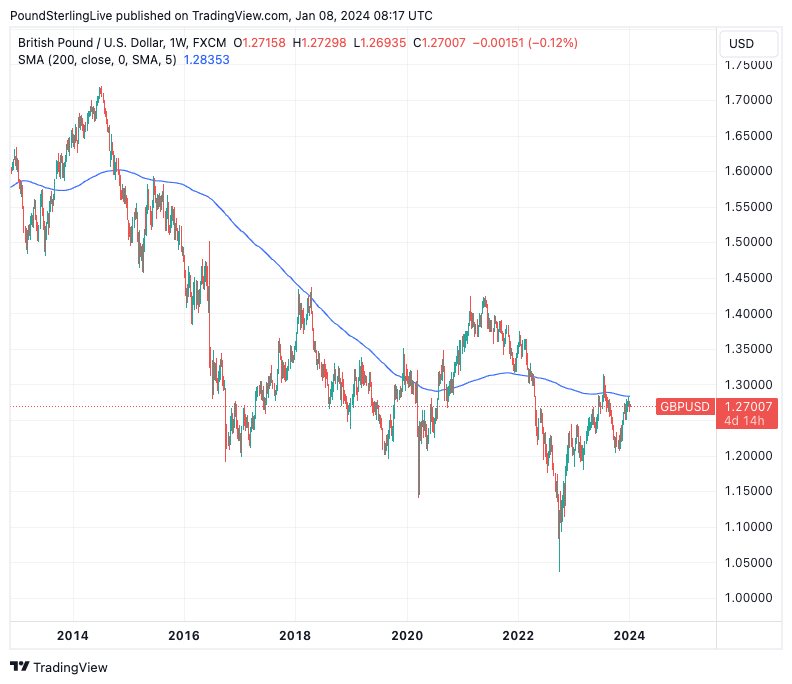

Above: GBP/USD at weekly intervals. Track GBP/USD with your own custom rate alerts. Set Up Here

"The NFIB has been the best single leading indicator of private payroll growth over the past couple years, and it is now consistent with a sustained slowing, to the point where private payrolls could fall outright by June or July," says Shepherdson.

If you knew that kind of development was incoming, would you be buying Dollars, or would you rather not risk it? I know where the smart money would be.

Bringing it all together, we are seeing reasons to expect further price action in the 1.26 area over the coming days, although it is worth pointing out that Wednesday's inflation report will be interesting.

The market looks for the headline CPI inflation rate to have risen to 3.4% year-on-year in March from 3.2% in February as it continues to drift further away from the Federal Reserve's 2.0% target.

The Dollar can rally should the figure exceed this, but given the reaction to the NFP data, it would require an exceptionally strong reading to deliver a significant appreciation in the Dollar.

Also of interest is Thursday's producer price index measure of inflation, which can provide insights into how the headline CPI index might behave in the coming months. Here, the market looks for a 2.3% increase y/y in March.