Pound-Dollar Tipped to See Near-term Weakness as Fed to Push Back on Rate Cut Expectations

- Written by: Gary Howes

Image © Federal Reserve

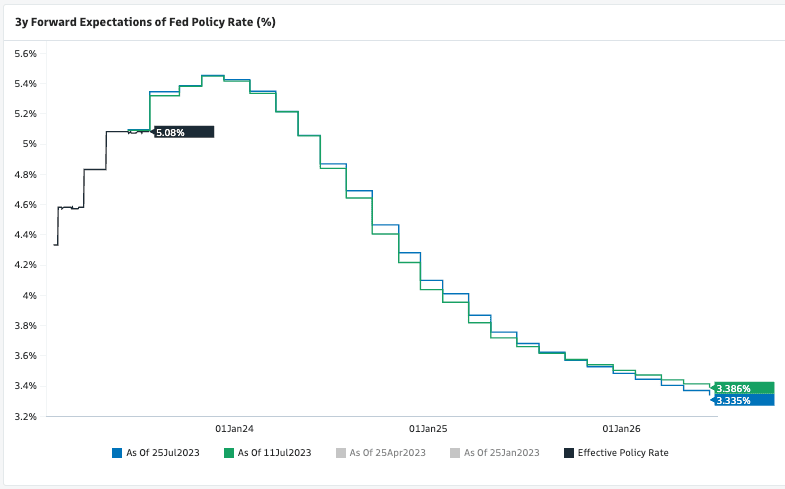

The Federal Reserve will offer the Dollar further near-term support if it pushes back against market expectations for a rapid series of interest rate cuts in 2024, according to analyst research released ahead of the July policy decision.

The Fed is expected to raise interest rates and give clues as to what the future holds in what amounts to arguably the most important calendar event of the month for investors.

"Fed day has arrived," says Chris Turner, an analyst at ING. "Important drivers of the FX story near term will therefore be whether the Federal Reserve stays hawkish."

Markets are fully expectant of a 25 basis point interest rate rise but the crux for foreign exchange market direction will be whether expectations for another rate hike firm or recede based on the guidance.

"A hike today is almost fully priced in, the bigger question for markets will be if the statement and the press conference signal anything about the likelihood of further rate hikes ahead," says Henry Allen, an analyst at Deutsche Bank.

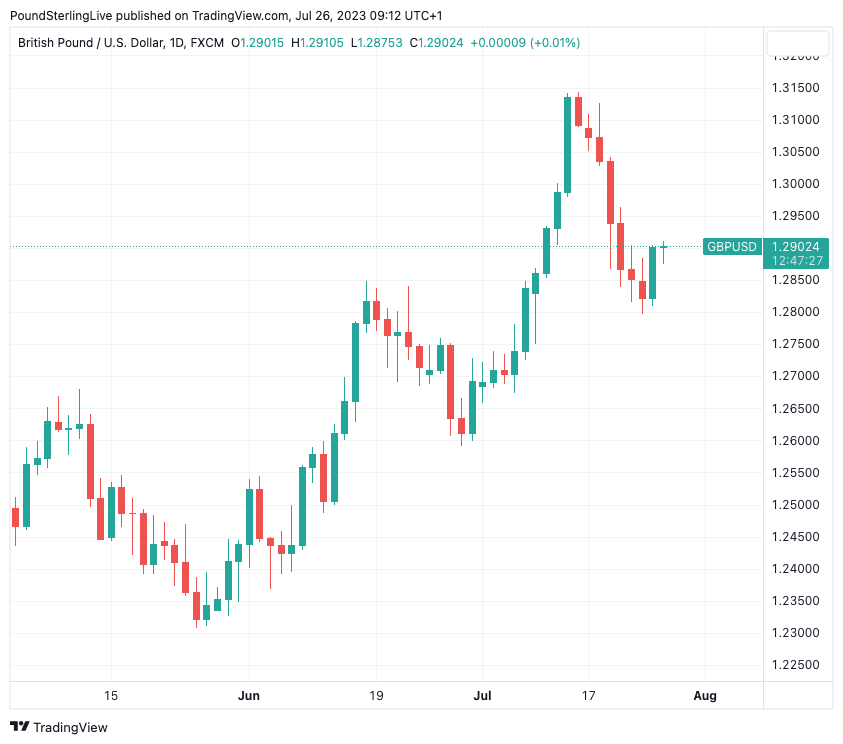

The Dollar has declined in value for much of 2023 as falling inflation has allowed the Fed to ease up on its rate-hiking cycle, ultimately allowing it to keep interest rates unchanged in June. The Pound to Dollar exchange rate (GBPUSD) hit a new high at 1.3140 on July 13 amidst the broader USD selloff linked to evidence that inflation was falling sharply and that the Fed would soon be in a position to start cutting interest rates again.

But the Dollar has recovered some ground over the recent days amidst ongoing robust economic data releases that signal the Fed could struggle to bring inflation back down to the 2.0% target on a sustained basis.

"A 25bp hike is widely expected and it looks far too early for the central bank to soften up its FOMC statement by embracing recent disinflationary trends," says Turner. "This should see the dollar holding onto some of its modest gains made over the last week."

Above: GBPUSD at daily intervals showing the recent pullback.

The broader medium-term trend, however, remains one of Dollar weakness and any 'dovish' tinge to today's guidance could allow the Pound to attempt another attack on its recent highs.

"Sterling's ascent off recent lows continued in pre-Fed trading Wednesday as traders looked past the expected 25bp hike for clarity from the statement and Chair Jerome Powell's presser, with rate futures pricing more than 100bp of Fed cuts by December 2024 likely to keep GBP/USD near trend highs," says Paul Spirgel, a Reuters market analyst.

The decision, due at 19:00 BST, will be followed by Fed Chair Powell's press conference half an hour later.

"The USD reaction to the Fed meeting outcome will depend on the credibility of Powell's 'hawkish bluff'," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole. "Should the US rates markets continue to call the Fed’s hawkish bluff after the meeting, the USD’s recent upward impetus should fade."

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

However, he adds the USD would rally if the U.S. rates market starts repricing further tightening ahead. "To the extent that risk sentiment suffers as a result as well, the Fed meeting could also fuel demand for the safe-haven USD," says Marinov.

Most analysts say it is too soon for the Fed to signal the all-clear on inflation and Powell is expected to remain cagey.

"We think it is too early to remove key language from its statement that further tightening may be appropriate after today's 25bp hike. And we wonder whether it wants to push back against the 100bp of easing priced in for 2024. We see the Fed event risk as a mildly positive one for the dollar," says Turner.

"With core inflation more than double the Fed’s 2% objective, signalling the end so early may be an unwise choice," says Charalampos Pissouros, Senior Investment Analyst at XM.com.

Pissouros expects officials to reiterate the view that the fight against inflation is not over, while at the press conference, Powell could reiterate the view that rate cuts are "a couple of years out."

Above: Markets are currently expecting significant rate cuts from the Fed over the coming months and years. Image courtesy of Goldman Sachs.

The Federal Reserve is widely anticipated to maintain a view that further interest rate decisions will be based on the tone of incoming data. This is a stance common amongst the majority of major central banks, many of which underestimated the extent of the post-pandemic inflationary surge.

"It has been a disappointing period for many of these institutions with key logic based on super cheap money in the form of quantitative easing (QE) and rock bottom interest rates and the resulting asset bubbles and inflation driving the existing counter measures," reflects Charles White Thomson, CEO at Saxo UK.

"The view on transitory inflation is a classic example – the collective Central Banks filled to the brim with invincible Economists, many of whom are all trained in the same institutions, in the same money theory and who, in the majority, believed that inflation would return quickly to 2% because that is what happens and that is what the model says," he adds.

Failed confidence in predicting the future evolution of inflation at central banks leaves them adopting a reactive stance to incoming data.

This, therefore, diminishes the market-jolting potential of the July policy decision as investors are required to look to August's job and inflation reports for clues on where U.S. interest rates are headed.

As such, initial volatility in Pound-Dollar exchange rates could soon be faded and further consolidation above 1.28 takes place before any resumption of the broader 2022-2023 uptrend.

"While the USD has managed to regain some ground across G10 FX in recent days, it has not fully recovered from its losses in the wake of the June Non-farm payrolls and CPI releases," says Marinov. "This is partly because the incoming data since then largely corroborated market expectations that a Fed peak is getting near as the US inflation and growth outlook deteriorates from here."

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks