GBP/USD Week Ahead Forecast: Fed Rain Cheque Possible

- Written by: James Skinner

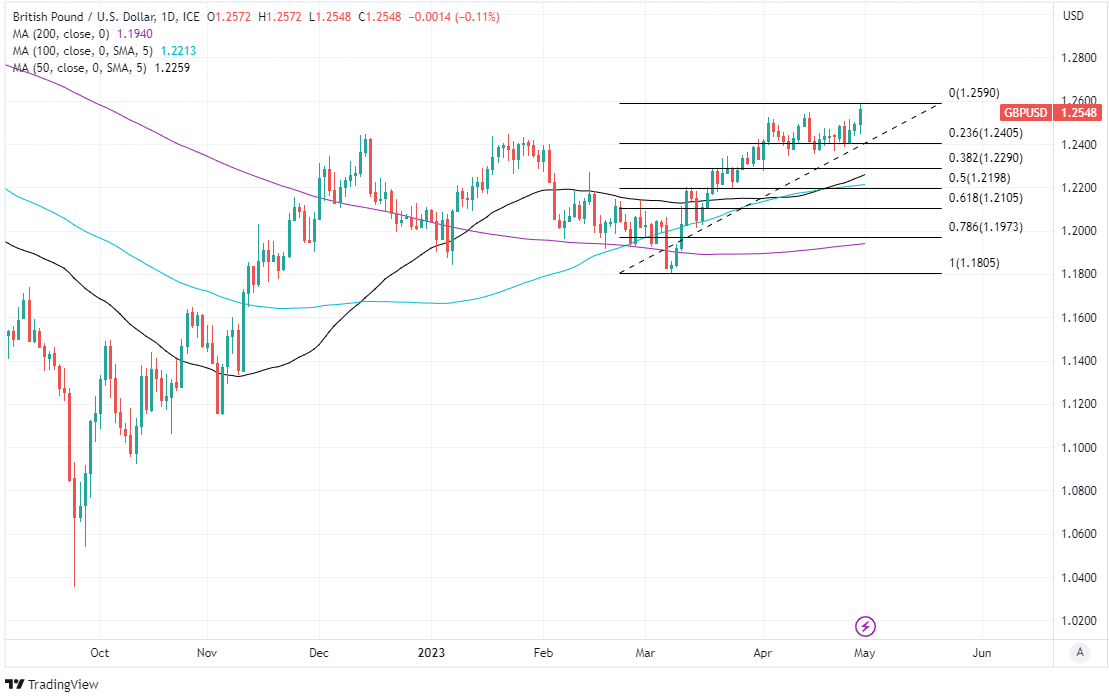

- GBP/USD in a potential break of key chart resistance

- Potentially scope to extend rally towards 1.2695 area

- If Fed takes rain cheque on widely expected rate step

- Technical support possible at 1.2405, 1.2290, 1.2259

Image © Adobe Images

The Pound to Dollar exchange rate helped lift Sterling to the top of the major currency league table for last week but could now rise further and potentially near to 1.27 if recent economic figures lead the Federal Reserve (Fed) to take a rain cheque on a widely anticipated increase in interest rates on Wednesday.

Dollars were sold heavily going into the weekend, leading the Pound, New Zealand Dollar, Swedish Krone and Euro to outperform other G10 counterparts even as they lagged behind the Russian Rouble, Indonesian Rupiah and Brazilian Real when measured on a G20 basis.

Friday's gains lifted the Pound to Dollar rate clear of technical resistance near the round number of 1.25 after official figures showed the Federal Reserve (Fed) making potentially underappreciated progress in its battle with inflation.

"We open two tactical USD long trades. We open short GBPUSD and set a limit buy for USDKRW +1m NDF expiry by the week end," says Paul Ciana, chief technical strategist at BofA Global Research.

"A risk to these trades is a failure of the USD to snapback due to regional bank concerns turning market Fed views dovish thus weakening the USD," Ciana writes in a review of the Dollar charts last week.

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of March rally and selected moving averages indicating prospective areas of technical support.

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of March rally and selected moving averages indicating prospective areas of technical support.

The Core Personal Consumption Expenditures (PCE) Price Index inflation rate - the targeted measure of the Fed - edged lower from 4.7% to 4.6% when data for March was released on Friday while the details of the report suggest the bank may actually have made even more progress than that.

This is because the monthly pace of services inflation halved to just 0.2% and its weakest since before the great reflation began in 2021 if the outcome for July 2022 is put to one side, which is also a pace of increase that is not inconsistent with the Fed already being close to attaining its 2% target,

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

Fed policymakers have said repeatedly that services inflation will be watched more closely than other types of price pressures but the latest declines could matter even more to the bank this week if considered in conjunction with the very sharp slowdown of GDP growth revealed last Wednesday.

"The US Fed has hiked the funds rate 475bps from 0.25% to 5%, and is likely to hike again next week to 5.25% (much like the RBNZ). The path for Fed policy beyond May is open to debate," says Jarrod Kerr, chief economist at Kiwibank.

Above: Quantitative model estimates of ranges for selected pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

"The recent turmoil in the banking sector is a significant risk factor," Kerr writes in a Monday research briefing.

U.S. growth slowed to an annualised 1.1% in the opening quarter. down from 2.1% previously, while the Fed's earlier significant increases in interest rates have in the meantime continued to place significant strain on the U.S. banking sector.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Slowing growth and tightening lending standards connected with vulnerabilities in the banking sector have both been cited by policymakers as likely help to bring inflation back to the target, hence why there may now be an underappreciated risk of interest rates being left unchanged this week.

"We expect FOMC chair Powell to be hawkish compared to market expectations, because inflation is too high and the labour market is too tight. We expect a further 25bp rate hike this week, to 5%-5.25%," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

Above: Pound to Dollar rate shown at weekly intervals with Fibonacci retracements of selected downtrends indicating various areas of technical resistance for Sterling. Selected moving averages denote possible support or resistance.

Above: Pound to Dollar rate shown at weekly intervals with Fibonacci retracements of selected downtrends indicating various areas of technical resistance for Sterling. Selected moving averages denote possible support or resistance.

"A hawkish FOMC and stronger USD can push GBP/USD down towards 1.2249 (50 day moving average). AUD/GBP can temporarily lift off its recent lows if the RBA hikes on Tuesday as we expect," Capurso writes in a Monday briefing.

Last month's forecasts already suggested there were only one or two further increases likely to come this year anyhow but with economists and markets banking on another one for this week, the Dollar could fall and the Pound-Dollar rally be extended further if the Fed takes a rain cheque on Wednesday.

Unchanged interest rates and a weaker Dollar would potentially help to guard against a too-abrupt slowdown in the U.S. economy, and would also be likely to support other currencies and economies along the way including the one in China where a reopening rebound is also reported to be flagging.

Meanwhile, any further weakness in Dollar exchange rates would also potentially be bullish for oil prices and a boon for the Organization of Petroleum Exporting Countries (OPEC) who sought to prop up prices with production cuts last month.

Wednesday's decision is the highlight of a busy U.S. schedule this week, which also includes Institute for Supply Management PMI surveys of the manufacturing and services sectors, as well as April's employment report on Friday.