GBP/USD Week Ahead Forecast: Outlook Hangs in Balance as UK Data Eyed

- Written by: James Skinner

GBP/USD in corrective setback from 11-month highs

Supported around 1.2374, 1.2265 & 1.2177 on chart

UK wage & inflation data could prompt further losses

Image © Adobe Stock

The Pound to Dollar exchange rate staged a hasty retreat from eleven-month highs ahead of the weekend but could slip further this week if a pending deluge of UK economic data calls into question some of the popular assumptions about the outlook for the Bank of England (BoE) Bank Rate.

Sterling was trading at some of its best levels against the Dollar since May last year on Friday when falling U.S. retail sales and hawkish remarks from Federal Reserve Governor Christopher Waller helped the greenback to recover from almost one-year lows against many currencies on Friday.

Governor Waller warned that he personally would look to lift interest rates further in May and thereafter unless he sees sufficient "signs of moderating demand" in U.S. economic data over the coming weeks and flagged a number of indicators that are likely to influence his next policy decision.

"There are still more than two weeks until the next FOMC meeting, and I stand ready to adjust my stance based on what we learn about the economy, including about lending conditions," he said.

"I would welcome signs of moderating demand, but until they appear and I see inflation moving meaningfully and persistently down toward our 2 percent target, I believe there is still work to do," he told the Graybar National Training Conference in Texas.

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of February rally and selected moving averages indicating possible areas of short-term technical support. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Surveys containing "managers' views of economic conditions" in April were among the indicators cited by Governor Waller and this means that S&P Global PMI surveys out this Friday might be likely to garner more of the U.S. market's attention than usualy.

"The hawkish sentiment may not be shared by all policymakers, but the odds of another rate hike at the upcoming FOMC meeting on May 3 are more than 50-50. The financial markets are pricing in a 80 percent probability," says Bob Schwartz, a senior U.S. economist at Oxford Economics.

"But the tough Fedspeak belies incoming data that indicates a strong disinflationary trend is settling in amid a slowing economy. The annual increase in consumer prices slowed for the ninth consecutive month, the longest stretch of disinflation since 1984," Schwartz adds.

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

With markets betting that the Fed is now likely to begin cutting its interest rate before the year is out, the Dollar would potentially benefit at the expense of the Pound this week if Friday's survey responses or any other U.S. data do anything to make further increases in the Fed Funds rate more likely.

But the biggest risks to the Pound to Dollar rate this week are homegrown with Tuesday's employment and wage figures for February, and Wednesday's inflation data for March set to either make or break the case for a widely expected increase in the Bank of England Bank Rate next month.

"The Bank of England will be watching for a further slowing in private sector earnings, core and services inflation," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

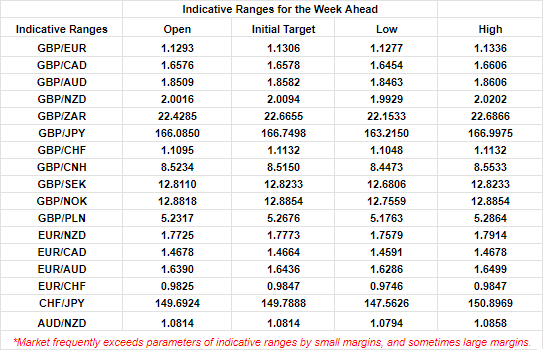

Above: Quantitative model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

"A resurgence in private sector earnings or an acceleration in core inflation can support UK interest rates and GBP/USD. But GBP is likely to fall well short of upside resistance at 1.2839(61.8% five year Fibbo," Capurso and colleagues write in a Monday research briefing.

The potential rub for the Pound is that forecasts broadly suggest that, if anything, this week's data is more likely to assure members of the BoE Monetary Policy Committee against the risk of inflation remaining persistent at too high levels in the UK.

The consensus suggests UK wage growth will fall for a fourth month running when February employment figures are released on Tuesday and Wednesday's data is expected to show inflation falling from 10.4% to 9.8% in March, with core inflation also down but from 6.2% to 6%.

These sorts of outcomes would likely lengthen the odds of a further interest rate rise from the BoE in May and could complicate any attempt by the Pound to resume its earlier rally, potentially ensuring that an important technical resistance sitting just above 1.25 remains in place on the charts this week.

"Currently, the market prices a 19bp hike, but James thinks the chances of a pause are under-appreciated. The big data releases kick off tomorrow. GBP/USD has once again stalled over 1.25 - largely on the dollar story," says Chris Turner, regional head of research for UK & CEE at ING.

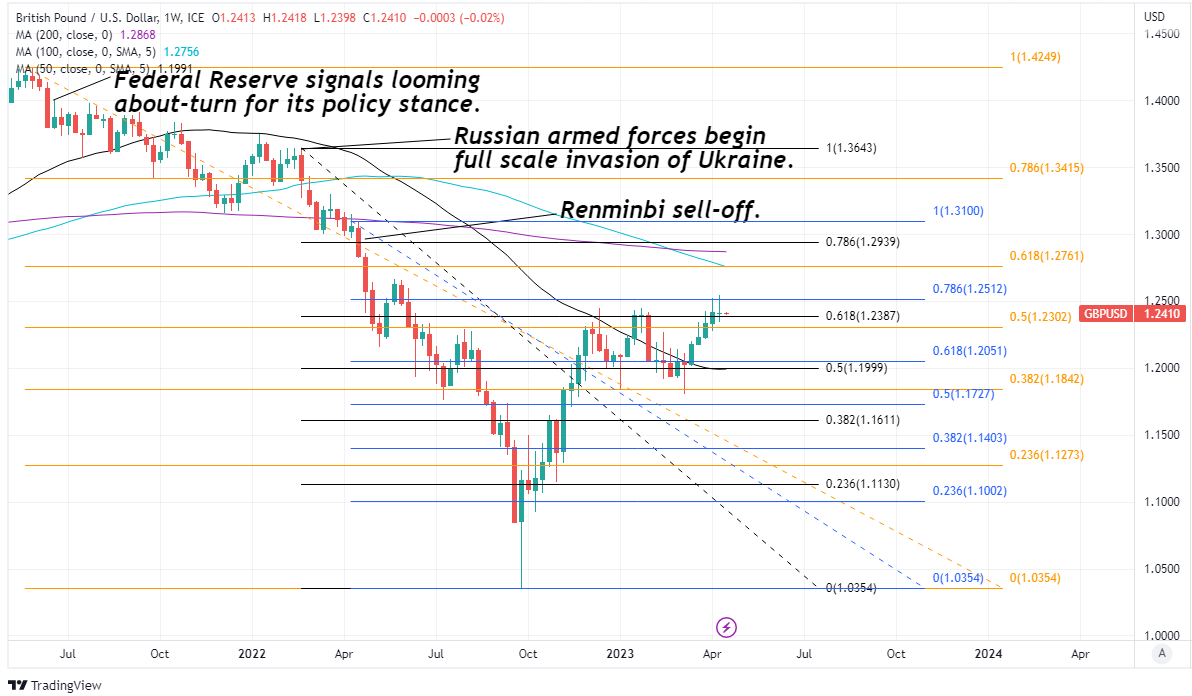

Above: Pound to Dollar rate shown at weekly intervals with Fibonacci retracements of selected downtrends indicating various areas of technical resistance for Sterling,. Selected moving averages denote possible support or resistance.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks