Dollar Holds Gains, Powell says 50bp Hike in March Not a Done Deal and Focus Turns to U.S. Jobs Report

Image © Adobe Images

In his second day of congressional testimony, Fed Chair Jerome Powell reiterated his message that interest rates may need to rise more and possibly faster than previously estimated, but he also added that officials have not yet made a call on the size of the March rate hike and that their future decisions will remain data dependent.

It seems that he may have wanted to pour some cold water on speculation that a 50bps hike in two weeks is a done deal, but market pricing and the dollar were not moved much.

Investors are still assigning a nearly 70% probability for a double hike (50bp), with the remaining 30% pointing to a quarter-point increment.

Perhaps they stuck to their guns as earlier data corroborated their view. The ADP employment report revealed that the private sector gained more jobs than expected in February, while the JOLTS job openings fell less than expected in January, suggesting that the labour market continues to strengthen.

The spotlight now falls on Friday’s nonfarm payrolls, where expectations point to a slowdown to 205k from 517k.

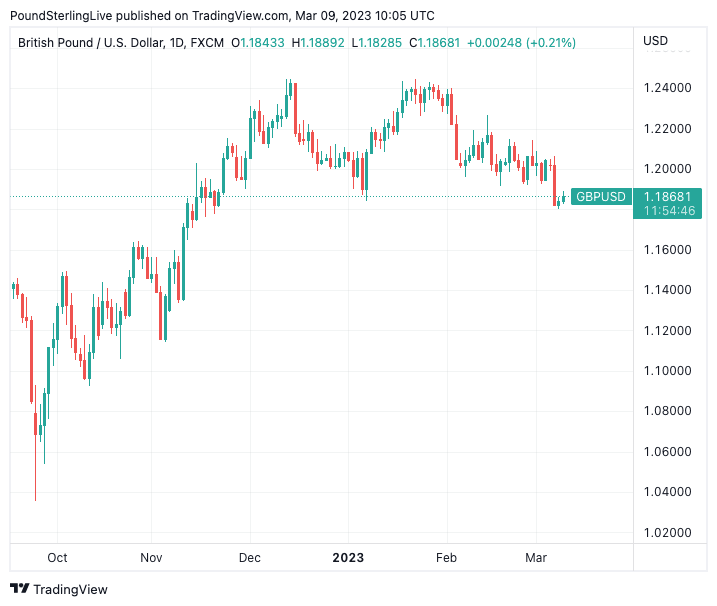

Above: GBP/USD at daily intervals. Consider setting a free FX rate alert here to better time your payment requirements.

That said, a slowdown from an outstanding print seems more than normal, and thus the dollar is unlikely to suffer if this is the case.

After all, the unemployment rate is forecast to have held steady at a more than 53-1/2-year low of 3.4%, while average hourly earnings are forecast to have accelerated to 4.7% y/y from 4.4%.

Coming on top of the hotter-than-expected CPI prints for January, accelerating wages could intensify speculation that inflation may not come down as fast as previously thought and thereby allow market participants to increase their Fed hike bets. This is likely to add more fuel to the dollar’s engines.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

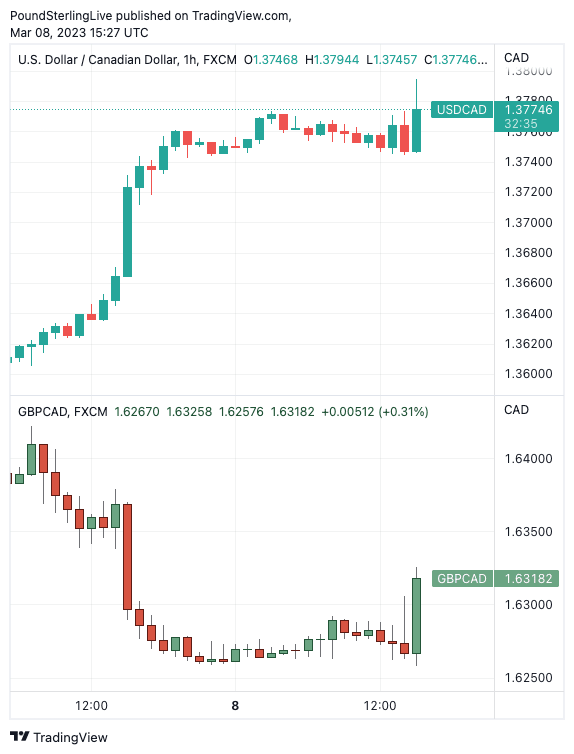

Canadian Dollar Loses Ground in Wake of Bank of Canada Hold

The loonie was the main loser among the majors yesterday, coming under pressure after the BoC decided to keep interest rates unchanged, becoming the first major central bank to hit the pause button in this tightening crusade.

Although in its statement, the BoC reiterated it remains prepared to increase rates further if needed, it also said that the latest data remains in line with the Bank’s expectations that CPI inflation will come down to around 3% in the middle of the year.

This was likely interpreted as the Bank’s intention to stay on the sidelines for a while and that’s maybe why the loonie declined even though yesterday’s decision was nearly fully priced in.

Above: Canadian Dollar price action in the wake of the BoC announcement.

Nonetheless, the market is still pricing in one more 25bps hike by December, meaning that there is ample room left for further declines should incoming data continue to come in soft.

The next key release from Canada may be the employment report for February, due out the same time as the US jobs report.

The unemployment rate is expected to tick up to 5.1%, while the employment change is forecast to reveal that the economy added only 10k jobs. If combined with a strong US jobs report on Friday, this is likely to send dollar/loonie closer to the peak of October 13 at 1.3980.

Japanese Yen: Will Kuroda Pass the Torch Untouched?

During the Asian session Friday, it will be the BoJ’s turn to decide on monetary policy.

This will be the last gathering with Governor Kuroda at the helm, and investors may be eager to find out whether his exit will be accompanied by fireworks, or whether he will hand over the reins quietly.

Latest economic data has been suggesting that there is no need to rush into taking another step towards normalization at this gathering, with several policymakers noting that Japanese inflation seems mostly fueled by surging import costs rather than strong domestic demand.

That said, a recent survey on the bond market showed that December’s action has failed to reduce market distortions, which may have allowed some market participants to bet on further action at this meeting.

Therefore, if the Bank decides to wait for a while longer before removing further accommodation, those expecting action at this gathering will be disappointed and the yen could slip.

Charalampos Pissouros is Senior Investment Analyst at XM.com. An original version of the article can be viewed here.