GBP/USD Rate: A Fatigued Rally Risks a Near-term Federal Reserve Setback

- Written by: Gary Howes

- USD selloff looking stretched ahead of Fed decision

- Fed could boost USD with 'higher for longer' message on rates

- But any strength tipped to be shortlived say analysts

Image © Adobe Images

The Federal Reserve is expected to raise interest rates by 25 basis points later on Wednesday in what is the first central bank challenge for the Pound, Dollar and Euro this week.

A 25bp hike is well anticipated and the surprises, therefore, rest with guidance as to whether this is the final hike of the cycle owing to falling inflation, or whether further hikes are needed.

Given market pricing shows investors are now fully priced for this being the final act, the upside risk for the Dollar lies with a signal that a further hike is required to firmly get on top of U.S. inflation.

Another variation on this theme would see the Fed push back forcefully on expectations for a rate cut later in 2023 in response to a slowing economy.

Success in raising expectations for U.S. interest rates staying 'higher for longer' could trigger a rally in the Dollar.

"We expect Chair Powell in his press conference to acknowledge the ongoing slowdown but stick to the FOMC’s higher-for-longer rate guidance, as although wage pressures have started to ease, there is still work to be done," says Daragh Maher, Head of Research for the Americas at HSBC.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Strategists at TD Securities say the Dollar selloff is "stretched" and "parts of FX are displaying signs of rally fatigue."

This increases the likelihood of any near-term boost to the Dollar as positions unwind in response to any repricing of future rate hike expectations.

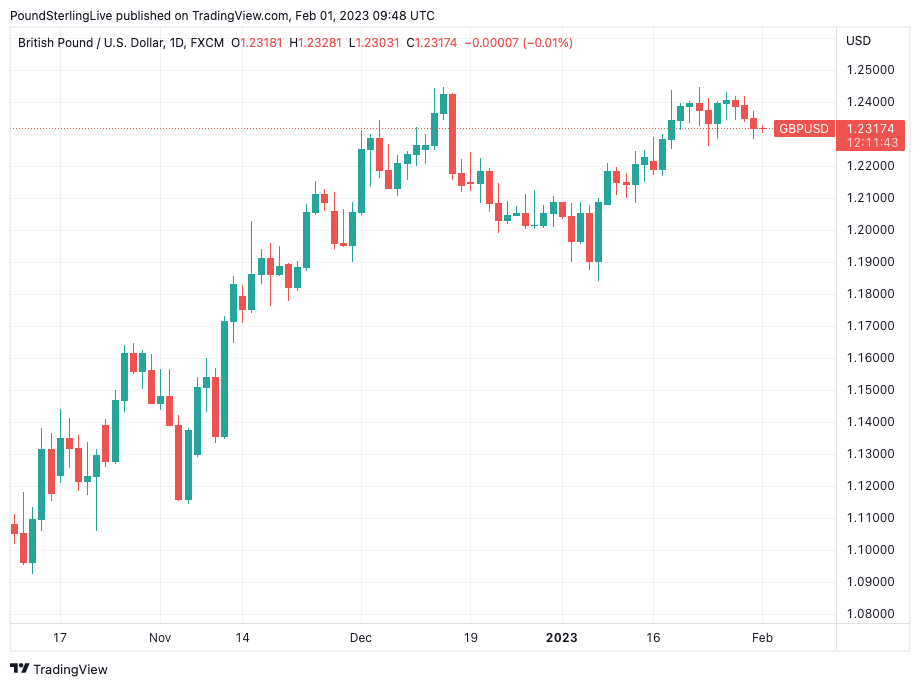

Ahead of the Federal Reserve decision the Pound to Dollar exchange rate (GBP/AUD) is quoted at 1.2318, the pair has averaged at 1.2205 in 2023, whereas the average for the final quarter of 2022 was 1.1736, according to data from Oanda, a provider of resources for online trading in the UK and historical data.

Although the Dollar could be prone to a near-term setback, most currency analysts see strength as being potentially shortlived.

"It would take a very explicit message from Chair Powell that more rate hikes than priced will be required to spark a rates-driven rebound for the dollar," says Derek Halpenny, Head of Research Global Markets EMEA at MUFG.

Above: GBP/USD at daily intervals showing a strained rally. Consider setting a free FX rate alert here to better time your payment requirements.

MUFG says the Fed finds itself in a position where there are some conflicting signs that argue for, and against, less tightening.

Making the case for the 'higher for longer' response is the robust labour market, where payrolls following the last Fed meeting came in stronger (263k vs 200k expected), and average hourly earnings were also stronger.

The most recent initial claims data were strong with claims dropping to 186k, underling continued resilience.

"Job cut announcements suggest weaker labour market conditions ahead but it hasn’t come through in the data yet," says Halpenny.

Also advocating for a 'hawkish' hike is the recent decline in U.S. bond yields, which is in turn lowering the cost of borrowing across the economy.

For the Fed, this works against its goal of constricting inflation and could therefore present another reason to opt for a pro-USD 'hawkish' 25bp hike.

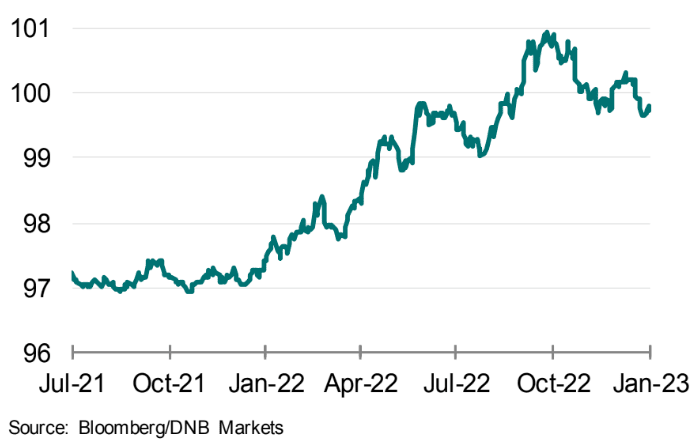

"The recent easing of financial conditions is clearly an argument for further rate hikes," says Knut A. Magnussen, an economist at DNB Markets.

Above: U.S. financial conditions index show an easing in the cost of money, which might not be consistent with the Fed's aims when targetting lower inflation.

In line with a need to keep funding conditions restrictive, Magnussen says that guidance is likely to indicate further interest rate hikes.

Specifically, the following key paragraph in the Fed's statement will likely be repeated:

"The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time."

Should the Fed push back against softer funding conditions in a 'hard' manner, the Dollar could rally as expectations for future rate hikes are shored up.

"A 'hawkish hike' of 25bps is probably how Powell would like to play it," says Halpenny, although he acknowledges achieving this will be a "hard ask".

Therefore any Dollar strength might prove temporary.

January's Federal Reserve interest rate hike has "all the hallmarks of being the last," says Steven Blitz, Chief US Economist at TS Lombard, an independent investment research company.

In a note to clients Blitz says all the data now points to an impending U.S. recession and the Fed will be pleased with evidence that the cost of money is finally getting to where the Fed wants it, which will help strangle inflation.

The Fed now has the cover of a slowing economy to end its hiking cycle. GDP still grew in the final quarter of 2022, according to the latest official data, but Blitz says a mild recession beginning in Q2 appears on track.

"Cuts arrive once employment turns negative, or even just softens to 100,000/month," he adds, suggesting market expectations for a rate cut from the Fed before year-end is on target.

Inflation has meanwhile peaked with the all-important core CPI inflation, excluding shelter, recording deflation of 1.0% in the three months to December, on an annualised basis.

"That must surely be a very notable development for the FOMC when it meets," says Halpenny.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes