Dr. Copper Prescribes More Gains for the GBP/USD Exchange Rate

- Written by: Gary Howes

Image © Adobe Images

The price of copper is in the ascendency and one eagle-eyed currency market analyst has noted that this development could signal further potential upside for the British Pound.

"One interesting positive correlation GBP/USD has is with copper prices," says Vessey, an analyst at Convera, formerly Western Union Business Solutions.

The term Doctor Copper is a market colloquialism for a base metal that is reputed to have a 'Ph.D. in economics' because of its ability to predict turning points and trends in the global economy.

Copper is widely used in applications in most sectors of the economy - from homes and factories to electronics and power generation and transmission - meaning demand for copper is often viewed as a reliable leading indicator of economic health.

The Pound-Dollar exchange rate has a positive correlation with risk, meaning it typically appreciates when markets - and copper - are rising.

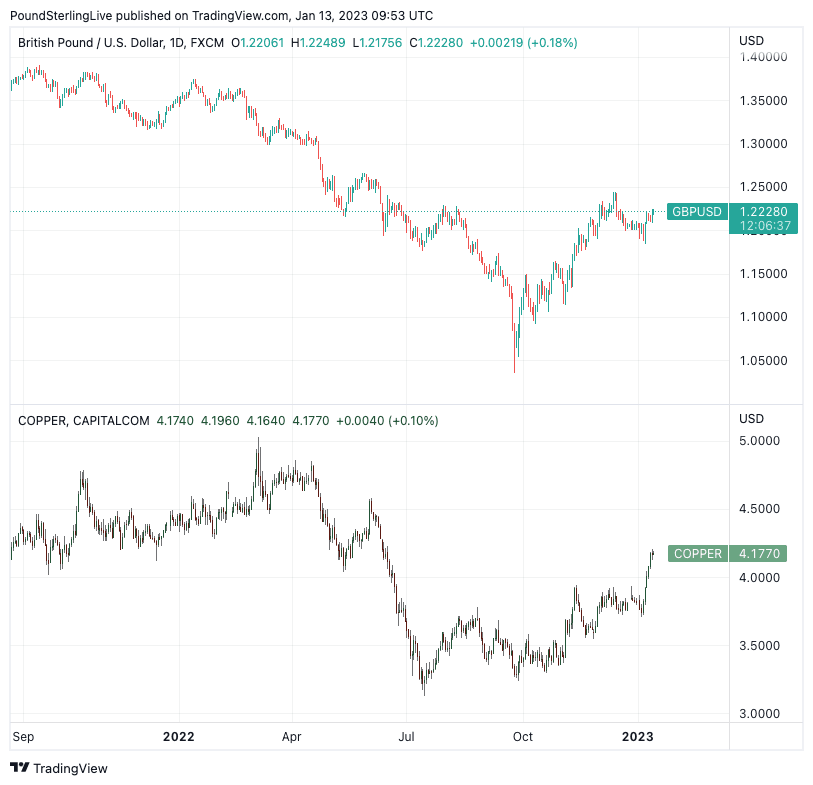

The below chart showing the Pound to Dollar exchange rate (GBP/USD) alongside copper prices confirms such a correlation:

Above: GBP/USD (top) and copper at daily intervals. Consider setting a free FX rate alert here to better time your payment requirements.

"Could this be another indication of further upside for GBP/USD in the short term?" asks Vessey, noting the upside hints in the GPB/USD-Copper dynamic.

The above is of interest at this juncture because a gap has opened up in copper and GBP/USD price action recently, potentially implying the Pound must rise if the long-running correlation is to be reasserted.

But why Pound upside and not copper downside?

The Pound doesn't lead the copper market as the UK offers no supply and is a negligible market owing to its small manufacturing and industrial base, therefore, if anything, it is copper that is the leading indicator.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

If Copper can be considered a useful leading indicator for the Pound against the Dollar, then its outlook is of relevance.

Dominic Schnider, CFA, CAIA, Strategist, UBS Switzerland AG, says "copper is showing signs of life".

"China's reopening efforts and support measures for its real estate sector have lifted copper prices in recent weeks. While near-term economic data do not favor another leg up, expectations of a growth normalization in China is likely to keep prices well bid," he says in a recent research briefing.

Much of late 2022 and 2023's turn lower in the Dollar has coincided with an uptick in global sentiment amidst signs China is exiting its zero-Covid policy, suggesting the world's number-two economy will lift global activity over the coming months.

"Both copper and iron ore are rallying as China reopens its economy, with benchmark copper prices passing $9,000 per tonne on Wednesday for the first time since June," says Vessey.

The Pound is pro-cyclical, meaning it tends to rally against the Dollar when the global economy is in an expansion and investor sentiment is robust. The anti-cyclical, safe-haven Dollar meanwhile tends to retreat.

"The copper market should be tight and prices could move toward USD 9,500/mt," says Schnider.

If the Pound is to retain its correlation with the industrial metal - and there is nothing to suggest the long-term relationship has broken down - then it could play catch-up and rally further.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks