U.S. Dollar Weakness Overdone: City Index

- Written by: Fawad Razaqzada, Market Analyst at City Index

Image © Adobe Images

Is the Dollar's 50% slump from 2022's highs justified? "in short, I don’t think it is and reckon a dollar recovery is long overdue," says Fawad Razaqzada, Market Analyst at City Index.

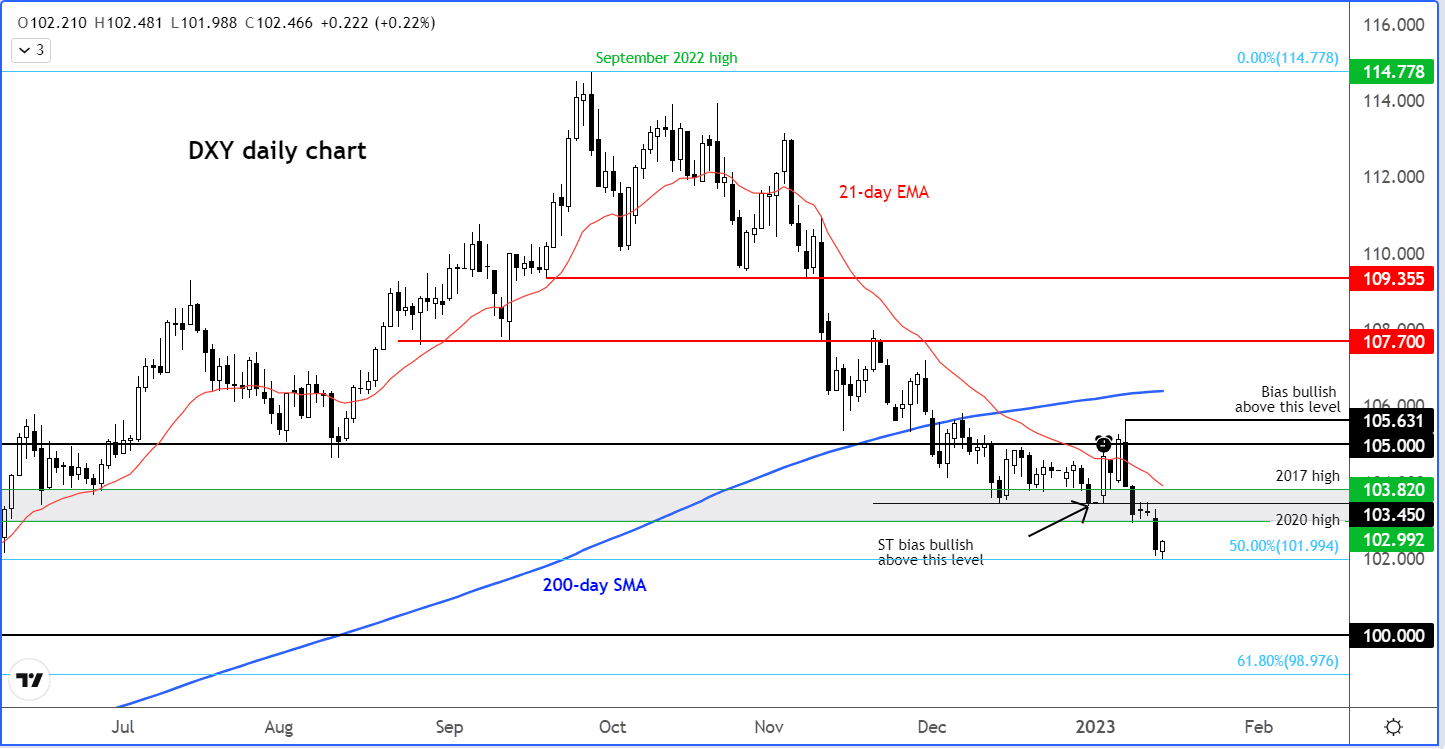

The Dollar Index, having just lost about 50% of its entire long-term gains since the start of 2021, was rebounding a little at the time of writing.

The GBP/USD failed to react positively to better-than-expected UK growth figures while industrial production in the eurozone also surprised to the upside, but the EUR/USD fell off the highs.

Concluding today's data releases will be the UoM Consumer Sentiment and Inflation Expectations surveys from the US, out later.

The greenback extended its falls on Thursday in response to a CPI report which continued to show easing price pressures.

But as the data was bang in line with expectations, we haven’t seen any significant downside follow-through, although the USD/JPY pair dipped to its lowest level since May overnight amid speculation that the BoJ might tweak its policy again next week.

As mentioned, the Dollar Index has now given back half of the entire gains made from the January 2021 low. Is this justified given that the Fed is still quite hawkish and the outlook for the rest of the world murky?

Granted, inflationary pressures have fallen sharply, while the downturn for Europe has been less severe than expected.

Still, the FX markets might have gotten ahead of itself. The market does have a tendency to overreact and overshoot, which is what might be happening here.

It has priced in a perfect soft-landing for the US and assumes rate cuts will come later this year.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

However, given the sharp tightening cycle, we have just seen and how bad inflation has been, we could well see more ripple effects come through this year, whether that is in terms of company earnings results, wage pressures or a severe global recession.

So, watch out for a possible dollar reversal.

The US dollar has rebounded a little bit and indices are coming off their best levels.

So far, not much to get excited about but that dollar index chart being at or around a major support zone circa 103.00 makes me wonder whether we are going to see a recovery for USD starting very soon.

Remember that Q1 is seasonally a very strong period for the dollar. Obviously, seasonality factors don’t always come to fruition, but given how much the dollar has sold off despite the Fed being more hawkish than other CBs, I reckon we could see a recovery for the dollar very soon.

But let’s wait for that reversal signal first.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks