Fed 'Push Back' is Key Risk to GBP/USD's Recovery

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling is in a clearly defined short-term rally against the U.S. Dollar but Wednesday evening's Federal Reserve interest rate decision is the second of three hurdles the exchange rate must leap ahead of the Christmas break.

The Pound to Dollar exchange rate (GBP/USD) rose to six-month highs at 1.24 on Tuesday following a softer-than-expected inflation release that investors reckon gives the Fed the green light to slow down its rate hiking cycle with a 50 basis point hike.

Bond yields fell sharply after the inflation release and further eased monetary conditions in the U.S. where the cost of funding has been falling since peaking in November.

The Federal Reserve might therefore push back against this development later on Wednesday, viewing the falling cost of finance as being an inflationary development at odds with its objective to bring inflation down to approximately 2.0%.

The Fed is expected by the majority of analysts to raise its projections for the peak in interest rates when it releases its latest forecasts, but this expectation is already incorporated in the value of the Dollar.

Any surprising pushback would therefore likely be contained in the minutes of the meeting or during Chair Jerome Powell's press conference.

"The softer CPI reading supports our views that the Fed will likely further slow the pace of rate hikes early next year to 25bp. However, with the labor market still very tight, the ISM services index robust, and with broad financial conditions easing, the Fed will likely say that their job is not done," says Edoardo Campanella, Economist at UniCredit Bank.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

If any pushback is forceful enough the Dollar would likely reclaim some of its recent losses, putting GBP/USD and EUR/USD on the back foot.

But the near-term trend favours the GBP/EUR and EUR/USD going higher and weakness might be limited.

After all, it is difficult to see what the Fed can really do to convince markets they need to perform an about-turn and push bond yields and the Dollar higher again in light of recent macroeconomic developments.

"A hawkish message this evening, if that’s what we get, just won’t have the same impact on market expectations than if the CPI print had been stronger than expected," says Derek Halpenny, Head of Research for Global Marketes EMEA at MUFG. "One weak CPI print can be ignored but two becomes a little more difficult and hence a signal of a further step-down in the pace of tightening in Q1 next year may be hinted at."

The Fed remains in 'data-dependent' mode and the data that matters is consistent with a slowing down in the rate hiking cycle.

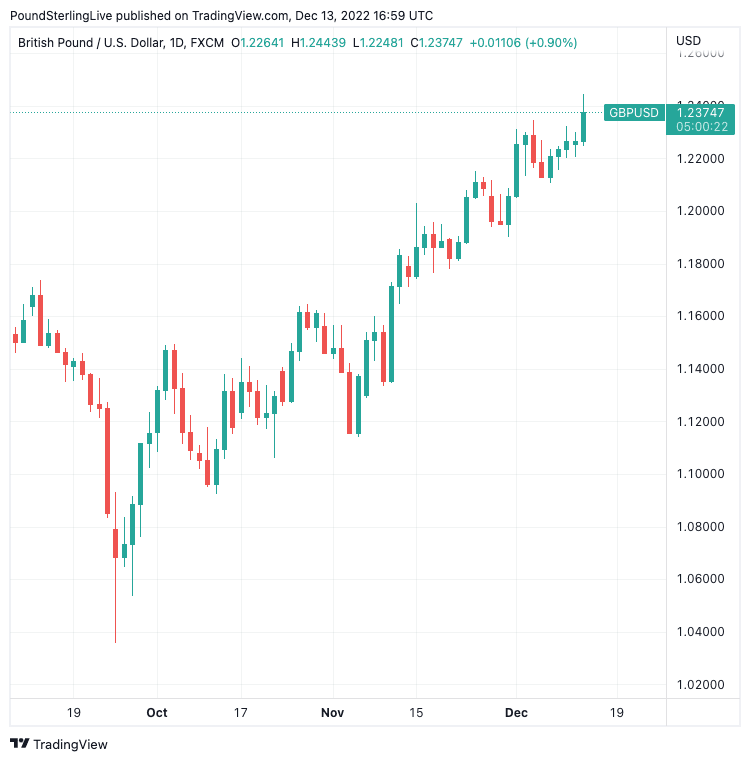

Above: GBP/USD daily chart showing clearly defined uptrend. Consider setting a free FX rate alert here to better time your payment requirements.

Investors are looking to a 'pivot' in 2023 when the central bank finishes its rate hiking cycle and investors will start to price in the prospect of interest rate cuts as the economy slows.

Given it was rising rates that propelled the Dollar higher over much of 2022 it stands that the prospect of rate cuts would see a reversal of that strength.

"We expect US dollar weakness to continue in 2023 given our out of consensus view of more aggressive rate cuts by the Fed in the second half of 2023 than by other central banks," says Georgette Boele, Senior FX Strategist at ABN AMRO.

"Falling inflation supports our call for significant Fed rate cuts in late 2023," says Boele's colleague at ABN AMRO, Bill Diviney.

"While there may be some temporary factors flattering inflation at present, there has been a clear trend change in US inflation over the past few months, and we expect this downtrend to continue," he adds.

Ultimately this is a trend the Fed will welcome over the coming months, even if it might go on the offensive at the December meeting.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks