U.S. Dollar Downturn to Favour Developed Market FX Over EM - Goldman Sachs

- Written by: James Skinner

"If global equities see a sustained recovery that is accompanied by lower US yields and a relaxation of European risks, the results above suggest that G9 FX can outperform" - Goldman Sachs.

Image © Adobe Images

The U.S. Dollar remained close to the top performing currency of 2022 this week but a decisive turn lower may not be that far off and this is something that would be likely to favour developed market currencies over their emerging market counterparts, according to research from Goldman Sachs.

Dollars were bought widely and hand over fist in the opening half of the year with the greenback also reaching new peaks against some currencies early in the final quarter but last month gave way to a sizable setback for the U.S. unit in what may have been an indication of its time in the sun nearing an end.

The risk is that next year brings a decisive turn lower that would typically be expected to benefit more the higher yielding emerging market currencies than their developed market counterparts as they are normally more sensitive to U.S. bond yields and risk appetite, though this time might be different.

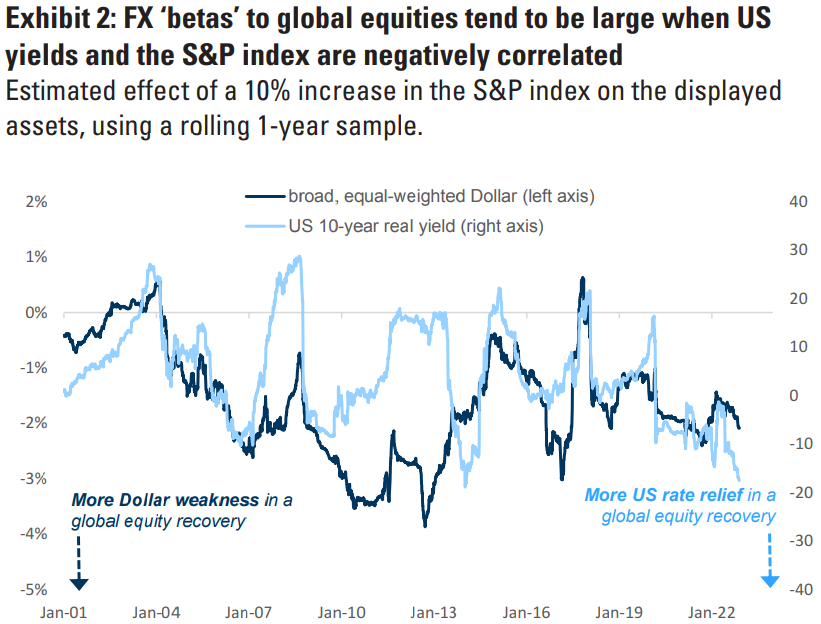

"FX ‘betas’ to global equities are more elevated for G9 currencies than for EM currencies," says Ian Tomb, a vice president in the Global Markets Research group at Goldman Sachs.

Source: Goldman Sachs Global Investment Research. Click image for closer or more detailed inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Source: Goldman Sachs Global Investment Research. Click image for closer or more detailed inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

The Goldman Sachs team says G10 currencies excluding the U.S. Dollar have been more sensitive to the trajectory and momentum of global stocks this year than at any other point in the last two decades with this 'beta' to risk appetite remaining elevated in both rising and falling markets.

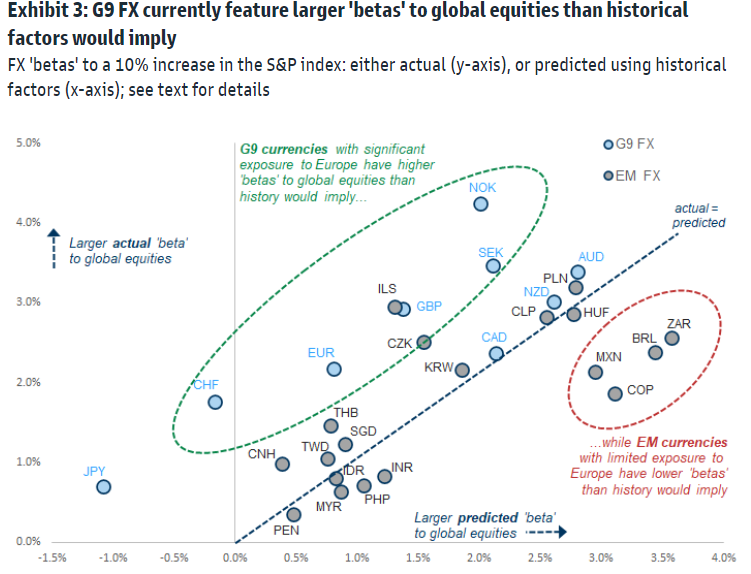

This has been most evident in the currencies of European economies that are most at risk from disruption caused by the war in Ukraine but it is also likely the result of other factors too, according to the Goldman Sachs team, and it may yet have implications for the way in which the Dollar eventually depreciates.

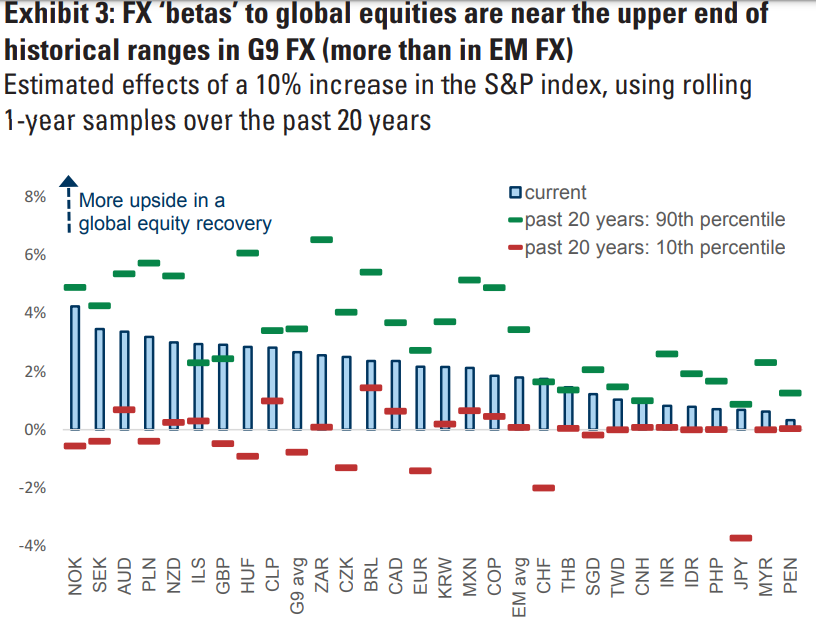

"Exhibit 3 shows that this result is broad-based: a range of G9 currencies (or ‘DM of EM’ currencies, such as ILS), for example, fall either close to, or even above, their 90th percentile values of the past 20 years," Tomb says.

Source: Goldman Sachs Global Investment Research. Click image for closer or more detailed inspection.

Source: Goldman Sachs Global Investment Research. Click image for closer or more detailed inspection.

"And, a number of EM currencies – such as ZAR, BRL, MXN and COP, which, as the green bars in Exhibit 3 show, have historically had ‘higher highs’ than most G9 currencies – currently feature ‘betas’ that fall well below these historical peaks," he adds.

Most notably, the Israeli Shekel, Pound Sterling, Swiss Franc and Thai Bhat have been the most sensitive to stock markets, which have themselves been responsive to movements in U.S. government bond yields driven higher by Federal Reserve (Fed) interest rate policy.

"With the Fed driving global risk assets to a significant extent, equity selloffs (which support the Dollar through ‘flight to safety’ dynamics) have been accompanied by rising US rates (which also support the Dollar through shifting interest rate differentials)," Tomb says.

Source: Goldman Sachs Global Investment Research. Click image for closer or more detailed inspection. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

Rising interest rates at the Fed have taken an especially heavy toll on European currencies by lifting local borrowing costs just as the energy price fallout from the war in Ukraine weighs on regional economies, thus explaining the increased sensitivity of currencies relative to stock markets and U.S. yields.

Against this backdrop of rising volatility in developed market currencies, many emerging market currencies have become more resilient to the twists and turns of U.S. bonds and the stock markets while there is statistical evidence to suggest that these trends could persist even after the Dollar turns lower.

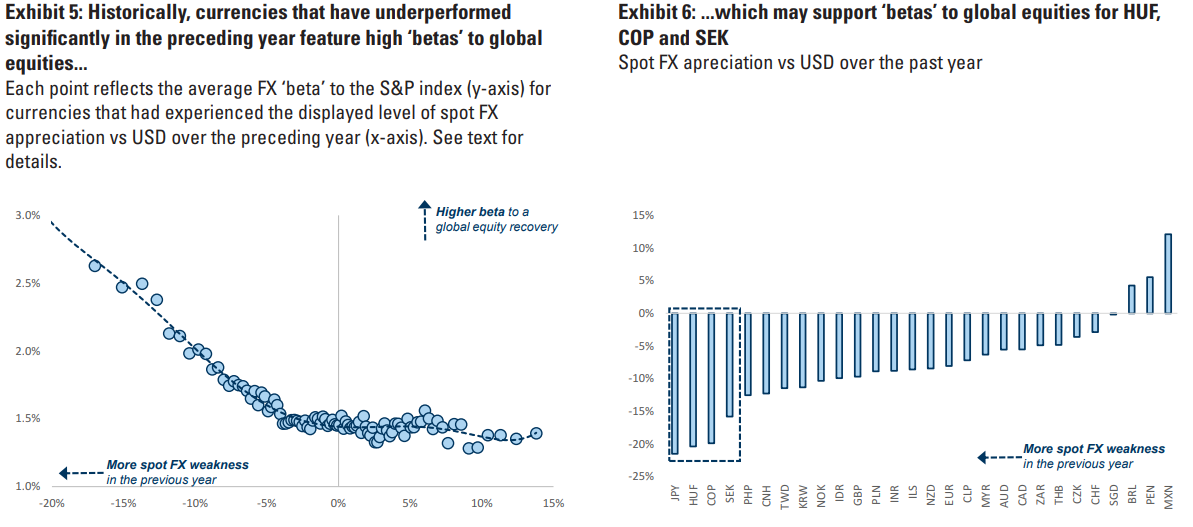

"We suspect that elevated G9 FX 'betas' to global equities reflect i) significant spot FX underperformance over the past year, ii) elevated sensitivity to US rates, and iii) significant sensitivity to shocks in Europe – all of which are greater for G9 than for EM FX in aggregate," Tomb says.

Source: Goldman Sachs Global Investment Research. Click image for closer or more detailed inspection.

Source: Goldman Sachs Global Investment Research. Click image for closer or more detailed inspection.

"A number of currencies in G9 and EM have sold off versus the Dollar by significant amounts, including HUF, COP, and SEK (Exhibit 6), and an elevated ‘beta’ to future equity moves in these currencies would be consistent with the historical evidence," he adds in a recent research briefing.

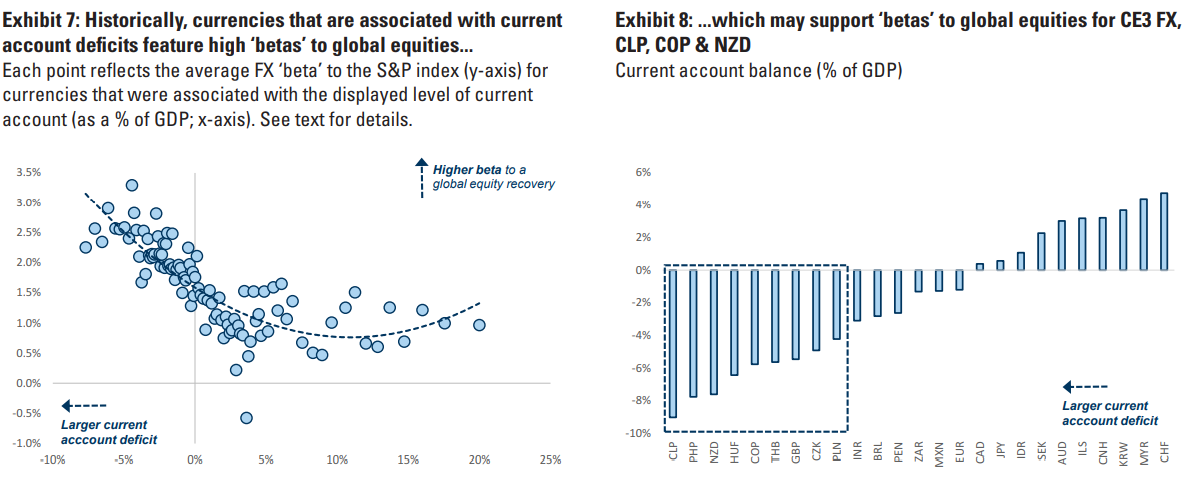

Goldman Sachs' research suggests other factors beyond the degree of past underperformance can also be influential in determining' sensitivities to international stock markets including the degree to which economies are dependent on external finance, and the level of interest rates.

"While large current account surpluses (such as those seen in the high ‘beta’ KRW, ILS, and AUD) may not reduce ‘betas’ significantly. These results suggest that wide current account deficits may support ‘betas’," Tomb says.

Source: Goldman Sachs Global Investment Research. Click image for closer or more detailed inspection.

Source: Goldman Sachs Global Investment Research. Click image for closer or more detailed inspection.

While developed market currencies can potentially be expected to outperform their emerging market counterparts when the U.S. Dollar eventually turns lower, there are also some currencies within the developed market group that could also be expected to outperform the other outperformers.

Included among these are the New Zealand Dollar and Swedish Krona but also potentially the likes of the Norwegian Krone, Pound Sterling and Swiss Franc although all of these prospective outcomes would only be likely in the event of a decisive and sustained trend lower U.S. exchange rates.

"If global equities see a sustained recovery that is accompanied by lower US yields and a relaxation of European risks, the results above suggest that G9 FX can outperform," Tomb writes in partial conclusion of late November research.