Dollar Strength as Republican's Inch Forward

- Written by: Gary Howes

Image © Adobe Images

A predicted Republican 'red wave' has not materialised in the U.S. midterm elections, but the party is nevertheless still expected to take control of the House of Representatives, a result that could be supportive of the Dollar in the near-term say analysts.

Dollar exchange rates were higher as the results of the midterm elections filtered through midweek, although how the U.S. currency ends the week will ultimately lie with the outcome of Thursday's inflation data print.

Ahead of the data markets will chew on media reports confirming that although the Republicans looked set to overturn a narrow Democrat majority in the House of Representatives, projections for a big win have failed to materialise.

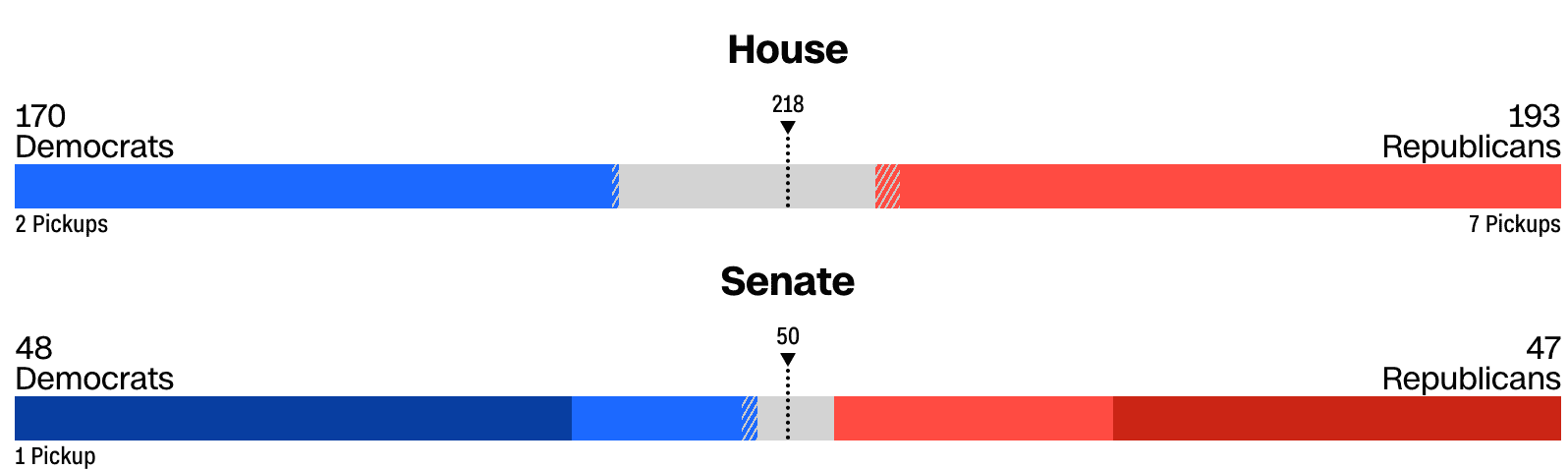

"The early tallies from the midterm elections indicate that a Republican wave is unlikely to materialise. The most likely result is a split Congress, with the Republicans taking over the House and the Democrats retaining the Senate. If the outcome is confirmed by the final vote counting, President Biden will have to resort to executive orders as his legislative powers will be heavily curtailed," says Edoardo Campanella, Economist at UniCredit Bank.

The midterm elections are widely considered by analysts to be a minor factor in the Dollar outlook, but some say the results could nevertheless have some implications for near-term price action.

The "midterm election is likely to be the issue that is front of mind for markets," says FX analyst, Stephen Gallo at BMO Capital Markets.

"If Democrats shock the world and hold the House, we think that would be USD-negative, but not by more than 1% at most," says Gallo.

Despite the Democrats breathing a sigh of relief that they were not subjected to a landslide, they are nevertheless likely to cede control of the House.

Above: Election outcome courtesy of CNN.

House Speaker Nancy Pelosi issued a statement on the results as of Wednesday morning, UK time, saying that while there are several races that remain too close to call "it is clear that House Democratic Members and candidates are strongly outperforming expectations across the country.

On balance, a Republican takeover is still expected by pundits and, according to Gallo, would be considered mildly bullish for the Dollar.

He says of a Republican takeover, "the biggest FX implication of that transition would be a lower likelihood of congress being able to work with other branches of government and the Fed to pass a coordinated response to an external shock (natural disaster, war, etc) if one becomes necessary. We view that heightened risk as USD-positive (although it would be currency negative for most other countries)."

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"The second biggest implication is probably tighter fiscal policy on the margin, which we would also view as USD-positive," he adds.

"I'm more inclined to see US politics as the potential catalyst for today’s dollar strength, than anything else," Kit Juckes, Société Générale said on Tuesday as voters cast their ballots.

A number of analysts we follow nevertheless assess the outcome of the midterm elections will ultimately prove neutral for currency markets, with any knee-jerk reactions proving short-lived.

"A divided government/congress is more of a 2023 market story when concerns with the debt ceiling will flare up again," says Rai Bipan, Head of North American FX Strategy at CIBC Capital Markets.

Looking ahead for the Dollar, what will certainly count is Thursday's inflation data.

Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank, explains:

"The results of the US midterm elections are beginning to come in one by one and the USD exchange rates are not moving.

"One could also come to the conclusion that the subject is of little interest to the FX market and that it was only discussed so intensively in an FX context because writers had to fill the gap until the next really important event for the USD exchange rates came along (the US inflation data on Thursday)."

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks