Dollar Strength Beckons as Markets Risk Being Wrong-footed by the Fed

- Written by: Gary Howes

Above: Federal Reserve Chairman Jerome Powell. Image © Federal Reserve.

Today's Federal Reserve policy update won't result in the 'pivot' many in the market are expecting say analysts at the world's largest primary foreign exchange dealer, Citi.

"We do not expect a dovish 'pivot' from the Fed," says a note from Citi. Economists at the U.S. bank say persistently strong demand in the economy is confronting already-tight labour markets.

If correct, the Pound to Dollar exchange rate could be on course to retreat further from its late-October highs.

The Dollar fell in late October as markets sensed the Fed was poised to confirm the time to exit its rate hiking policy was nearing.

It is this rapid rise in U.S. interest rates relative to elsewhere that has driven USD outperformance in 2022, and the ending of the policy could therefore spell the end of the rally.

"The first two weeks of November will be pivotal for the dollar's near-term trajectory as it will likely define the timing of the slowdown in the Fed’s hiking cycle," says Simon Harvey, Head of FX Analysis at Monex Europe.

For markets, another 75 basis point hike today won't come as a surprise.

Any big moves in global currency markets would therefore most likely stem from the guidance, intended or otherwise, offered up by Fed Chair Jerome Powell.

The Dollar fell in late November as expectations rose that this meeting would see Powell signal that a time to ease back on rate hikes was now nearing as the economy was finally reacting to previous hikes and was slowing.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Markets see a terminal Fed Funds rate at around 5.0% and simple mathematics means a slowdown is inevitable following November's 75bp move.

Expectations for the Fed to ease back rose sharply following a Wall Street Journal article released last week and comments from Federal Reserve President Mary Daly that suggested Fed officials will want to "step-down" the pace of rate hikes.

The Dollar fell and stocks rose as investors sensed a potential shift in policy, but Citi warns the economy is still running too hot to allow the Fed to contemplate a softening in tone.

"We have emphasised that markets are structurally overestimating the extent of the Fed's flexibility to react to downside risks to growth," says Citi.

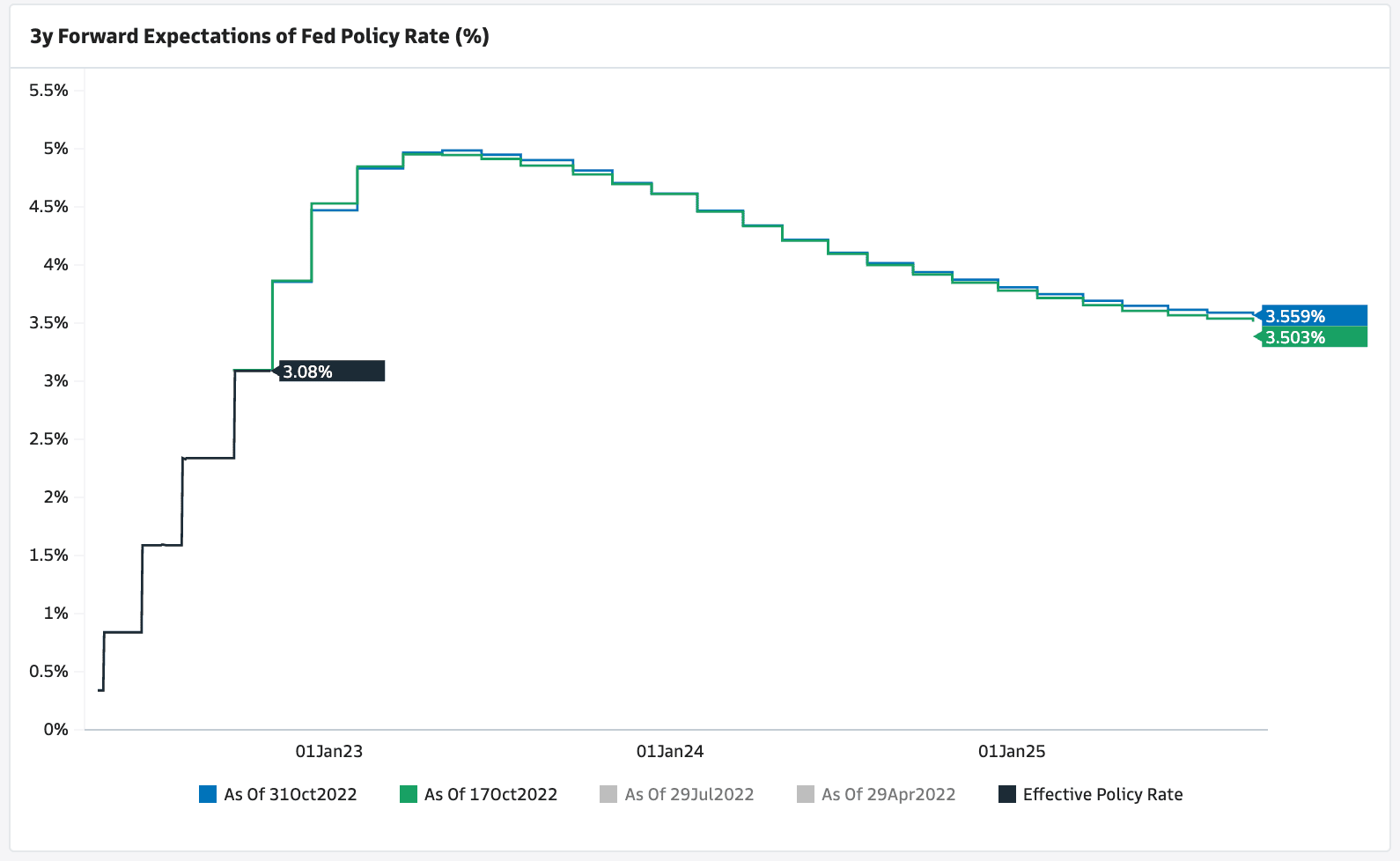

Above: Market expectations show the Fed is expected to take its rate to 5.0%.

Citi's U.S. economists now expect any slowdown in the pace of rate hikes to be met by “guidance that the Fed might hike for longer and to a higher terminal rate”.

"The dovish pivot may still be quite far given the wage-price spiral gripping the US economy," says a note from Citi issued November 02.

If Citi are right the Dollar could push higher, prompting a reversal of some of the gains registered by the Pound to Dollar exchange rate during the course of October.

GBP/USD rose to a high of 1.16 on October 27 before paring gains to 1.15 where we see it on Wednesday. Dollar payment rates at high-street banks are at approximately 1.1276 and those offered by payment specialists at approximately 1.1470.

Arguments for a Fed 'pivot' rest largely with signs the U.S. economy is in fact slowing down as a result of the rate hikes the Fed has already delivered.

"The emphasis will lie on the tone taken by Chair Powell in the press conference and his assessment of US economic conditions, especially since September’s data showed the first signs of a substantial growth slowdown," says Harvey.

A continued deterioration in housing market activity and signals that goods disinflation is likely underway could be acknowledged.

But Citi says the Fed will be loath to send a signal that eases monetary conditions.

"Too-high inflation acts as a constraint on monetary policy: resilient activity and jobs data and persistently rapid increases in wages and prices will make the Fed reluctant to communicate anything that would lead to a risk-rally and substantially loosen financial conditions," says Citi.

Analysts at BNY Mellon say Chair Powell won't be too committal in his comments Wednesday, instead he is expected to stay close to the language he and other Fed officials have been using all along.

This could prove disappointing to those looking for a more overt pivot, and could therefore boost the Dollar and pressure the Pound-Dollar rate lower.

However, BNY Mellon are looking for a weaker Dollar as the market could well make up its own mind as to where Powell is heading.

"The risk now, of course, is that either the language comes out more dovish than we expect or, more likely, the same language that has been used for months now gets repeated but is received as a change in orientation by the Fed, with a subsequent rally in risk assets and dollar weakness," says Velis.

Raffi Boyadjian, Lead Investment Analyst at XM.com, agrees:

"There is quite a significant degree of uncertainty going into the November FOMC meeting. Although a 75-bps rate hike is fully priced in, it’s difficult to see Chair Powell toning down his hawkish rhetoric when the data remains strong - not just on inflation, but also on the labour market.

"There's a risk that those investors expecting to see a Fed pivot this week will get wrongfooted as this runs contrary to the Fed's current mantra of higher for longer."

For currency markets, such a surprise will most likely be reflected in a stronger Dollar.

(If you are looking to secure your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks