GBP/USD Week Ahead Forecast: Recovery at Risk from Data Divergence

- Written by: James Skinner

- GBP/USD may have scope for probe above 1.15

- But rebound could fade on fresh data divergence

- U.S. GDP or PCE data could halt USD correction

- S&P PMIs set to remind of UK's darkeing outlook

Image © Adobe Images

The Pound to Dollar exchange rate has rallied strongly in recent trade and may rise further in the short-term but will run the risk of a setback as the week goes on when forthcoming economic data is likely to see attention return to the increasingly divergent prospects of the UK and U.S. economies.

Sterling rose broadly from the open on Monday including against the Dollar after parts of the governing Conservative Party succeeded in deterring former Prime Minister Boris Johnson from participating in the latest selection process for the role of Prime Minister.

That leaves behind as contenders in the race two candidates who are each preferable for the financial markets if and when stood next to former PM Johnson with the outcome of the race set to become known as soon as Monday and no later than Friday.

"We continue to expect a relief rally in the currency pair once the new Conservative Party leader is chosen, but we've had to tone down our expectations for the extent of that rally given the strength of the USD and general conditions surrounding risk appetite," says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

"If the 1.15-1.17 range in cable does materialize over the very near-term, we would currently view that range as a decent short entry point. Our year-end target range for cable is 1.08-1.12," Gallo wrote in a Monday research briefing.

Above: Pound to Dollar rate shown at 4-hour intervals with Fibonacci retracements of August fall indicating possible areas of technical resistance for Sterling. Click image for closer inspection.

Above: Pound to Dollar rate shown at 4-hour intervals with Fibonacci retracements of August fall indicating possible areas of technical resistance for Sterling. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

While the latest developments in the Prime Ministerial selection process were welcomed by the market, they do little on their own to improve the UK's economic prospects, which will be in focus again on Monday with the release of October's S&P Global PMI surveys.

"Purchasing managers’ confidence likely has been undermined greatly by the sharp deterioration in financing conditions for their businesses and uncertainty about the political and fiscal outlook. The PMI also has a tendency to overstate the impact of shock events on economic activity," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

Monday's PMI surveys are expected to indicate deepening recessions in the manufacturing and services sectors but will be just the latest in a growing list of signs of the economy slowing faster than had been anticipated by the Bank of England (BoE) and other forecasters.

But the outlook for the Pound-Dollar rate also likely depends on if a pre-weekend setback for the U.S. Dollar extends into the new week and on what the market makes of forthcoming U.S. economic data in relation to the Federal Reserve policy outlook.

"Several key reports will be closely watched in the coming week, including Q3 real GDP and the Q3 Employment Cost Index (ECI). Data on wages and PCE inflation will reinforce the Fed’s hawkish message," says Kevin Cummins, chief U.S. economist at Natwest Markets.

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of August fall and selected moving-averages indicating possible areas of technical resistance for Sterling. Click image for closer inspection.

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of August fall and selected moving-averages indicating possible areas of technical resistance for Sterling. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"Core PCE inflation–the Fed’s preferred inflation measure--could have climbed higher in September. We project a second monthly gain of 0.5% (0.451%)," Cummins wrote in a Friday look at the week ahead in the U.S. calendar.

One risk for the Pound-Dollar rate this week is that Wednesday's GDP data shows the U.S. economy exiting a technical recession just as the UK is thought to be entering one in a divergence of economies that could have scope to undermine the recovery from mid-week on.

However, this Friday's release of the Core PCE Price Index, the preferred inflation measure of the Federal Reserve, for September is also a possible headwind for the Pound-Dollar rate given expectations for this measure of inflation to rise from an annualised 4.9% to 5.2%.

That would likely be more than enough to ensure the Fed remains on the interest rate path set out in September, which has helped lift the Dollar against many currencies in the weeks since the bank set itself on course to lift its benchmark interest rate to 4.5% by year-end and 4.75% early next year.

"There are upside risks to US PCE inflation that could increase US interest rates and the USD," says Carol Kong, an economist and currency strategist at Commonwealth Bank of Australia.

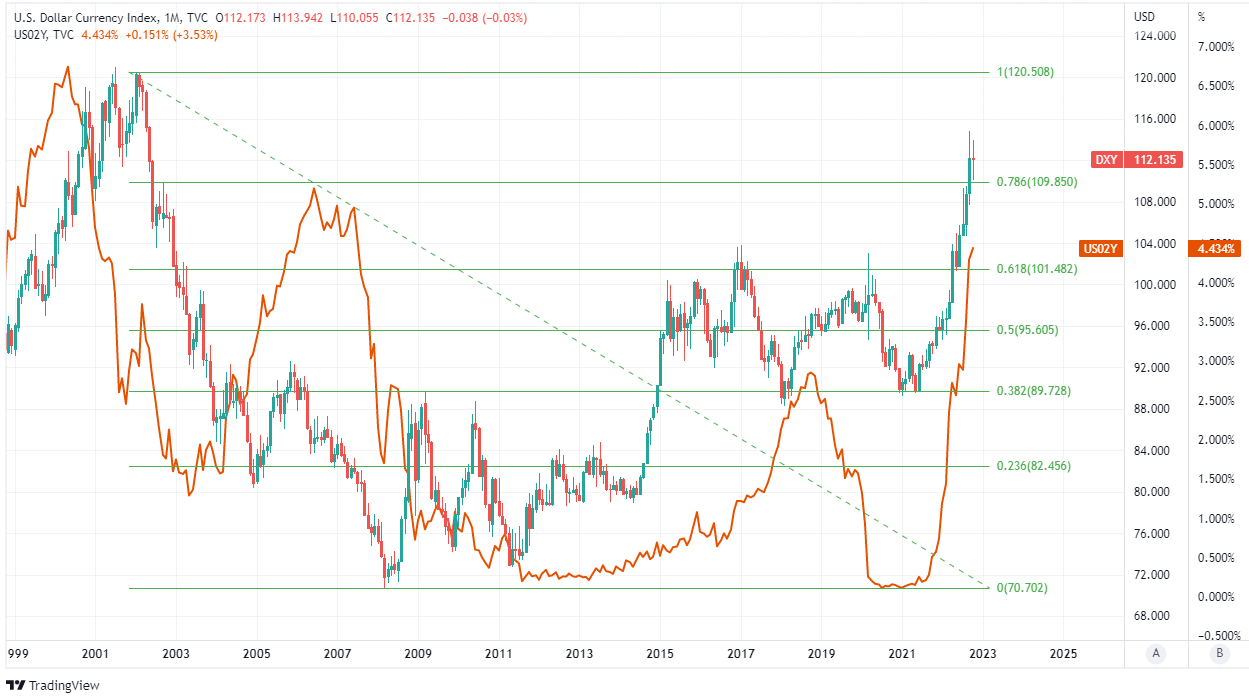

"Overall, we expect the USD [Dollar Index] to track higher towards 114pts this week," Kong and colleague said in a Monday look at the week ahead.

Above: Dollar Index shown at monthly intervals with Fibonacci retracements of new millenium downtrend indicating possible areas of long-term technical resistance for the Dollar and shown alongside 02-year U.S. government bond yield. Click image for closer inspection.

Above: Dollar Index shown at monthly intervals with Fibonacci retracements of new millenium downtrend indicating possible areas of long-term technical resistance for the Dollar and shown alongside 02-year U.S. government bond yield. Click image for closer inspection.