Pound "Extremely Cheap" and a Buy on Dips says BCA Research

- Written by: James Skinner

- Deeply undervalued GBP/USD could rise 5% per year over 5 years

- But market noise & GBP/USD volatility could persist for a while yet

- Accumulating GBP/USD on dips near 1.08 said to be best strategy

Image © Adobe Images

The Pound to Dollar exchange rate could remain volatile in the months ahead but the bottom has likely already been seen back in late September, according to BCA Research, and Sterling's deep undervaluation means that limit orders to buy around the 1.08 level could pay dividends in the years ahead.

Sterling has been the talk of the town since its late September slide to all-time lows against the Dollar with many forecasters becoming even more bearish in their outlooks over the weeks since, although some do see nearby levels of GBP/USD as offering a bargain.

"Bottom Line: The pound has likely seen the lows for the next few years, near 1.035. This makes it a buy long term. For short-term investors, our capitulation index has hit rock bottom, also suggesting the pound is due for a rebound," says Chester Ntonifor, chief FX strategist at BCA Research.

"Our assessment is that the risk-off environment is likely to last a bit longer, which could make cable trading volatile," Ntonifor and colleagues wrote in a Friday review of the outlook for Sterling.

Above: Pound to Dollar rate shown at 2-hour intervals.

Above: Pound to Dollar rate shown at 2-hour intervals.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Much of this week's volatility came amid intense market focus on Bank of England (BoE) interventions in the bond market where heavy losses for government bonds have left pension funds deep underwater with some of them especially vulnerable due to 'leverage' resulting from derivative exposures.

But Sterling's large losses were in late September when it fell close to 1.08 against the Dollar in the hours immediately after Chancellor Kwasi Kwarteng's budget, which was widely criticised in financial circles for various reasons and followed by a pickup in market volatility.

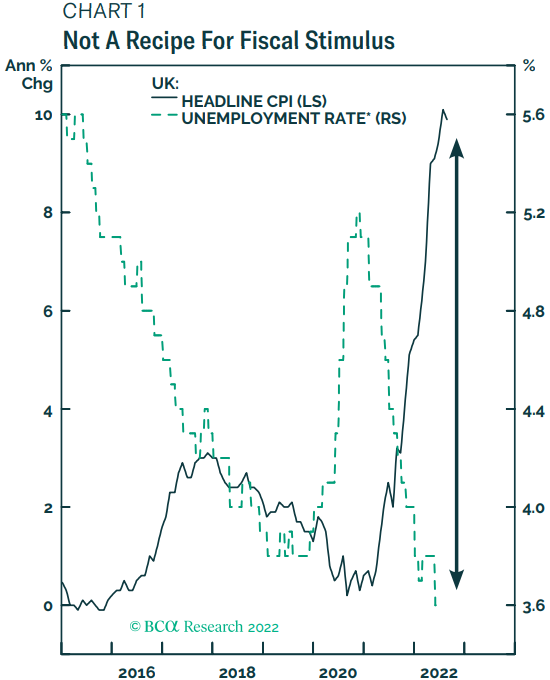

"A simple framework for thinking about fiscal policy is in relation to the output gap. In general, fiscal policy should be used when the output gap is wide. Otherwise, it becomes inflationary and leads to a depreciation in the real exchange rate," Ntonifor wrote last week.

"From a bird’s eye view, the stimulus package looks irresponsible. For one, the UK unemployment rate is hitting the lowest level since the 1970s, and inflation is equally at a 40-year high (Chart 1). Quite simply, the output gap in the UK is closed," he added.

One common criticism of the budget relates to the tax cuts and other giveaways, which many argue will add further to inflation by making it easier for companies to raise prices in response to the increased costs of materials that have stemmed from this year's increases in commodity prices.

Another criticism that has been seconded by Ntonifor is that the fiscal plans were not accompanied in late September by any other plan for eventually eliminating the budget deficit and instead appeared to gamble that tax cuts alone would boost the economy sufficiently to correct the deficit themselves.

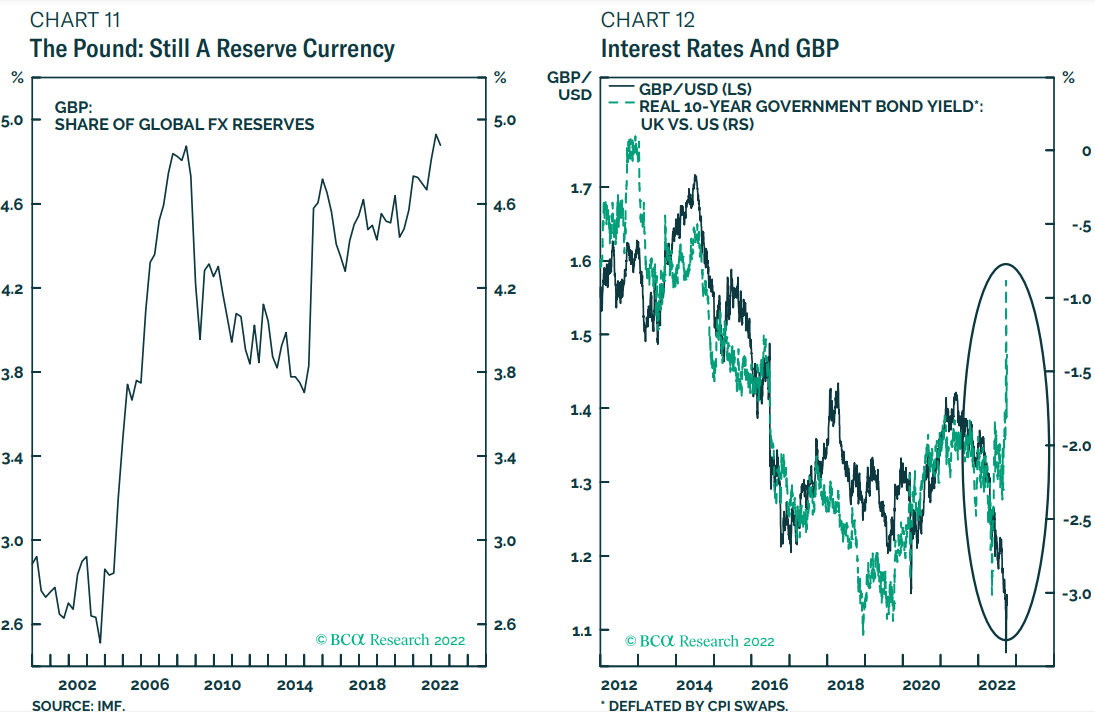

"There is a second angle to this story. Sterling is very much a reserve currency," Ntonifor and colleagues also said.

"This puts sterling very much at risk of a crisis of confidence, similar to the US dollar. With the recent turn of events, real interest rates have risen in the UK, but the currency has collapsed (Chart 12), akin to what one would observe in emerging markets (Chart 13)," he added.

The budget has led many economists to anticipate that the Bank of England is now likely to raise its interest rate much further than otherwise would have been case, which would add further to the burdens weighing on the economy while likely ensuring that the government bond market remains under pressure too.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

But while the budget is widely reviled and the UK economic outlook remains bleak, the Poundwas already one of the biggest fallers among the G10 currencies for 2022 even before the budget and subsequent losses.

All of this has left Sterling trading at what are deeply discounted levels on many different measures of valuation, hence why it has now caught the eye of the BCA Research team, which is tipping the Pound-Dollar rate as a long-term 'buy and hold' kind of investment proposition.

"On balance, we prefer to set a limit buy on GBP/USD at 1.08," Ntonifor wrote. "Cable is very cheap, even accounting for elevated UK inflation. Our in-house PPP model suggests the pound could appreciate by 5% per year, over the next 5 years, just to revert to fair value."

Above: Pound to Dollar rate shown at daily intervals.