Dollar's Demolition Derby May Have Cost $1 Trillion of Reserves by September

- Written by: James Skinner

Image © Adobe Images

The U.S. Dollar's ongoing demolition of other currencies swallowed more than $500BN of official reserves in the second quarter, according to International Monetary Fund (IMF) data, and from this it can be somewhat reliably inferred that the reserve cost of the Dollar rally topped $1 trillion in September.

Dollars were back in demand again throughout the session on Wednesday but notably more so after the September edition of the Institute for Supply Management (ISM) Services PMI appeared to cast the U.S. economy's most important sector in a more resilient light than forecasters had anticipated.

Wednesday's report showed business activity levels falling alongside new orders for services firms while the prices component of the index fell for a fifth consecutive month in a development that potentially portends an easing of U.S. inflation pressures during the months ahead.

Nonetheless, the barometer of overall activity fell less than was expected by the economist consensus so if anything Federal Reserve (Fed) officials may well view this as vindication for a continued hawkish policy stance, while many in the market will inevitably see it as a reason to keep buying the rallying Dollar.

"An advance in the employment sub-index to 53.0 from 50.2 mostly offset the weakness in other components," says Katherine Judge, an economist at CIBC Capital Markets.

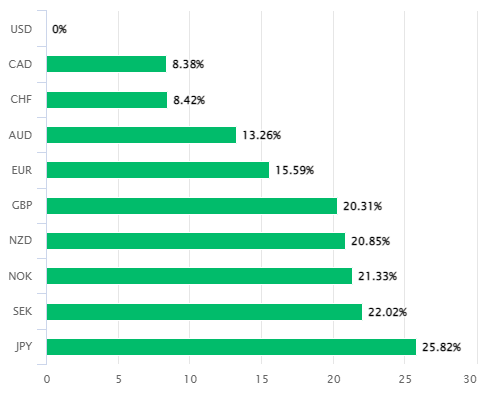

U.S. Dollar performances relative to G10 and G20 counterparts in 2022. Source: Pound Sterling Live.

"While that suggests that a wider range of firms were hiring in September, that doesn't provide any information on the magnitude of job gains, and that improvement is in contrast to the drop seen in job openings at the end of August," Judge said following Wednesday's data release.

The Dollar built further on intraday gains over all G10 and G20 currencies following the release of the PMI report, lifting its 2022 return to more than 20% against around half of the G10 basket while adding further to much more limited gains over other counterparts within the G20 grouping.

This does come at a cost to countries and economies around the world, however, some of which have sold Dollars by the boatload this year in attempts to avoid taking losses that can add to inflation while accentuating risks to energy supplies already compromised by the war in Ukraine.

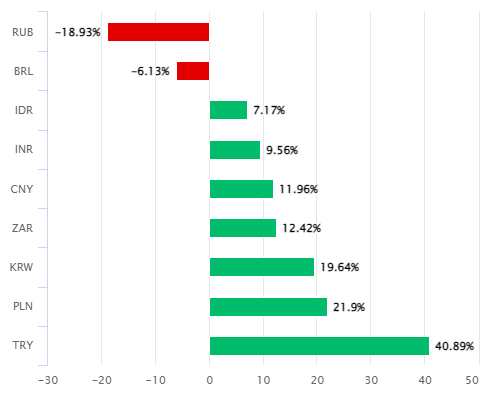

That was confirmed by the IMF's latest Currency Composition of Official Foreign Exchange Reserves (COFER) report released at the end of September, which showed the Dollar value of U.S. Dollars held in official foreign exchange reserve portfolios falling by more than $500BN over the second quarter.

Source: International Monetary Fund Currency Composition of Official Foreign Exchange Reserves (COFER) report.

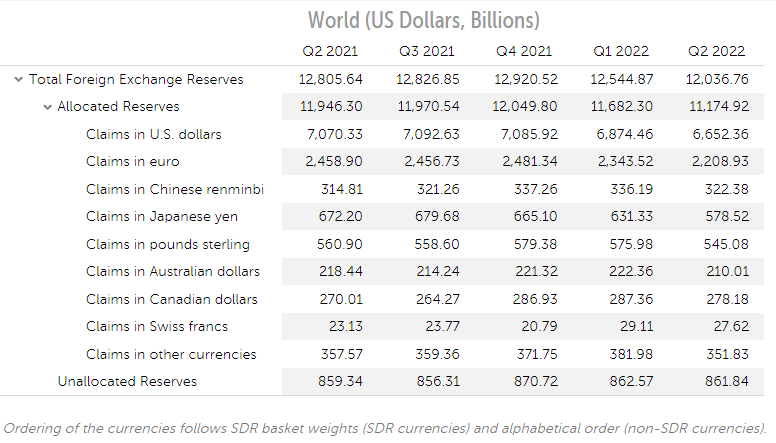

Source: International Monetary Fund Currency Composition of Official Foreign Exchange Reserves (COFER) report.

The second quarter saw the U.S. Dollar Index rally by around 7.4% before going on to rise a further 7.0% during the third quarter and this implies some chance of a similar sized drawdown on reserves over the third quarter, which could have seen the decline in U.S. Dollar holdings surpassing $1 trillion.

Applying the same methodology to the first quarter suggests this is an imperfect but nonetheless useful way of anticipating the increase or decrease of the Dollar holding declared by the IMF, given that this fell by $211BN in the opening quarter and during a period in which the Dollar Index rose by 3.6%.

Some readers may wonder what the Dollar Index has to do with anything given that it is generally viewed as a very narrow gauge that does not properly reflect the greenback's overall performance, although it's relevant that this gauge does reliably measure the Dollar's performance against other reserve currencies.

This is important because when changes in the other reserve holdings outlined above are measured as a portion of "allocated reserves," the results suggest that other reserve currencies were sold by countries around the world in order to replenish their declining holdings of U.S. Dollars.

That would almost certainly have contributed to losses for all currencies listed in the IMF table when those are measured against the U.S. Dollar.

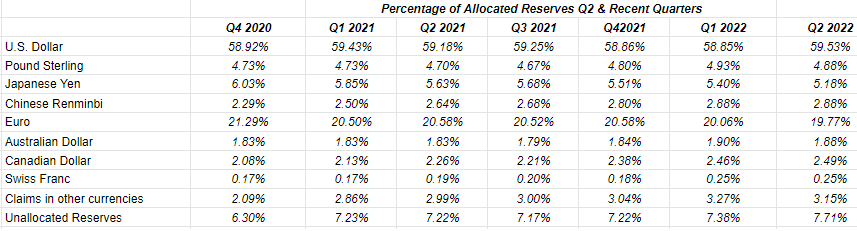

Source: Pound Sterling Live calculations.

Source: Pound Sterling Live calculations.