GBP/USD Week Ahead Forecast: High Yield Safe Haven Weighs

- Written by: James Skinner

- GBP/USD risks return near to pandemic’s 27 year lows

- After Fed looks back to 70s & 80s for policy instruction

- Saying interest rates to stay high even in U.S. downturn

- Stoking upside risks for bond yields & USD short-term

Image © Adobe Images

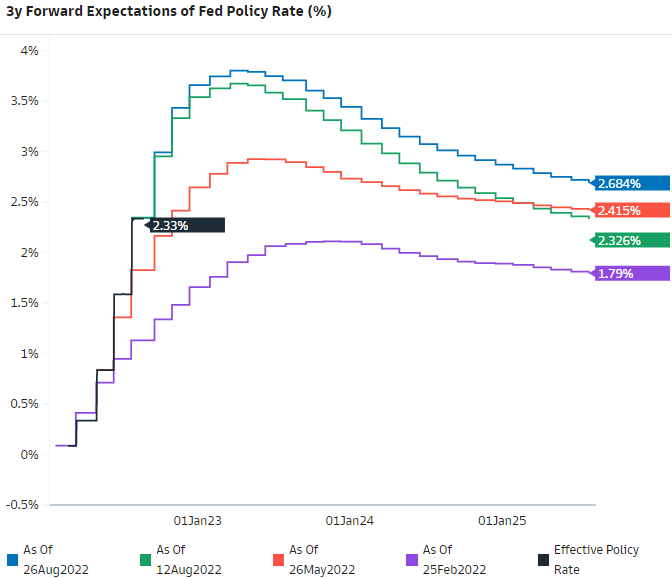

The Pound to Dollar rate slipped to a new post-pandemic low to open the holiday-shortened week but could fall further yet if the Federal Reserve's (Fed) increasingly gloves-off approach to inflation continues to dampen risk appetite in another important week for the U.S. economic backstory.

U.S. exchange rates were bought with Sterling sold in Bank Holiday trade on Monday, leading the Pound to unfurl into a new post-pandemic low beneath 1.17 afterChairman Jerome Powell said on Friday that a U.S. economic downturn would not deter the Fed from lifting interest rates further in the months ahead.

"Reducing inflation will take time and require a sustained period of below-trend growth,which will soften labour market conditions and cause pain for households and businesses. It will require policy that is restrictive enough to return inflation to the 2% target," says Tom Kenny, a senior economist at ANZ.

"Such a stance is likely to be needed for some time,with history strongly cautioning against prematurely loosening policy. A clear pushback against the market view that rate cuts are coming as soon as mid next year," Kenny and colleagues wrote in a Monday research briefing.

Chairman Powell suggested at the Jackson Hole Symposium on Friday that he and others at the Fed are looking back to the 1970s and 1980s for instruction on how to bring down U.S. inflation rates, leading global market risk appetite to evapourate and prompting the Dollar to rise alongside U.S. bond yields.

Above: Pound to Dollar exchange rate shown at 4-hour intervals. Click image for closer inspection.

Above: Pound to Dollar exchange rate shown at 4-hour intervals. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

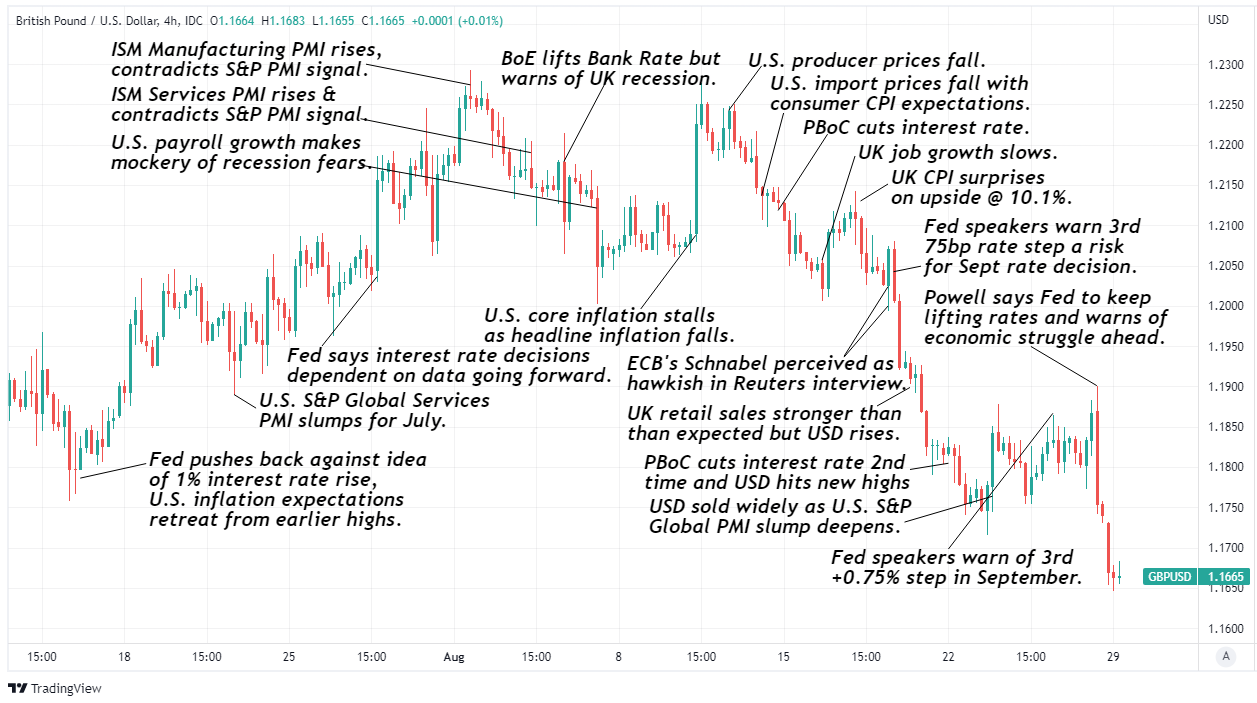

U.S. interest rates were lifted to punishing levels for an economically crippling period in the 1970s and 1980s to bring inflation down and financial markets were led on Friday to anticipate a similar approach from the Fed this time around when Powell said U.S. rate will likely have to be held at their anticipated peak of 3.75% “for some time.”

“The Fed’s ongoing tightening gives the USD far-and-away the highest carry among global safe-havens and recent data in China and natural gas stress in Europe remind that the global growth backdrop is still shaky,” says Paul Robson, Europe head of G10 FX strategy at Natwest Markets.

“The key question for European currencies is whether the natural gas crisis and its impact on regional growth is already in the price. Our sense is that it’s already well socialized, particularly in the UK,” he added before suggesting that there is little, if any further downside left in GBP/USD.

Friday’s widely anticipated address has lifted shorter maturity U.S. bonds yields and squeezed those parts of the market that had been betting on interest rate cuts being delivered by the Fed in the early months of next year while burnishing the high yield and safe-haven appeal of the U.S. Dollar.

That sent the Pound-Dollar rate tumbling to new post-pandemic lows on Monday and with few technical impediments left over on the charts to interrupt any further declines, there is now a risk that Sterling ebbs further toward 1.1412 in the week ahead, which is its joint lowest level since March 2020 and April 1985.

Above: Pound to Dollar rate shown at daily intervals with Fibonacci extensions of various falls indicating prospective pivot points for would-be buyers and targets for any sellers of Sterling. Click image for closer inspection.

Above: Pound to Dollar rate shown at daily intervals with Fibonacci extensions of various falls indicating prospective pivot points for would-be buyers and targets for any sellers of Sterling. Click image for closer inspection.

“Rising energy prices have seen financial markets ramp up pricing for the Bank rate. However, we expect concerns around the UK’s (and world’s) economic growth outlook will weigh on GBP/USD. A break though downside support at 1.1718 can see GBP/USD trade down to its covid low of 1.1412,” says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

“The restrictive interest rate setting needed to bring US inflation back to target is likely to push the US economy into a recession by early 2023. We expect recessions in the UK, the Eurozone and Japan too. We expect both the US ISM manufacturing and non-farm payrolls to be weaker than consensus this week,” Capurso and colleagues said in a Monday research briefing.

Whether or not the Pound makes it as far as 1.1412 will, however, depend on the details and implications of multiple important pieces of U.S. economic data due out this week including Friday’s non-farm payrolls report and the latest Institute for Supply Management (ISM) Manufacturing PMI.

The Pound has found support recently whenever U.S. data has illustrated a weakening economy and this can still lean against Dollar and bond yields if such data is perceived as making it more likely that the Fed will lift its interest rate at a slower pace than otherwise.

The highlight of the week is Friday’s employment report but before then the ISM survey will be scrutinised closely after S&P Global PMIs suggested last week that both the manufacturing and services industries continued to fall deeper into recession during August.

Above: Spread or gap between 02-year UK and U.S. government bond yields shown at weekly intervals alongside GBP/USD.

Above: Spread or gap between 02-year UK and U.S. government bond yields shown at weekly intervals alongside GBP/USD.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

“In the UK it’s a relatively quiet week ahead, with just UK household borrowing figures,” says Jordan Rochester, a G10 FX strategist at Nomura.

“We remain short GBP/USD (entry: 1.3460, target 1.15 by end-September, conviction 3/5),” Rochester wrote in a Monday research briefing.

In what is a quiet week for UK economic data, much of the market focus will be on what each of the above figures implies about the likely size of the interest rate step taken by the Fed in September, which is a decision that is widely seens as being a toss up between a 0.75% increase and a smaller 0.5% move.

Fed Chairman Jerome Powell did acknowledge on Friday that the size and pace of interest rate steps would still eventually slow even as the U.S. economy heads toward a period over which borrowing costs are likely to be held at their peak for longer than financial markets have given credit for.

“While the Fed remains unsure of whether the data will allow a slowing of the pace of hikes next month (especially in the context of the latest comments from other Fed officials), rising recession risk in Europe on the back of the sharp rally in natural gas prices and the slowdown in activity already under way (see the August flash PMIs) means that the Dollar still looks like the clearest long in the near term,” says Michael Cahill, a G10 FX strategist at Goldman Sachs.

Above: Market implied expectations for the Fed Funds interest rate at differing points of 2022. Source: Goldman Sachs Marquee.