Pound Nears Peak Undervaluation against U.S. Dollar

- GBP/USD nearing peak undervaluation

- But undervaluation can last for a long time

- Three drivers could rescue GBP says Validus

Image © Adobe Images

Marc Cogliatti, Principal, Global Capital Markets at Validus Risk Management, investigates the catalysts that could ultimately bring an end to the Pound's decline against the U.S. Dollar.

Since the beginning of 2022, sterling has fallen 11.8% against the dollar, making it one of the worst performing currencies (in terms of spot return) in the G10.

Only the Norwegian Krone (-13.45%) the Swedish Krona (-13.89%) and the Japanese Yen (-15.74%) have fared worse.

With GBPUSD testing below $1.18 this morning and seemingly only heading in one direction, we once again find ourselves asking how much further will sterling fall and what will be the catalyst to turn it around?

When I wrote a piece on this theme last month, I cited the pound’s undervaluation as a key factor that may prevent it falling much further.

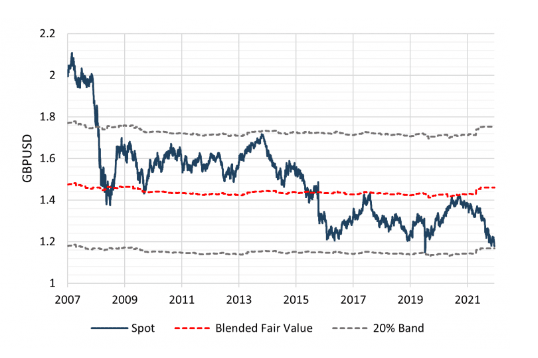

Over the past 15 years, GBPUSD has not exceeded a +/-20% deviation from 'fair value'.

That still rings true today, with the pound currently 19.3% undervalued (we calculate fair value using a blended CPI/PPI model).

However, those of us able to remember the heady days of two dollars to the pound, will note that sterling was considerably overvalued for a couple of years before it fell back sharply in 2008 at the height of the Global Financial Crisis.

With this in mind, it’s not beyond the realms of possibility that sterling could fall further and remain significantly undervalued for a prolonged period.

Above: GBPUSD Purchasing Power Parity Valuation, Source: Bloomberg, Validus Risk Management.

With regard to the outlook, the narrative appears very gloomy.

Particularly telling was sterling’s reaction to last week’s higher-than-expected inflation reading for July (headline CPI rose 10.1% y/y vs the consensus forecast of +9.8%) and Friday’s stronger than expected retail sales (+0.3% m/m vs expectations of -0.2%).

As the market quickly shifted to price in the prospect of additional tightening from the MPC, sterling fell.

Conventional wisdom suggests that an increased probability of higher rates should result in a stronger currency, so the fact that the opposite rang true is a worrying signal for the pound.

A breakdown in UK rates / currency performance is more akin to what we might expect to see in emerging markets. The problem is that even with nominal rates set to go higher, significantly higher inflation means that real rates are still heading lower.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

An article published by Citi Bank has been picked up by mainstream media in the UK, suggesting inflation could rise above 18% amid the energy crisis (gas prices in particular).

Clearly this is an extreme forecast and is well above both the consensus (11.9%) and the Bank of England’s own forecasts (13%) but at the very least, it’s a scenario worth considering from a risk management perspective.

It may not be beyond the realms of possibility if a new Prime Minister takes charge and stokes the fire with fresh fiscal stimulus.

Interestingly, looking at the latest FX forecasts complied by Bloomberg, amongst the banks who updated their forecasts last week, the consensus for the end of both Q3 and Q4 was still $1.19.

A notable outlier was JP Morgan, which sees sterling falling to $1.14 at the end of Q3 before staging a very slow recovery in 2023.

At Validus, our overall bias is still against the dollar (based on valuation) but our conviction is beginning to wane given recent price action.

What is also interesting, is that this move isn’t isolated to sterling.

All G10 currencies are down against the dollar since the beginning of the year and the euro has put in a very similar performance to the pound. So much so, EURGBP has traded largely between 0.83 and 0.86 since the beginning of the year (currently mid-range at 0.8450).

What could reverse sterling’s decline?

First and foremost, sterling has always fared better in a ‘risk on’ environment. Although equity markets have been surprisingly robust in recent months, underlying concerns about the health of the global economy, the war in Ukraine and central banks’ ability to control inflation persist.

However unlikely it seems, a more positive risk sentiment would certainly help sterling’s cause.

A second influence which may aid all currencies comes from the dollar side of the equation.

A drop in real US rates (either because of the Fed cutting rates or higher inflation) would certainly make the dollar look less attractive (or at least on more of a level playing field with its peers).

Finally, my point about valuation still stands.

At current levels, sterling assets look very cheap for foreign investors (at least those with dollars).

Granted such assets could quite feasibly become cheaper still, but as Baron Rothschild once said, “the time to buy is when there's blood in the streets.”

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks