GBP/USD Week Ahead Forecast: Recovery Constrained by Inflation Risks

- Written by: James Skinner

- GBP/USD supported near 1.2091, 1.2066 & 1.2044 on charts

- Trio of resistances stymie recovery between 1.2271 & 1.2282

- U.S. inflation moderation supportive for GBP/USD short-term

- UK jobs & retail sales important but CPI the highlight for GBP

Image © Adobe Images

The Pound to Dollar exchange rate attempted to extend its month-long recovery last week but was unable to establish a new high and could now be headed for a period of consolidation unless an action-packed economic calendar provides a catalyst for a fresh advance in the days ahead.

There were multiple signs last week of a great inflation moderation being near in the U.S. though not nearly enough to dissuade the Federal Reserve (Fed) of its hawkish policy stance, which makes for lingering interest rate risks that are also limiting factors for the Sterling-Dollar outlook.

“This week’s softer inflation reports caused some understandable relief for risky assets and put depreciation pressure on the Dollar,” writes Michael Cahill, a G10 FX strategist at Goldman Sachs, in a Friday research briefing.

“That can likely extend a bit further given the light calendar ahead and likelihood that next week’s FOMC minutes will contain some discussion of the FOMC’s apparent desire to slow the pace of hikes soon. But we do not expect it to be a lasting relief,” he added.

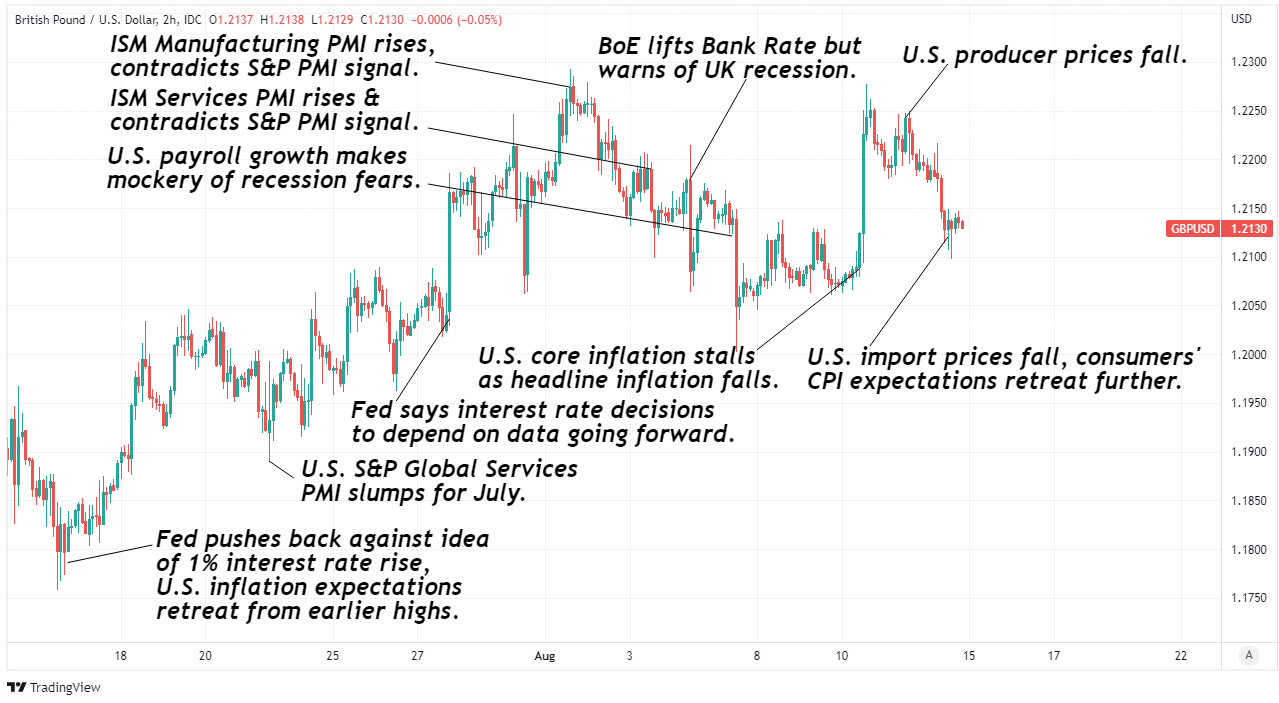

Above: Pound to Dollar rate shown at 2-hour intervals. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Data suggested last week that each official measure of U.S. inflation was either stalling or falling in July while separate measures of producer prices and import costs also surprised on the downside when declining for the recent period.

Meanwhile, a New York Fed survey showed expectations for future inflation falling at all horizons last month and an important University of Michigan survey also suggested that expectations ebbed at all but the longest horizons.

“The Fed will be unhappy to see five-to-10-year inflation expectations rising a tenth to 3.0%, but the increase won’t be sustained in the wake of the plunge in gas prices,” says Ian Shepherdson, chief economist at Pantheon Macroeconomics.

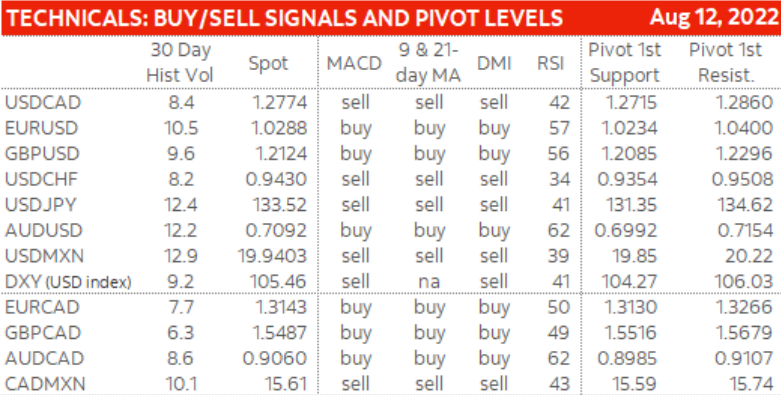

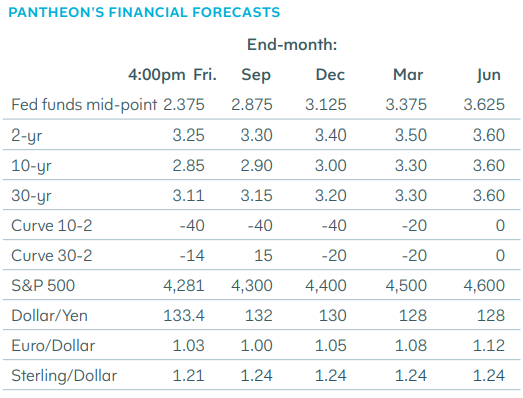

Source: Pantheon Macroeconomics.

Source: Pantheon Macroeconomics.

“Margin inflation is now falling rapidly, and our forecast of a further sustained drop is a key reason why we think inflation will fall faster than markets expect over the next year,” Shepherdson also wrote in a Monday research briefing.

The trouble for the Pound and underwriter of the Dollar is in things like per-person employment costs, which rose by an annualised 10.8% in the second quarter following a 12.6% increase previously and in an outcome that points to wage growth rates being slow to recede from recent multi-decade highs.

Taken alongside the uptick in longer-term expectations and combined with the recent mark-down of market expectations for the Fed Funds rate, these factors keep U.S. inflation and interest rate risks on the upside while limiting the Pound-Dollar rate in its ability to recover further.

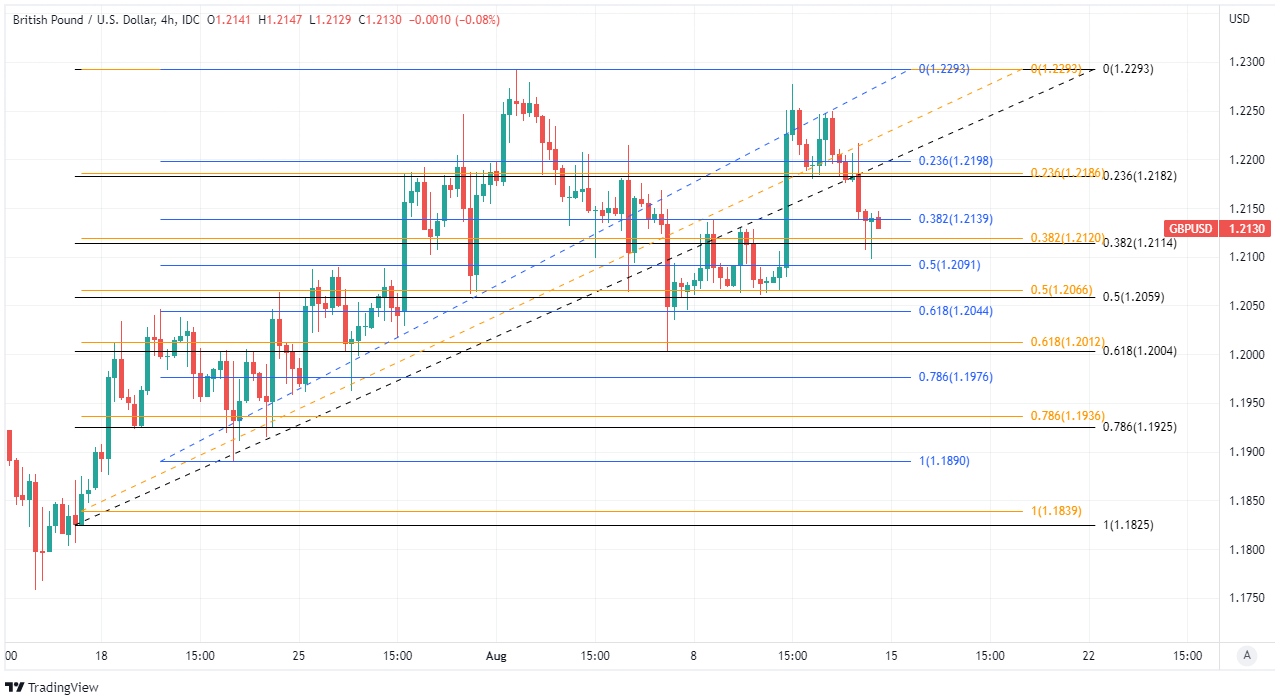

Above: Pound to Dollar rate shown at 2-hour intervals with Fibonacci retracements of various recent rebounds indicating possible areas of short-term technical support. Click image for closer inspection.

Above: Pound to Dollar rate shown at 2-hour intervals with Fibonacci retracements of various recent rebounds indicating possible areas of short-term technical support. Click image for closer inspection.

“The retail sales report on Wednesday is the most high-profile data on the upcoming week’s calendar. Weekly jobless claims on Thursday warrant some extra attention too, in light of the recent pickup,” says Kevin Cummins, chief U.S. economist at Natwest Markets.

“We expect the minutes to underscore additional rate hikes to a restrictive stance remain in store for this year. We doubt that the FOMC sends any clear message of whether the expectation for the September rate hike is 50bps or 75bps,” Cummins said on Friday.

Much about how the Pound-Dollar rate now fares through the days ahead is likely to be determined by a busy economic calendar that includes multiple highly important appointments for both Sterling and the greenback.

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of various recent extensions of 2021 downtrend indicating possible areas of short-term technical resistance. Click image for closer inspection.

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of various recent extensions of 2021 downtrend indicating possible areas of short-term technical resistance. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

“The energy crunch and cost-of-living crisis suggest significant economic headwinds lie ahead for the UK economy and that will restrain the GBP’s ability to advance,” says Juan Manuel Herrera, a strategist at Scotiabank.

“The top of the range this week coincided with a test of key resistance at 1.2275 and failure here suggests Cable risks heading back to the 1.20 zone. We spot key support at 1.2080 in the short run,” Herrera and colleagues said on Friday.

Wednesday’s release of U.S. retail sales and minutes from the July Fed meeting are the highlights of the week ahead for the Dollar but both are bookended by important data emerging from the UK including the latest employment and inflation figures for the month of July, which could impact the outlook for Bank of England (BoE) interest rates.

“GBP/USD can remain heavy this week” says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

“The UK’s economic outlook remains weak. The economy contracted by 0.1%/qtr in Q2 2022. The Bank of England expects a recession beginning in Q42022, though the risk is sooner,” Capurso and colleagues said on Monday.

Employment figures will be scrutinised closely on Tuesday for clues about the resilience of the labour market and for insights into the trend in wage growth, both of which are influential when it comes to the outlook for Bank of England (BoE) interest rate policy.

But it’s Wednesday’s inflation figures that will matter most for BoE monetary policy and Pound Sterling in the short-term and this time out there is uncertainty about how the market will be likely to respond to up or downside surprises.