GBP/USD Week Ahead Forecast: Testing 1.21 if Fed Stays June's Course

- Written by: James Skinner

- GBP/USD supported near 1.1945 & 1.1911

- Scope to test 1.21 if Fed stays June course

- Fed, Q2 GDP & Core PCE data all in focus

Image © Adobe Images

The Pound to Dollar exchange rate ended last week back above 1.20 and may have an opportunity to recover further, with a test of the 1.21 handle a possibility, if the Federal Reserve (Fed) sticks on Wednesday to its June plan to steer interest rates toward a “modestly restrictive level” by year-end.

Dollars were sold widely to the benefit of Sterling and other currencies last week after one measure of long-term U.S. inflation expectations fell in the prior period and Fed policymakers appeared to push back against the notion that an outsized 1% interest rate rise might be likely this Wednesday.

The resulting shift in market pricing of the Fed Funds rate offered balm to beleaguered risk assets and currencies while leading the Pound to Dollar exchange into multiple attempts at rising back above 1.20, a level that Sterling eventually managed to hold above for the weekend close.

That was after S&P Global PMI surveys cast the all-important U.S. services sector in an even more troubled light than Europe’s equally important manufacturing industry late on Friday afternoon, leading to further declines for the Dollar and setting the stage for this week’s Fed decision.

“I said the next meeting could well be about a decision between 50 and 75. That would put us, at the end of the July meeting, in that range—in that more normal range, and that’s a desirable place to be,” Fed Chairman Jerome Powell said most pertinently in the June press conference.

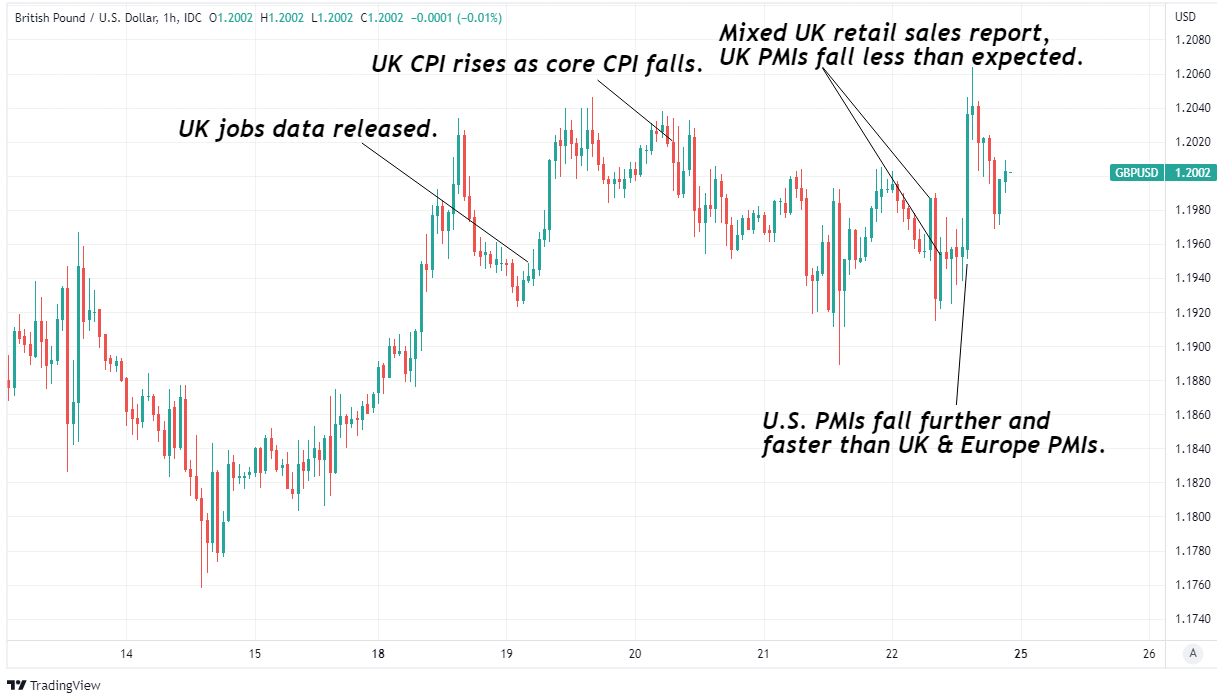

Above: Pound to Dollar rate shown at hourly intervals. Click image for closer inspection.

Above: Pound to Dollar rate shown at hourly intervals. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Wednesday’s decision is the highlight of the week for the Pound to Dollar rate but Thursday’s second-quarter U.S. GDP data and Friday’s Core PCE Price Index reading are also highly important because of their possible implications for Fed policy further down the line.

The decision is widely expected to result in a second 0.75% increase in the Fed Funds range that would lift the benchmark to between 2.25% and 2.5%, which also happens to be the middle of the estimated “neutral range” where borrowing costs neither stimulate nor inhibit the economy.

That would leave the Pound-Dollar reaction hinged upon any remarks about the pace at which the Fed intends to proceed from September 21, the date of its next meeting, although this itself will be to some extent dependent on U.S. economic developments during the interim.

“While markets will again focus on the hiking increment at this meeting and guidance for September, the lesson from the June meeting is that it will be more important to focus on the Fed’s criteria for adjusting its approach,” says Michael Cahill, a G10 FX strategist at Goldman Sachs.

“We will primarily be focused on whether officials broaden that criteria to put more focus on slowing activity data. Until that shift is clearer, it will be difficult for the market to price a more accommodative Fed and a weaker Dollar,” Cahill and colleagues said on Friday.

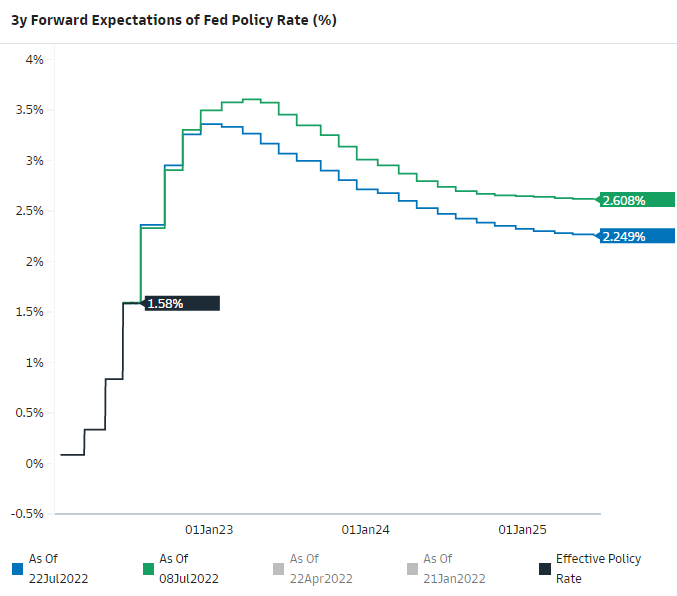

Above: Market-implied expectations for U.S. interest rates and changes since July 08. Source: Goldman Sachs Marquee.

Above: Market-implied expectations for U.S. interest rates and changes since July 08. Source: Goldman Sachs Marquee.

The Fed set itself on course in June to lift interest rates to a “modestly restrictive” level thought to be anywhere between 3.25% and 4% by year-end but also indicated that its arrival at the neutral level of around 2.5% could prompt it to reevaluate the speed at which rates are lifted going forward.

This is most pertinent in light of recent market concerns about the trajectory of the economy and the latest business surveys suggesting that key parts of the economy may be slowing faster than Fed policymakers had expected, and due to recent trends in hiring at some of the largest U.S. companies.

“The policy rate will be up where we think it should be. And then the question would be: Do you slow down? Does it make you— you’ll be making these judgments about, is it appropriate now to slow down—from 50 to 25, let’s say,” Chairman Powell said in the June press conference.

June’s plan to push the Fed Funds rate up to “moderately restrictive” levels by year-end was motivated by a desire to cool the economy so that inflation begins to fall and eventually returns to the Fed’s 2% target, and there have been indications of the Fed having some early success in this regard.

Notably, and with the latest business surveys aside, hiring freezes at major U.S. companies and captains of global industries are suggestive of a cooling labour market that would inhibit wage growth rates and reduce the risk of inflation remaining elevated beyond the short-term.

Above: Pound to Dollar rate shown at hourly intervals with Fibonacci retracements of recent rebound indicating prospective areas of short-term technical support for Sterling. Click image for closer inspection.

Above: Pound to Dollar rate shown at hourly intervals with Fibonacci retracements of recent rebound indicating prospective areas of short-term technical support for Sterling. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

A cooling labour market has been a key objective of the Fed and is something that could potentially lead it to favour sticking with the plan already announced in June as opposed to encouraging a further ‘hawkish’ repricing of the outlook for U.S. interest rates this Wednesday.

This kind of outcome would potentially aughur profit-taking from the parts of the market harbouring bullish wagers on the Dollar, keeping directional risk for the Pound-Dollar rate tilted higher and creating scope for a possible test of technical resistances around 1.21 during the latter half of the week.

“We don't expect the accompanying statement to give investors too much reason to question the guidance of continued tightening for the next several FOMC meetings this year. Nor do we suspect Powell should want to speculate about a specific size hike at the September meeting,” says Kevin Cummins, chief U.S. economist at Natwest Markets.

“If the Fed has any surprises in store for us, it is likely to save them for some time after the summer when they will have much more information in hand to judge the size of upcoming rate hikes,” Cummins and colleagues said on Friday.

While Wednesday’s Fed decision is the highlight for Sterling, the Dollar and many other currencies this week, Thursday’s second-quarter U.S. GDP data and Friday’s release of the Core PCE Price Index for July will also be scrutinised closely for what they could imply about the Fed policy outlook.

Above: Pound to Dollar rate shown at 4-hour intervals with Fibonacci retracements of various recent extensions of downtrend indicating prospective areas of technical reistane for Sterling. Click image for closer inspection.

Above: Pound to Dollar rate shown at 4-hour intervals with Fibonacci retracements of various recent extensions of downtrend indicating prospective areas of technical reistane for Sterling. Click image for closer inspection.

“If GDP contracts for the second consecutive quarter in Q2 2022, the US would meet the conventional definition of recession (even if the US uses a different definition),” says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

“If the recession is interpreted as isolated to the US, the USD could fall. But if the recession is seen as a prelude to recession elsewhere, the USD could jump as the preeminent safe haven currency,” Capurso also said on Monday.

Much recent market commentary has been concerned with the risk of the U.S. economy slipping into a technical recession as soon as the second quarter although the economist consensus suggests that Thursday’s data is likely to reveal a 0.4% increase in GDP for the period.

It’s not clear that this would have much implication for the Fed policy outlook and it’s likely that Friday’s Core PCE inflation reading will be far more important, given that it’s the Fed’s preferred measure of U.S. inflation.

The average or consensus of economist forecasts suggests the month-on-month pace of Core PCE inflation ticked higher from 0.3% to 0.5% in July, and the consensus suggests this will keep the annual pace of PCE inflation steady at June’s reduced level of 4.7%.