Pound Could Benefit as Resistance Looms Over Dollar Index

- Written by: James Skinner

- GBP/USD sell-off could ease in short-term

- If resistances succeed by stalling the USD

- GBP/USD near multiple prospective pivots

- Resistances now looming over USD index

- CHF & EUR near long-term support levels

Image © Adobe Images

The Pound to Dollar exchange rate fell further this week but with the greenback now facing technical resistance against the Euro and Swiss Franc, the U.S. Dollar Index may be in danger of running out of gas and this could in turn potentially help GBP/USD to stabilise close to current levels in the near future.

Sterling saw only momentary relief from recent selling against the Dollar this week and mostly in the wake of a UK GDP report that beat expectations by some distance when revealing a 0.5% economic expansion for May.

This followed remarks from a series of Bank of England (BoE) rate setters including Deputy Governor David Ramsden, Governor Andrew Bailey and Chief Economist Huw Pill, each of which alluded to the possibility of continued, if not larger or faster increases in Bank Rate up ahead.

“Next week brings UK CPI, jobs, and PMIs that will shape expectations ahead of the BoE’s policy decision in August where it seems highly likely that the bank will raise its policy rate by 50bps—and the data may even build speculation over a 75bps hike,” says Shaun Osborne, chief FX strategist at Scotiabank.

“Still, we think the country’s cost-of-living crisis will stay the BoE’s hand in the second half of the year. Market expectations seeing about 175bps in hikes between now and year-end look overdone and pose considerable downside risk for the GBP towards the 1.15 area,” Osborne and colleagues also said.

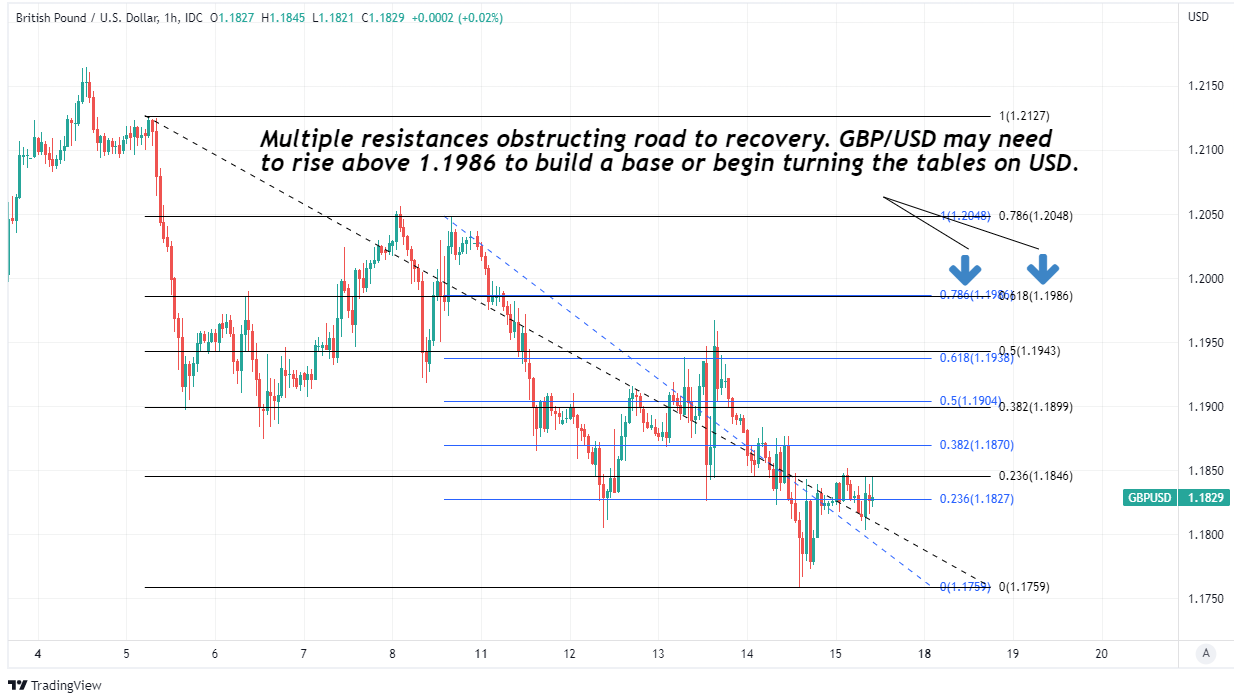

Above: Pound to Dollar rate shown at hourly intervals with Fibonacci retracements of July 05 and July 09 falls indicating possible short-term areas of technical resistance for Sterling. Click image for closer inspection.

Above: Pound to Dollar rate shown at hourly intervals with Fibonacci retracements of July 05 and July 09 falls indicating possible short-term areas of technical resistance for Sterling. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

While the UK’s GDP number surprised the market, many economists do still anticipate an economic contraction for the second quarter and the Pound’s gains in the wake of the data were short-lived, with Sterling quick to retreat further from a Dollar that rallied to new highs against many currencies.

"We think May's performance was flattered by there being one extra working day that month. The monthly activity data is likely to remain hugely volatile for the next few months, only settling down once we reach late-summer," says Andrew Goodwin, chief UK economist at Oxford Economics.

"The BoE's recent behaviour has signalled that it prioritises combatting inflation over supporting activity, so the MPC seems more likely to be exercised by the prospect of higher inflation than weaker growth as it debates whether to step up the pace of rate hikes at August's meeting," Goodwin also said on Friday.

Above: Pound to Dollar rate at hourly intervals with Fibonacci extensions of July 05, July 06 and July 08 falls indicating prospective pivot points for Sterling and possible areas of technical resistance for the Dollar. Click image for closer inspection.

Above: Pound to Dollar rate at hourly intervals with Fibonacci extensions of July 05, July 06 and July 08 falls indicating prospective pivot points for Sterling and possible areas of technical resistance for the Dollar. Click image for closer inspection.

Meanwhile, U.S. Dollar gains built following a significant upside inflation surprise for June and amid mounting market concerns about the global economy.

“Cable looks at risk of moving to 1.1600-1.1700 in the coming days on the back of USD strength,” says Francesco Pesole, an FX strategist at ING.

U.S. inflation rose to a new high of 9.1% in June and while the rate of core inflation - which ignores energy and food prices - did ebb from 6% to 5.9%, the month-on-month number surprised strongly on the upside and suggested that the road back to the 2% target will be a long and arduous one.

“The big picture should continue to favour the dollar for now. The ECB remains likely to stick with its well-flagged 25bp hike next week, to just -0.25%,” says Richard Franulovich, head of FX strategy at Westpac.

Above: U.S. Dollar Index at monthly intervals with Fibonacci retracements of 2002 downtrend indicating possible areas of short and medium-term technical resistance, and shown with USD/GBP. Click image for closer inspection.

Above: U.S. Dollar Index at monthly intervals with Fibonacci retracements of 2002 downtrend indicating possible areas of short and medium-term technical resistance, and shown with USD/GBP. Click image for closer inspection.

“The FOMC will have to remain hawkish both at the July meeting and beyond, solidifying US dollar yield support. [The Dollar Index] has probed above 109 and yield spreads suggest scope for 111 multi-week,” Franulovich added on Friday.

There was, however, some respite for beleaguered financial markets on Friday after Chinese retail sales numbers surprised strongly on the upside of market expectations for June after sales rose at their strongest pace since February.

But with coronavirus infections rising again and the country continuing its attempts to eradicate the virus, many analysts continue to see the Chinese economic outlook as a source of risk for the overall global economy.

“As long as China sticks to its Covid zero goal, further domestic economic disruptions are likely. China reported yesterday its highest daily Covid‑19 case tally since 25 May,” warns Elias Haddad, a senior currency strategist at Commonwealth Bank of Australia.

Above: Pound to Dollar rate shown at weekly intervals with Fibonacci extensions of June 2021’s Federal Reserve induced fall and other further legs lower indicating prospective pivot points or otherwise target levels. Click image for closer inspection.

Above: Pound to Dollar rate shown at weekly intervals with Fibonacci extensions of June 2021’s Federal Reserve induced fall and other further legs lower indicating prospective pivot points or otherwise target levels. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

With the Chinese economy aside, persistent increases in inflation have pushed central banks into interest rate policy actions of a scale not seen for decades, which are in turn stoking concerns in and around markets about the risk of rate setters going too far for their economies to bear.

“This can trigger a sharper undershoot in risk assets and push USD higher against most major currencies,” CBA’s Haddard warned on Friday.

These concerns have been key drivers of the strength-to-strength rally by the Dollar but it may also be relevant that the greenback appeared to be approaching technical road blocks against some currencies on Friday.

This was especially the case in relation to the Euro and Swiss Franc.

Above: USD/CHF shown at monthly intervals with Fibonacci retracements of new millenium downtrend indicating possible short, medium and long-term areas of technical support for the Franc and resistance for the Dollar. USD/CHF has been unable to sustain a break above resistance from the 23.6% retracement thus far in 2022. Click image for closer inspection.

Above: USD/CHF shown at monthly intervals with Fibonacci retracements of new millenium downtrend indicating possible short, medium and long-term areas of technical support for the Franc and resistance for the Dollar. USD/CHF has been unable to sustain a break above resistance from the 23.6% retracement thus far in 2022. Click image for closer inspection.

Both the Swiss Franc and Euro are key components of the U.S. Dollar Index and could effectively act to slow, if not outright stall the barometer’s advance in the days or weeks ahead, while any such outcome would likely also be positive for Sterling and other currencies too.

But much also inevitably depends on the market's reading of next week's event risks including June inflation figures from the UK and July's European Central Bank (ECB) monetary policy decision, and many analysts are still bearish in their outlooks for Sterling and other non-Dollar currencies.

"EUR-USD finally made a more substantial fall below parity to 0.9953, but its ability to recover back beyond parity and hold this level suggests that investors are still prudent about dragging the pair much lower ahead of the ECB meeting next week now that most option barriers have probably been hit," says Roberto Mialich, an FX strategist at UniCredit Bank.

USD-JPY is close to breaking 140, a threshold that might make Japanese policymakers more nervous, although Japan is probably one of the countries in the world that could best tolerate a depreciation of its own currency. GBPUSD is also set to remain weak, after having already been dragged down to 1.1761 and selling the pair into rally remains favored for now," Mialich added on Friday.

Above: EUR/USD at monthly intervals with Fibonacci retracements of new millenium uptrend indicating possible short, medium and long-term areas of technical support for the Euro and resistance for USD. Click image for closer inspection.

Above: EUR/USD at monthly intervals with Fibonacci retracements of new millenium uptrend indicating possible short, medium and long-term areas of technical support for the Euro and resistance for USD. Click image for closer inspection.