Dollar Bid ahead of Fed Minutes

- Written by: Gary Howes

Image © Adobe Images

The U.S. Dollar rallied through the midweek session amidst poor investor sentiment and ahead of the release of the minutes of the Federal Reserve's May meeting.

Investors are keen to find out how aggressively the Fed will raise interest rates over coming months in order to tackle inflation.

Expectations for the total number of rate hikes to be delivered by the Fed have fallen over recent days and the yield paid on U.S. government bonds fell as a result, with analysts blaming rising expectations for a recession in the U.S.

This decline in expectations and yields pulled Dollar exchange rates lower and allowed the Euro, Pound and other currencies to recover from multi-year lows.

But yields are firmer again and the Dollar is bid, creating the possibility that the broader trend of Dollar appreciation could be restarting.

"The dollar rebounded from more than two-week lows against the UK pound and Canadian dollar, and its lowest in a month against the euro," says Joe Manimbo, Senior Market Analyst at Western Union Business Solutions.

"It's hard to keep the dollar down for long amid a skittish backdrop for global growth," adds Manimbo.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Stock markets remain heavy on a combination of factors that include the war in Ukraine and a Chinese economic slowdown driven by a zero-covid policy, but perhaps more important for investors are rising U.S. interest rates.

"In the context of the Fed’s aggressive rate hiking cycle, slowing global growth and rising risk aversion, we remain positive on the dollar," says Stéphane Monier, Chief Investment Officer at Lombard Odier Private Bank.

The Federal Reserve is expected to hike rates by 50 basis points at the next three meetings, raising the cost of borrowing and draining liquidity from global markets.

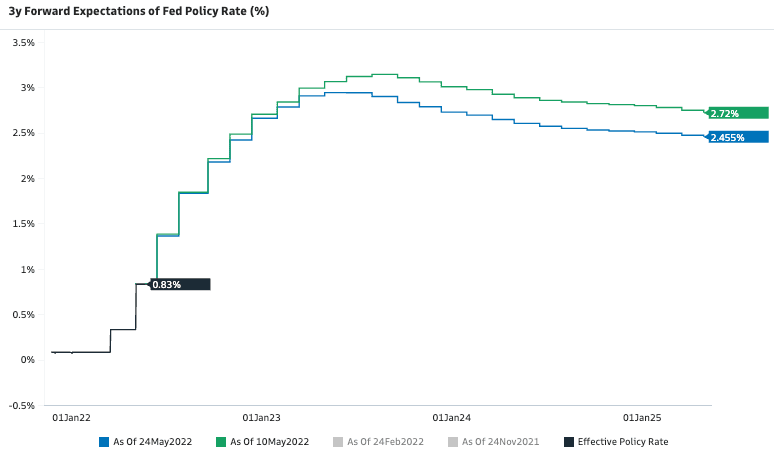

The peak Fed Funds rate expected by markets as of May 24 was at 3.0% by early 2023.

Above: Market implied expectations for the future of the Fed Funds rate. Image courtesy of Goldman Sachs.

Stock markets traditionally struggle during rate hike cycles and a more prominent turnaround in stocks might only be possible when the end of the cycle comes into view.

"In monetary-policy-driven corrections, the market has on average tended to bottom when the Fed has shifted towards easing, regardless of whether economic activity has troughed," says economist Vickie Chang at Goldman Sachs.

Investors will turn to the Fed's latest minutes for clues as to how fast and far the Fed intends to raise rates.

Rising rates are likely to stall U.S. consumer demand and cool inflation, but raises the risk the economy falls into a recession as a result.

In this environment the Dollar tends to be supported as investors opt to increase exposure to cash and with little alternatives to the Dollar as a global store of value further gains are therefore likely.

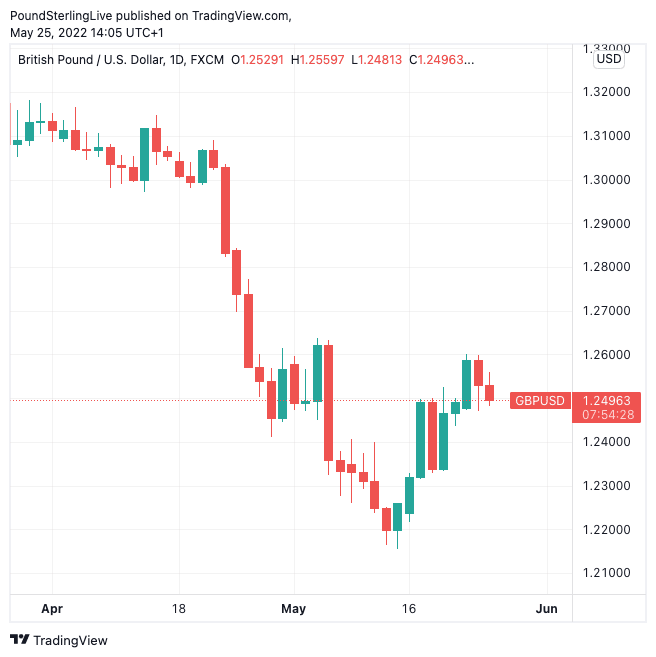

Above: GBP/USD at daily intervals.

"In order for equities to come off their recent lows (and stop declining)... it may be necessary for the market to become more confident than it is that financial conditions tightening has been sufficient and that the Fed has delivered and signalled enough tightening," says Chang.

Until such a time weakness in the Dollar will likely remain shallow.

"We do not yet feel the “heavenly stars” are aligned for persistent USD weakness. As far as Fed pricing goes, the evidence that inflation will actually slow sharply enough to change Fed trajectory is still missing," says Shahab Jalinoos, Global Head of FX Strategy at Credit Suisse.

Ahead of the Fed minutes the Pound to Dollar exchange rate has fallen back below 1.25 and the Euro to Dollar exchange rate has pared recent gains to quote at 1.0655.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks