U.S. Dollar Pares Losses after PCE Inflation Stalls and Labour Costs Rise

- Written by: James Skinner

- Dollar Index in tentative retreat from multi-decade highs

- But USD declines moderate after PCE, labour cost data

- Core PCE prices stalled but labour costs rose in March

- Likely keeps Fed on pathway to accelerated tightening

Image © Adobe Images

U.S. Dollar exchange rates pared earlier intraday losess in the final session of the week after Bureau of Economic Analysis figures showed the Federal Reserve's (Fed) preferred inflation measure stalling in March and after other data suggested that employment costs rose further last month.

Dollar exchange rates remained lower almost across the board on Friday but losses were crimped after the core measure of the Personal Consumption Expenditures (PCE) Price Index came in at 0.3% for March, unchanged from February's level, which was revised down from 0.4% to 0.3%.

The core PCE price index is more closely watched than the overall measure because it excludes changes in energy and food costs so is thought to better reflect domestic and demand-driven U.S. inflation pressures.

Friday's number pulled the annualised rate of core PCE inflation down from 5.3% to 5.2% in March but there was a rub for other currencies coming from the Bureau of Labor Statistics's measure of employment costs, which rose by 1.4% during the three months to the end of March.

"These data have no immediate policy implications because the Fed has long been set on a 50bp hike in May, but at the margin it makes a second 50bp hike in June more likely," says Ian Shepherdson, chief economist at Pantheon Macroeconomics.

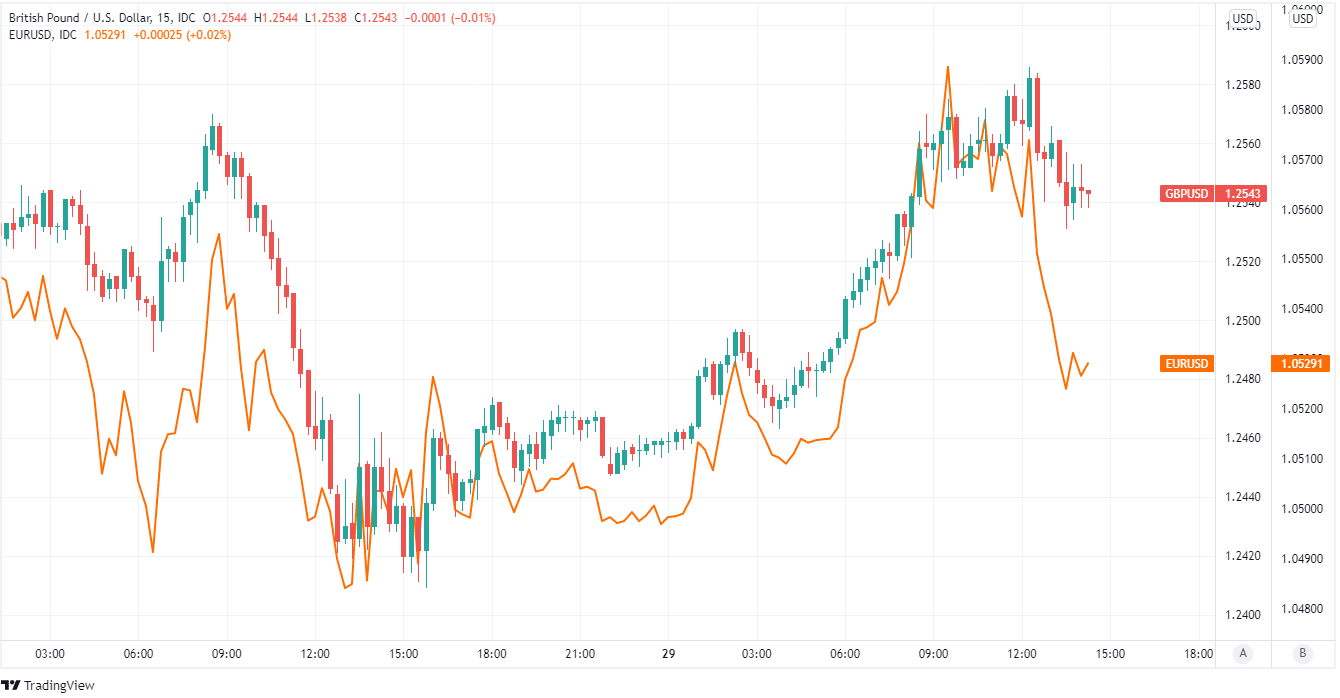

Above: Pound to Dollar rate shown at 15-minute intervals alongside EUR/USD. Click image for closer inspection.

Above: Pound to Dollar rate shown at 15-minute intervals alongside EUR/USD. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Pantheon's Shepherdson cites the Employment Cost Index as something that could be more likely to catch the eye of Fed policymakers than Friday's PCE inflation data and this might be because accelerating wage costs are widely thought by central bankers to have a significant influence on inflation.

Accelerating employment costs, and especially wage costs, could potentially prolong the period over which inflation rates remain at levels that are far above the Fed's 2% average inflation target, hence the view that Friday's data may impact the central bank's June monetary policy decision.

"After that, all bets are off, and the pace of tightening could easily be slowed by the meltdown in the housing market, now in its early stages, and the coming rapid decline in inflation," Shepherdson said following a review of the figures.

All of this is one candidate explanation for why the Dollar's Friday losses were pared back briefly in the wake of the data, leading the ICE Dollar Index to retreat from what was previously its highest level for two decades.

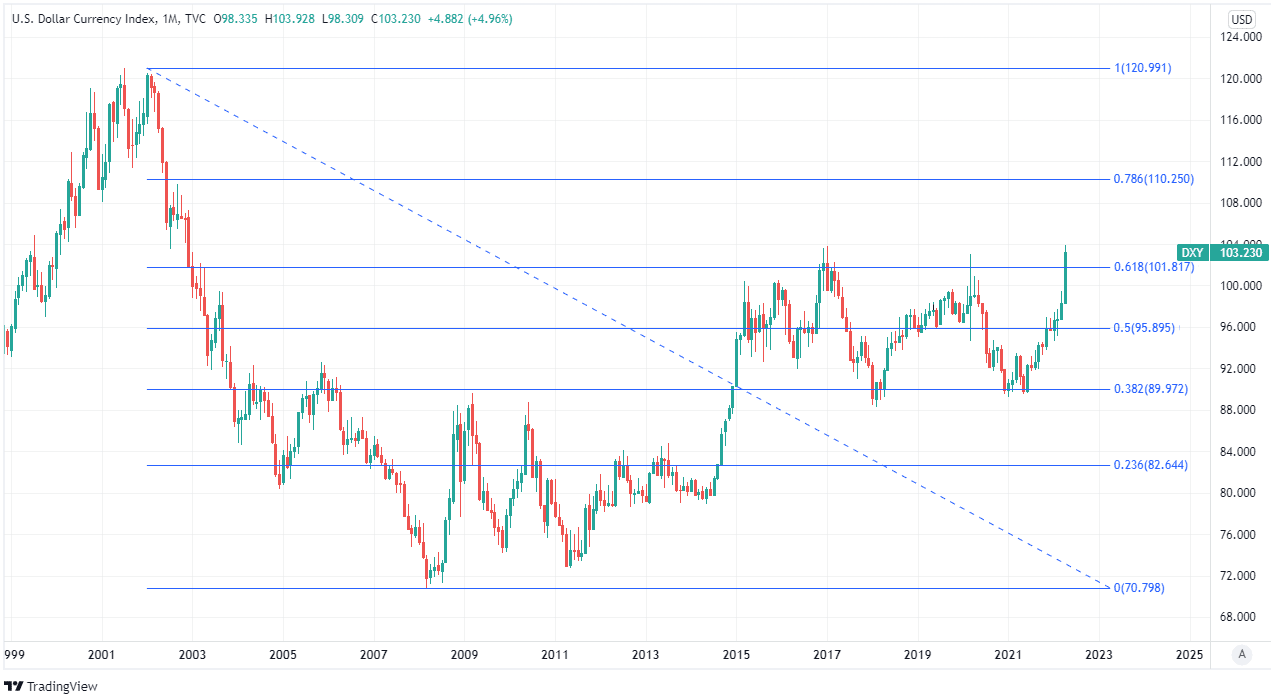

Above: U.S. Dollar Index shown at weekly intervals with Fibonacci retracements of 2020 decline indicating various levels of technical resistance to the Dollar's recovery. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"The debate on whether euro goes to parity has returned for the fifth time in seven years. While euro bounced from trend line support in the 1.08s to the 1.11s, no bottom formed thereafter to support a change in trend," says Paul Ciana, chief technical strategist at BofA Global Research.

"Because of the break down this month in euro below 1.08 and 1.0636 (1Q20 low) and the DXY near an 18 year high, the likelihood of an extended dollar up trend has increased. A DXY monthly close above 103.82 would be an additional technical break to look for to favor further strength," Ciana also said on Friday.

The Dollar strengthened broadly during April with the Fed increasingly having set itself on a frank and unapologetic course to raise interest rates at the fastest pace for decades this year as it seeks to rein in runaway inflation rates.

Much of that inflation began with surging international energy and food costs that have been felt globallly, although U.S. prices pressures have been bolstered by an outperforming economy that was helped along repeatedly during the pandemic years by large economic aid packages from Congress.

Above: U.S. Dollar Index shown at monthly intervals with Fibonacci retracements of 2002 decline indicating various levels of technical resistance to the Dollar's recovery. Click image for closer inspection.

Above: U.S. Dollar Index shown at monthly intervals with Fibonacci retracements of 2002 decline indicating various levels of technical resistance to the Dollar's recovery. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"We suspect the weakness in the USD thus far today is due to a combination of yesterday's disappointing Q1 US GDP estimate (which was admittedly weak on real net exports, federal spending, and inventories, but still extremely strong in nominal terms), profit taking on recently initiated USD long positions, and verbal intervention from China on easing policy," says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

Minutes of the March Federal Open Market Committee meeting showed earlier this month that “many” Fed policymakers felt that “one or more” larger-than-usual 0.5% increases in the Fed Funds interest rate could be necessary.

In addition, the minutes also confirmed that the Fed may begin shrinking its near-$9 trillion balance sheet at a pace of around $95BN per month as soon as May 2022, which is much faster pace than the average $34BN per month pace of reduction seen between January 2018 and September 2019.

Meanwhile, Chairman Jerome Powell indicated last week that next week's Fed policy decision could see the bank lift the Fed Funds rate by 50 basis points, taking up into a 0.75% to 1% range, while other remarks made clear that further similarly large steps could still be taken in the months ahead.