Pound-Dollar Rate at Risk of Fall Below 1.25: Analysts

- Written by: James Skinner

- GBP/USD nearing lowest since July 2020

- Could find support near 1.2496 short-term

- But sellers see risk of further losses ahead

- As BoE, Fed policy divergence set to grow

Image © Adobe Images

The Pound to Dollar exchange rate was closing in on a major level of technical support on the charts during the mid-week session, which could potentially act to slow its declines, although some sellers have warned there’s a risk of it sliding below 1.25 in the days ahead.

Sterling was on course for a fifth consecutive decline against the greenback on Wednesday as the U.S. currency strengthened almost across the board in price action that brought the Pound-Dollar rate to within arm’s reach of a major medium-term technical support level around 1.2496 on the charts.

The Dollar has been lifted and the Pound pummeled by a perfect storm of domestic and international factors that could be set to remain a weight around the ankles of GBP/USD for some time yet, giving rise to the risk of a break beneath the above-referenced level in the near future.

“We’ve been short GBP/USD since late February owing to the Russia-Ukraine conflict, the UK government raising taxes and doing little to avert a cost of living crisis, relative central bank pricing for the Fed and BoE and more,” says Jordan Rochester, a strategist at Nomura.

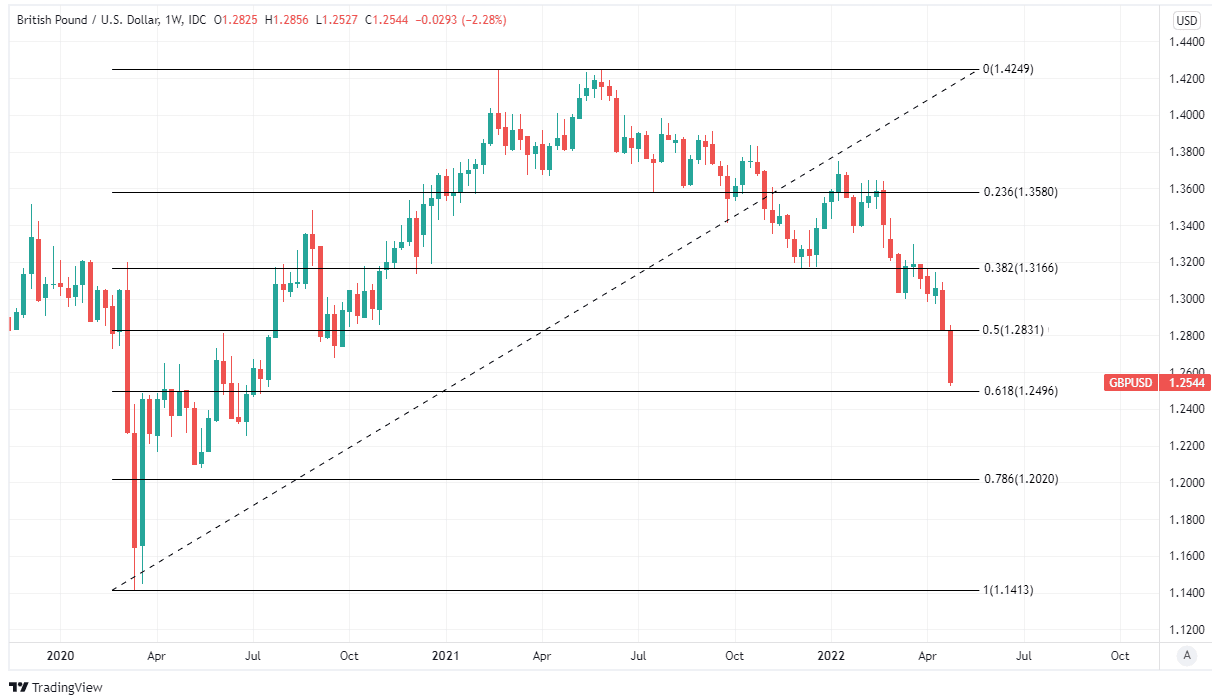

Above: Pound to Dollar rate at weekly intervals with Fibonacci retracements of 2020 recovery indicating medium-term areas of technical support for Sterling. Click image for closer inspection.

Above: Pound to Dollar rate at weekly intervals with Fibonacci retracements of 2020 recovery indicating medium-term areas of technical support for Sterling. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

“Since we entered the trade the outlook for global growth has worsened and our US team has revised up its Fed call for more hikes. This is why instead of taking profit today, we are lowering our target to 1.25 and levels last seen in 2020,” Rochester wrote in a Monday research briefing.

The Nomura team is currently targeting a fall to 1.25 for Sterling but Rochester warned on Monday that it would fall even lower “if a policy response to the growth shock is not seen soon,” and since then developments in China and international energy markets have only made this even more relevant.

“The 1.2500 support could prove a rather strong one, but further deterioration of the external environment could see that level being heavily tested before the end of the week,” says Francesco Pesole, a strategist at ING.

Rising coronavirus infections and renewed containment measures in some of China’s key metropolitan hubs including Beijing have fomented risks of further inflationary disruption to international supply chains for manufactured goods while Russian government policies have lifted energy prices further.

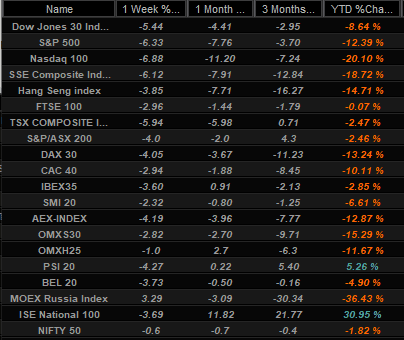

Above: Selected stock market indices and returns over various short-term horizons. Source: Netdania Markets.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

“The step-up in risks to Chinese growth is set against the widespread acceptance that the war in Ukraine could continue for many months and amid an anticipated aggressive tightening in monetary policy by the Federal Reserve this year,” says Jane Foley, head of FX strategy at Rabobank.

All of these factors are a stimulant for the Dollar and a headwind for Sterling because they potentially reinforce expectations for divergence between Federal Reserve (Fed) and Bank of England (BoE) monetary policy stances.

“GBP/USD is clearly oversold, suggesting that those who have been short of GBP on the break of 1.30 may look to take some profit. However, the move looks set to run further, towards 1.2480 in the first instance,” says Jeremy Stretch, head of FX strategy at CIBC Capital Markets.

“Sliding retail sentiment adds to political woes and risks of another spat with the EU over the Northern Ireland protocol. Together they provide good reasons to maintain a short GBP bias,” Stretch wrote in a Wednesday market commentary.

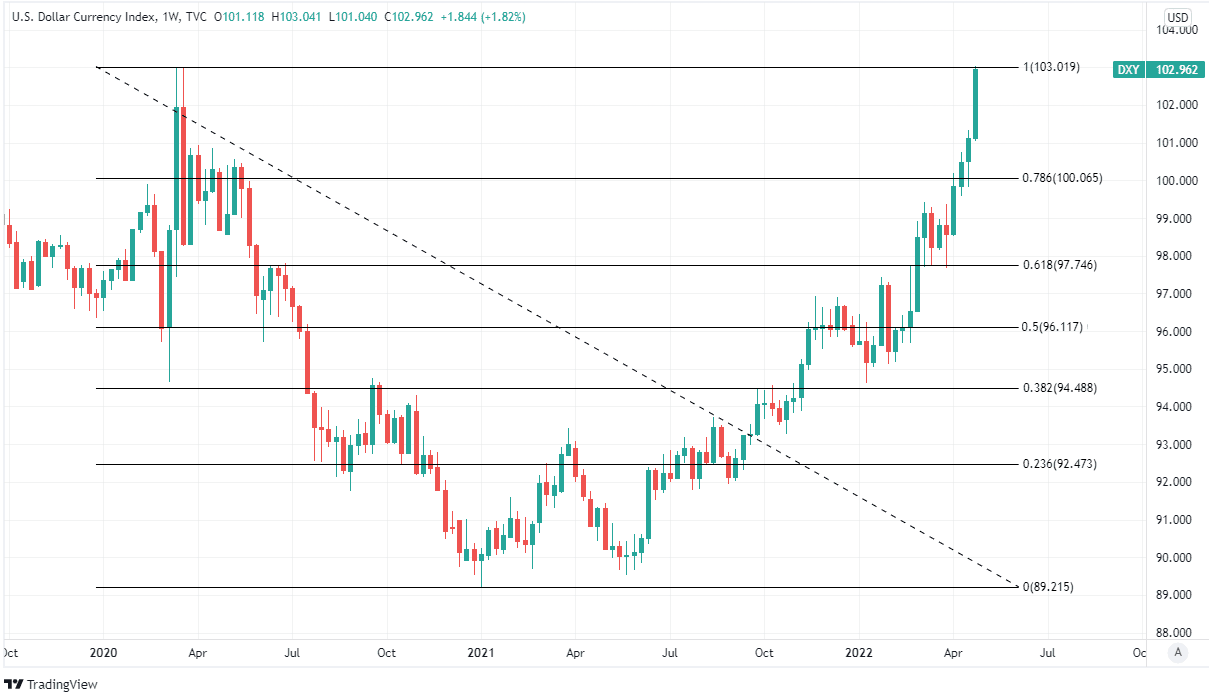

Above: ICE U.S. Dollar Index at weekly intervals and shown testing the 100% Fibonnaci retracement of 2020’s downtrend; an area of possible short-term technical resistance to any further recovery. Click image for closer inspection.

Above: ICE U.S. Dollar Index at weekly intervals and shown testing the 100% Fibonnaci retracement of 2020’s downtrend; an area of possible short-term technical resistance to any further recovery. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The BoE warned in its February and March policy decisions of uncertainty about the extent to which it might need to raise Bank Rate further this year after lifting the benchmark from 0.1% to 0.75% between December and March.

That uncertainty stems from difficulties in gauging exactly how much rising energy and food costs would be likely to reduce demand elsewhere within the economy and so, in the process, help to bring down the rate of inflation.

But it’s a risk for Sterling because markets have bet heavily on a lengthy series of additional rate rises coming later this year, and is a particular risk for the Pound-Dollar rate due to Fed's monetary policy stance.

Minutes of the March Federal Open Market Committee meeting showed earlier this month that “many” Fed policymakers felt that “one or more” larger-than-usual 0.5% increases in the Fed Funds interest rate could be necessary this year to rein in runaway U.S. inflation rates.

Meanwhile, Chairman Jerome Powell indicated last week that this measure of increase is likely on the table for the Fed’s next meeting in May.