Pound / Dollar Week Ahead Forecast: Atmosphere Thins Once Above 1.36

- Written by: James Skinner

- GBP/USD looking to cement recovery of 1.35

- Eyeing retest of 1.36 but may struggle above

- As strong USD limits GBP recovery prospects

- Fed speakers in focus ahead of UK’s CPI data

Image © Adobe Images

The Pound to Dollar rate has stabilised above the recently-recovered 1.35 level and may again attempt to regain 1.36 over the coming days but an increasingly hawkish Federal Reserve (Fed) policy outlook could be likely to constrain Sterling above there.

Pound Sterling held up better than many other major currencies during last Friday’s bout of strength in the U.S. Dollar, which was lifted ahead of the weekend by remarks from the Federal Reserve’s James Bullard as well as by investor risk aversion connected to events around Ukraine.

The Pound-Dollar rate had been testing an important level of technical resistance around 1.36 on Friday before being sunk by reports in U.S. and international media suggesting that an extension of Russia’s 2014 incursion into the country could be likely some time this coming week.

"Our view is that we do not believe he has made any kind of final decision - or we don’t know that he has made any final decision," National Security Advisor Jake Sullivan later said, in reference to Russia’s President Vladimir Putin during press interviews from the White House on Friday evening.

Although White House officials later acknowledged that an attack on Ukraine is not actually certain, the alleged threat of one has helped to lift the Dollar and is something that could potentially have a suppressive effect on the Pound to Dollar rate throughout the opening stage of the week.

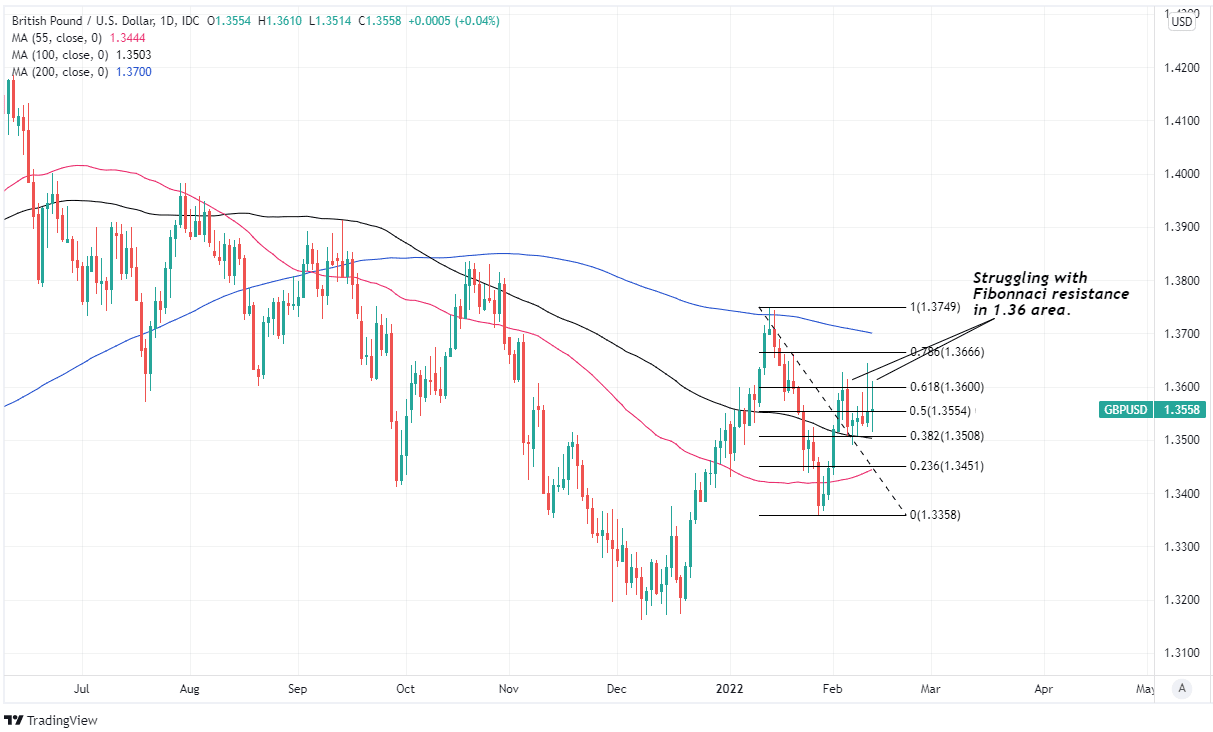

Above: GBP/USD shown at daily intervals with Fibonacci retracements of January decline indicating likely areas of technical resistance to any further recovery by Sterling. Selected moving-averages denote possible areas of technical support and resistance for Sterling.

- GBP/USD reference rates at publication:

Spot: 1.3532 - High street bank rates (indicative band): 1.3158-1.3253

- Payment specialist rates (indicative band): 1.3410-1.3464

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

Last week saw the Pound-Dollar rate draw support from dip-buyers each time episodes of weakness took it back toward the 1.35 handle, which coincides closely with Sterling’s 100-day moving-average and is a level around which it might continue to find support over the coming days.

“The fact that this range-bound period has now lasted longer than the rebound off ~1.3350 suggests the window for a continuation of its gains is closing—and the GBP may in fact head back under 1.35 to resume the downward trend since last June,” warns Juan Manuel Herrera, a strategist at Scotiabank.

“Support is the figure alongside the 100-day MA of 1.3505 followed by the 50-day MA of 1.3463,” Herrera also said in a Friday market commentary.

While geopolitics will almost inevitably be a key focus for financial markets this week, the Pound-Dollar rate is also likely to be sensitive to remarks from the Federal Reserve Bank of St. Louis President James Bullard, who’s scheduled to be interviewed by CNBC News at 16:00 London time on Monday.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

It was Federal Open Market Committee member James Bullard who suggested last Thursday that the Fed should consider lifting its interest rate by a larger-than-usual increment of 50 basis points in March following the release of official data showing U.S. inflation rising to a four-decade high of 7.5% in January, which lifted the U.S. Dollar sharply on Thursday and weighed on the Pound-Dollar rate ahead of the weekend.

“The CPI boosted both market and analysts’(including ourselves) expectations that the FOMC will start its tightening cycle with a 50bp hike in March. This week’s FOMC’s minutes from the January meeting may reveal a debate about a 50bp start to the tightening cycle,” says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

“Given aggressive market pricing for near term policy tightening, the USD may ease if the minutes are not hawkish enough. The FOMC is not alone in responding to high inflation. As a result, we expect any further USD gains will be modest in the absence of an equity market sell-off,” Capurso and colleagues wrote in a Monday research briefing.

Wednesday’s release of minutes from January’s Federal Reserve meeting at 19:00 London time is also likely to be a point of focus for the greenback and Pound-Dollar rate, although some analysts say the bar is high for these to lift the U.S. Dollar further from current levels.

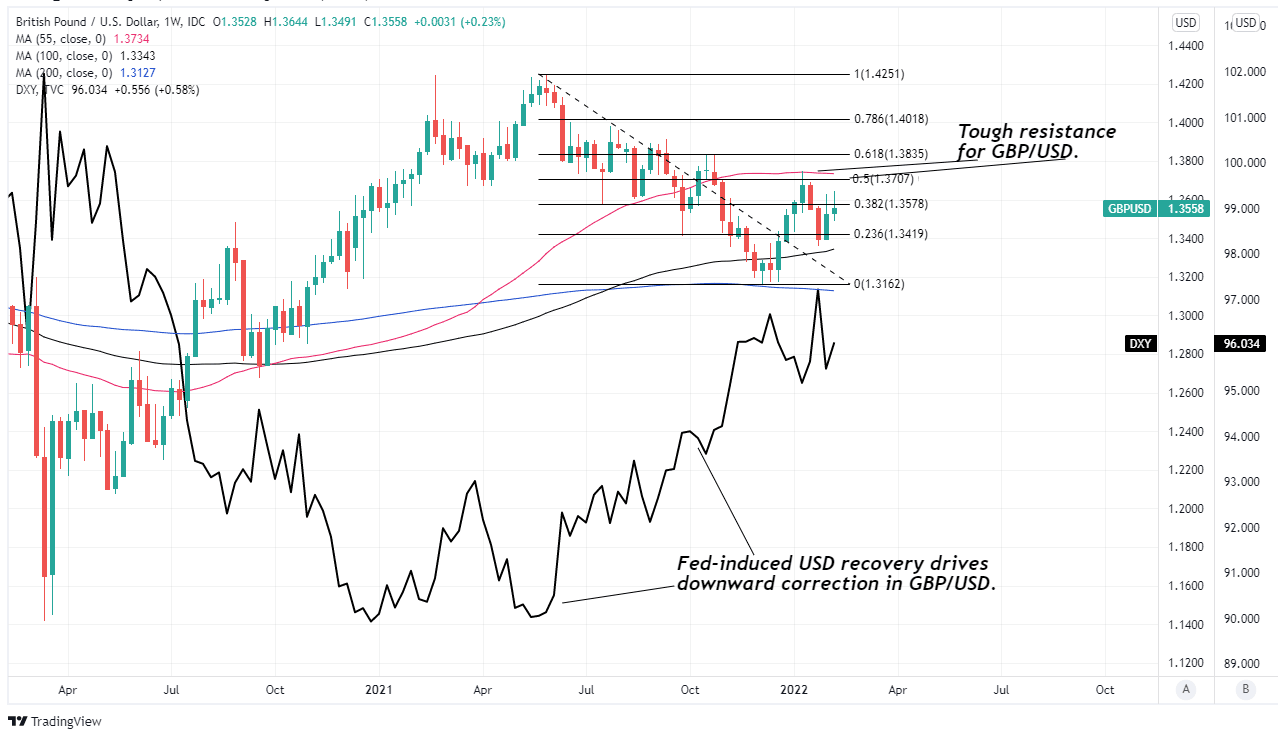

Above: GBP/USD shown at weekly intervals with Fibonacci retracements of June 2021 decline indicating likely areas of technical resistance to any further recovery by Sterling. Selected moving-averages denote possible areas of technical support and resistance for Sterling. Shown alongside U.S. Dollar Index.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

For Sterling the highlight of the week ahead is Wednesday morning’s 07:00 release of inflation figures for January, which might provide the Pound-Dollar rate with another opportunity for an attempted recovery of the 1.36 handle if they reinforce recently-mounting market expectations for an accelerated pace of interest rate rises at the Bank of England (BoE) this year.

“While Omicron had a relatively muted economic impact, the cost of living crisis is shaping up to be a key risk to the recovery in 2022. This will be on the radar of MPC members who appear split not only on the appropriate level, but also pace of tightening. Next week's labour market and inflation data are in focus,” says Fabrice Montagne, chief UK economist at Barclays.

“We expect headline and core CPI for January to moderate slightly (fc. 5.2% and 4.1% y/y, respectively) from December (5.4% and 4.2% y/y, respectively), with clothing and footwear set to be a key negative contributor, when prices usually fall in January post Christmas. That said, we see upside risks to this given evidence from the Bank of England's Agents' survey that discounting in non-food retail was lower and less widespread than normal during the post-Christmas sales,” Montagne and colleagues said in a note to clients on Friday.

Consensus among economists suggests UK inflation is likely to have held steady around 5.4% during January, although recent upside surprises from the U.S. and Eurozone for the same month could be an indication that these expectations are too optimistic.