Dollar to Get Another "Leg-up" says JP Morgan

- Written by: Gary Howes

Image © Adobe Images

A leading U.S. investment bank is prepared for another broad move higher in the value of the U.S. Dollar, posing downside risks for the Pound-Dollar exchange rate.

JP Morgan says the U.S. Federal Reserve provides the foundation for the move with a promise to deliver multiple rate hikes over the next two years.

The Federal Reserve in January communicated that the U.S. economy had reached full employment and that they would therefore need to raise interest rates to tackle inflation.

"The market is now having to take seriously the prospect that the Fed acts hard and for a more protracted period, irrespective of the reaction of risk markets," says Daniel P Hui, an analyst at JP Morgan. "This, in turn, has opened the door for another leg-up in the overall dollar index".

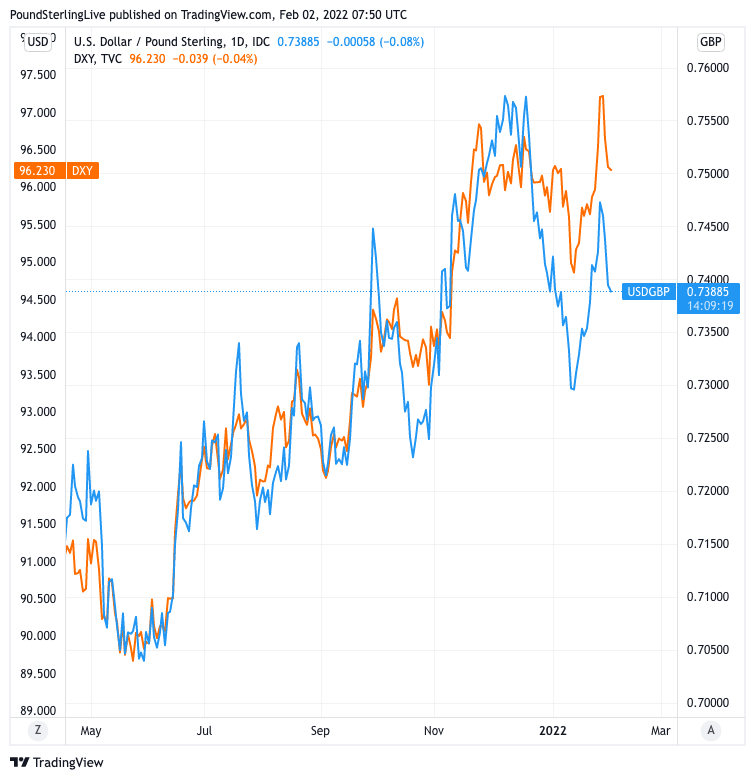

The Dollar rallied in the second half of 2021 as markets anticipated a rate hike could come in 2022; this dynamic has been reinforced by the Fed committing to more rates, and sooner.

"If the markets coalesce around six hikes a year, and raise the terminal rate to 2.25% for sake of argument, this might imply 3% upside for the dollar," says Hui.

Above: The Dollar index (orange) and USD/GBP (blue - note this is an inversion of GBP/USD). Chart shows the influence of the Dollar index on the Pound-Dollar exchange rate.

- GBP/USD reference rates at publication:

Spot: 1.3530 - High street bank rates (indicative band): 1.3155-1.3250

- Payment specialist rates (indicative band): 1.3155-1.3250

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

This calculation is based off of historical rate relationships and JP Morgan assumes "some beta of empathetic Rest of World rates repricing as U.S. yields rise".

"Incidentally, this 3% is also the average historical rise in the dollar typically seen 2-3 months before Fed lift-off and the peak of US OIS and USD pricing," says Hui.

The Dollar index - a broad measure of the value of the U.S. Dollar - fell at the start of 2021 amidst a strong start to the year for equities and a clear-out of 'long' Dollar positioning.

But the Fed's subsequent hawkish communications combined with a retreat by global equity markets propelled the U.S. currency to its highest level since July 2020.

The Pound to Dollar exchange rate rose to a multi-month high at 1.3748 in early January - in tandem with the Dollar sell-off - but has since retreated back to the 1.34-1.35 area.

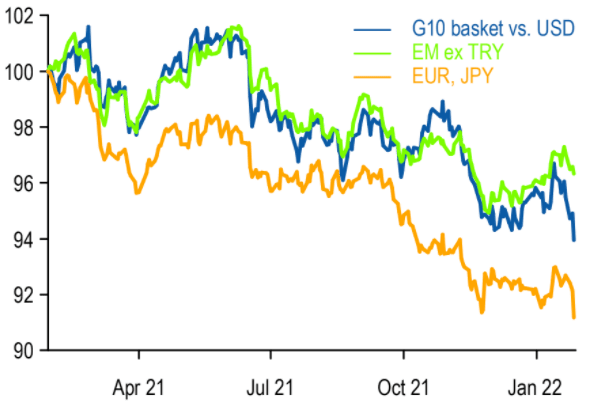

Above: "USD strength continues to be primarily vs. other G10 FX rather than EM" - JP Morgan. Chart shows FX basket performance vs. USD; spot indices. Source: J.P. Morgan.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Dollar could further benefit if market concerns surrounding geopolitics escalates, with the deterioration of the US-Russia-Ukraine situation being watched.

JP Morgan's economists warn of downsides to global growth from a geopolitical-side supply surge in energy prices linked to Russia-Ukraine.

"The macroeconomic implications from a worst-case scenario of war and an intentional withholding of oil exports could be more severe than other supply shocks from the last decade," says Hui.

Illustrative calculations by JP Morgan shows a sudden spike in oil up to $150 per barrel could shave 3% off of their current first-half 2022 global growth forecasts.

The Dollar would be an obvious beneficiary as global currencies with a high sensitivity to growth were to retreat.

JP Morgan's foreign exchange strategists say they are looking to sell the Euro and Yen against the Dollar, largely in anticipation of higher U.S. interest rates relative to those in the Eurozone and Japan.

"We expect FX to still be driven by the twin forces of policy divergence with focus on the Fed and higher commodity prices, although geopolitical risks have now emerged as a risk factor as well," says Hui.