Pound / Dollar Rate Attempts to Draw Line Under Six Month Spiral of Losses

- Written by: James Skinner

- GBP/USD making technical progress on charts

- After recovery above key average, retracement

- Suggests a possible bottom in six month spiral

- Virus curbs, BoE & Fed top of new year agenda

Image © Adobe Images

The Pound to Dollar rate attempted a recovery off 2021 lows in the final week of trading ahead of the festive break, reaching key technical milestones along the way in what may be a tentative effort by Sterling to draw a line under a six month spiral of losses.

Sterling set new 2021 lows when trading down to 1.3162 against the greenback during the opening days of December although last Thursday’s short-lived rally back above 1.33 proved this week to be a forewarning of what was to come.

The Pound-Dollar rate rallied over the course of Tuesday and Wednesday to enter the Thursday session back above 1.33 and within arm’s reach of the highs achieved when the Bank of England surprised the market with its decision to lift Bank Rate back to 0.25% last Thursday.

“GBP/USD has built good support near 1.3200, after failing to sustain breaks below that level over the past few weeks,” says Elias Haddad, a senior currency strategist at Commonwealth Bank of Australia.

“Bottom line: the BoE’s policy normalisation process is intact and GBP can edge higher especially against currencies of dovish central banks, like the ECB,” Haddad and colleagues said on Wednesday.

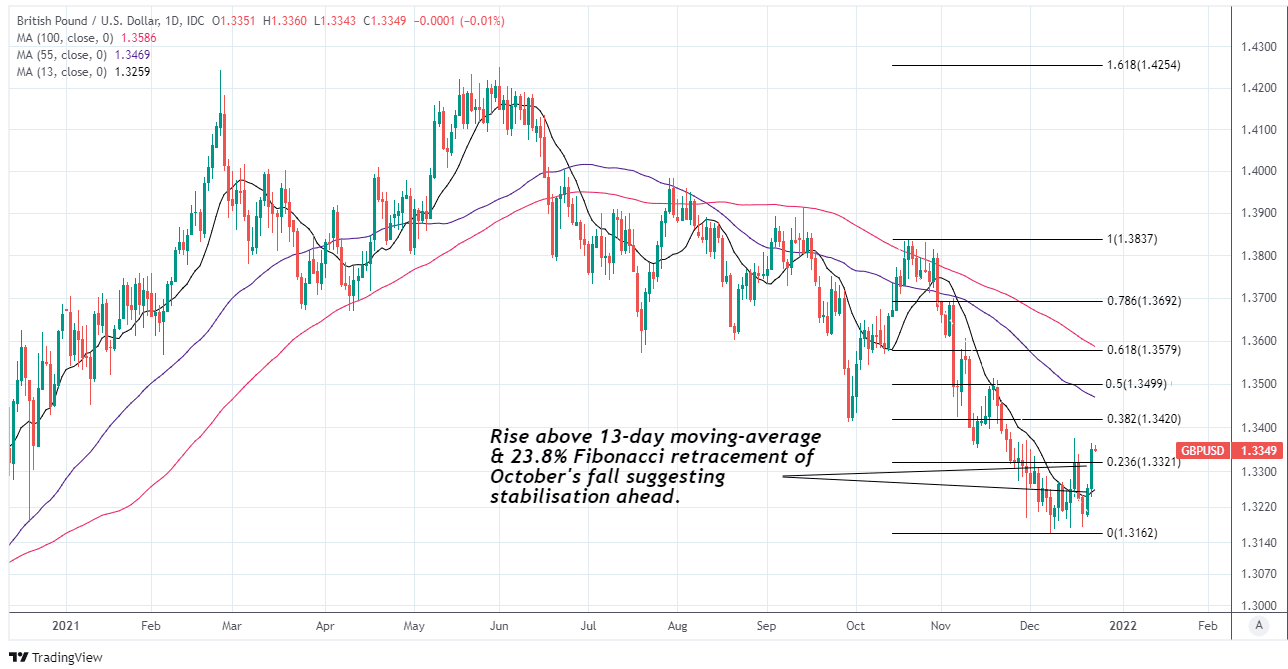

Above: Pound-Dollar rate at daily intervals with 13-day moving-average and Fibonacci retracements of October fall indicating likely areas of resistance.

- GBP/USD reference rates at publication:

Spot: 1.3420 - High street bank rates (indicative band): 1.3050-1.3144

- Payment specialist rates (indicative band): 1.3299-1.3353

- Find out about specialist rates, here

- Set up an exchange rate alert, here

Sterling was undeterred this week by data released on Wednesday suggesting that third quarter economic growth was slower than previously thought with the Office for National Statistics estimating a 1.1% increase in GDP, down from the 1.3% initially estimated.

“The Omicron variant is likely to push down UK GDP in December and in 2022 Q1. But as the BoE points out “the experience since March 2020 suggests that successive waves of Covid appear to have had less impact on GDP,” CBA’s Haddad notes.

Nor was the Pound-Dollar rate held back by last week’s Federal Reserve policy decision and accompanying forecasts, which accelerated the winding down of the bank's quantitative easing programme so that it ends in March 2022 rather than June and suggested that interest rates could rise sooner than previously thought likely.

“Financial conditions are changing to reflect, you know, the forecasts that we made and -- which was, I think, fairly in line with what markets were expecting,” said Chairman Jerome Powell, in response to a question from CNBC’s Steve Leisman at the Fed’s press conference last week.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The Fed's new forecasts showed a majority of Federal Open Market Committee members saw themselves as being likely to vote for three increases in the Fed Funds interest rate next year, although many analysts had come to expect exactly that kind of a hawkish shift in stance ahead of December's meeting.

Meanwhile, the Pound-Dollar rate was quick to rise after, providing an early indication that the greenback's six-month advance may be near its end and opening the door for Sterling to reach key technical milestones this week.

Sterling extended the Pound-Dollar rebound after last Thursday's BoE decision and this week recovered above its 13-day moving-average and overcame resistance from the 23.8% Fibonacci retracement of October's decline.

“This breakout significantly reinforces our view that 1.3189/35 will remain a floor for the unfolding of a consolidation range,” says David Sneddon, head of technical analysis strategy at Credit Suisse, referring to the Pound-Dollar rate’s initial rise above 1.3259 last week.

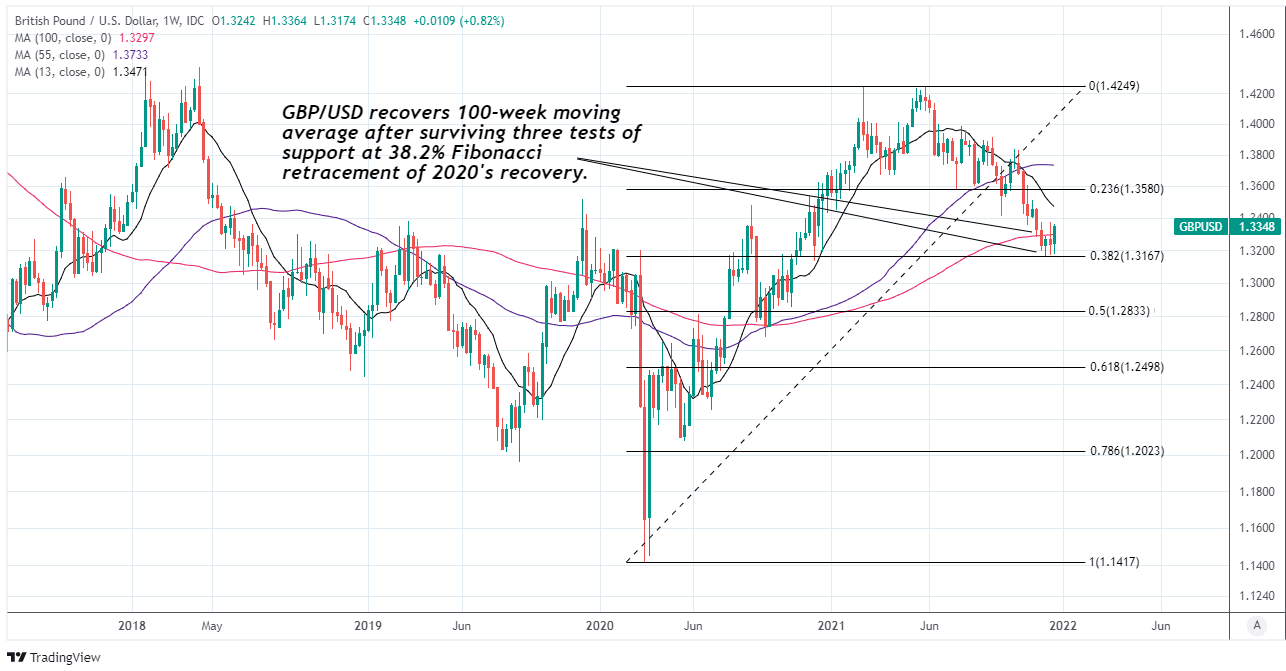

Above: Pound-Dollar rate at weekly intervals with major moving-averages and Fibonacci retracements of 2020 rebound indicating likely support levels.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Recent gains lend weight to the views of technical analysts at Credit Suisse and BofA Global Research who’ve been suggesting of late that the Pound-Dollar rate’s six-month decline could also be nearing at least a temporary end.

Credit Suisse looks for a range trade to develop as the Pound-Dollar rate consolidates between its recent lows and estimated highs around 1.3371 over the coming weeks, although the technical strategy team at BofA Global Research sees scope for the Pound-Dollar rebound to extend as far as 1.36.

“During the last month we have viewed GBP/USD as a contrarian long idea at about 1.32 and while above the 1.3150 support (Reference reports: Dec 13, Dec 6 and Nov 23). Market reactions in response to the deluge of central bank meetings and data releases this/last week affirm this view,” says Paul Ciana, chief technical strategist at BofA Global Research.

“While support continues to hold we see tactical scope for GBP/USD to move higher into year-end such as to the 50d SMA now at 1.3491 and possibly the top of the channel at 1.36 (which is the top of the channel during the first week of 2022),” Ciana wrote in a review of Sterling’s charts last Friday.