Surging Gas, Oil Price Could Benefit U.S. Dollar against the Euro and Dollar: Analysts

- Written by: Gary Howes

- GBP/USD reference rates at publication:

- Spot: 1.3602

- Bank transfers (indicative guide): 1.3226-1.3321

- Money transfer specialist rates (indicative): 1.3480-1.3534

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

An environment of historically elevated inflation is likely to benefit the U.S. Dollar at the expense of the Euro and British Pound shows new research.

Inflation has fast replaced the Covid-19 Delta variant as the prime focus for financial markets and economists thanks to an ongoing surge in energy prices.

Oil prices are hitting multi-year highs at the time of writing on October 05 while gas prices in Europe and the UK have printed fresh records, again.

For foreign exchange markets, the outlook now rests with how these rising energy prices translate into inflation and what the subsequent central bank reactions they subsequently elicit.

"A rare combination of post-COVID-19 pent-up demand, severe supply shortages, high energy costs and temporary special factors have driven inflation on both sides of the Atlantic to well beyond what central banks and we had expected at the start of the year," says Holger Schmieding, Chief Economist at Berenberg Bank.

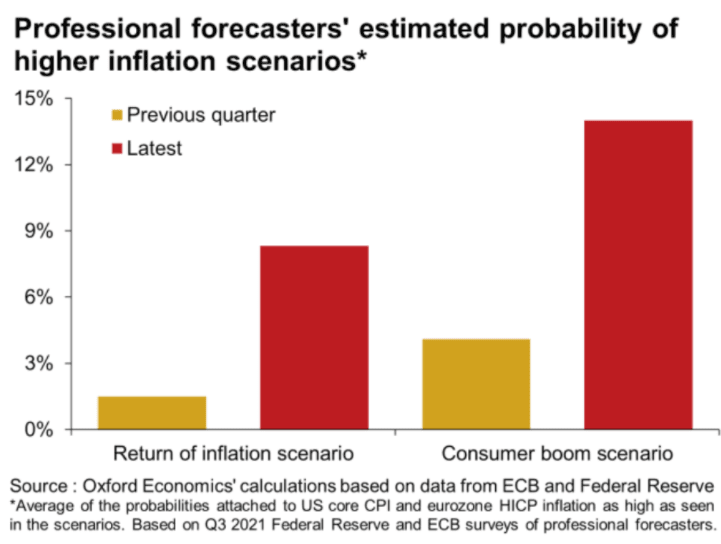

Image courtesy of Oxford Economics.

Brent crude oil prices have recently risen to above $80/bbl, up more than 50% since the start of 2021.

Natural gas prices in Europe have increased by over 350% in 2021 while UK contracts have risen 300%.

The surge in price comes after stockpiles in Europe and the UK were seen at their lowest levels heading into Autumn in more than ten years.

Supplies from Russia and other producers remains limited and strong demand from China and northern Asian countries mean any seaborne gas attracts intense bidding interest.

New records were set on Tuesday: Dutch gas futures jumped 18% to €114/megawatt-hour.

German futures for 2022 delivery rose to €155/megawatt-hour.

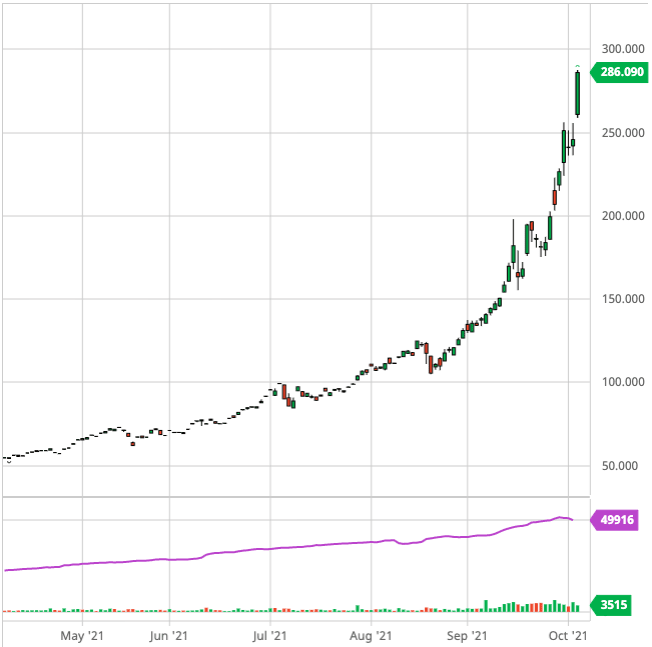

UK gas for November delivery hit £287/therm.

Above: UK gas contract for November delivery, source: BarChart.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The weighting of energy in the Eurozone HICP basket is 9.5%, with liquid fuels such as petrol, diesel and heating oil making up the largest component at 4.1% of total HICP.

Electricity accounts for 2.9% and gas 1.9%.

But, for the UK the energy input to CPI inflation is less at 6%, with liquid fuels accounting for 2.8% of the basket, electricity 1.9% and gas 1.2%.

"This suggests that, mechanically, every 10% increase in consumer gas and electricity prices adds around 0.5pp to headline inflation in the Eurozone and 0.3pp in the UK," says Anna Titareva, Economist at UBS.

In response to rising inflation levels economists anticipate central banks to raise interest rates, fearing that the elevated supply prices will act as a propellent on inflation elsewhere in the economy.

"We currently look for two Fed hikes in 2H 2022 and two BoE moves next year. We now expect the BoE to start with a first step in May instead of August 2022, with the first ECB rate increase in late 2023," says Schmieding.

Typically, expectations for higher interest rates in one country or bloc relative to another would be considered beneficial to its currency.

But Jonas Goltermann, Senior Markets Economist at Capital Economics, warns that such assumptions can be discarded if inflation proves longer-lasting than initially anticipated.

"We think that a return to a regime of higher and less stable inflation in many major economies would result in a rise in exchange rate volatility," says Goltermann.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

He adds that over time countries which experience higher inflation will see their currencies depreciate.

"Over longer time horizons countries with relatively high inflation tend to experience depreciation of their nominal exchange rates," he says.

Economists are still trying to understand the nature of the current inflationary boost, and how long it might last; a difficult task given they have spent the past decade trying to understand the prevalent deflationary forces.

As such, confidence in which countries/currencies will benefit remains difficult to ascertain.

But Capital Economics thinks the U.S., UK, Canada and Australia, are more at risk of sustained higher inflation.

"This suggests to us that their currencies will weaken in nominal terms relative to the currencies of many European and Asia economies, where we expect inflation to remain subdued," says Goltermann.

Such a call flips on its head the belief that countries experiencing low inflation would stagnate, as would their currencies.

This is largely because of the distinction that inflation the stems from economic growth is preferred to inflation arising from external global shocks.

Kit Juckes, Macro Strategist at Société Générale says the Dollar could in fact prove a beneficiary in an environment of elevated inflation.

"There was a time when tightening monetary policy to fight inflation despite soft growth was good for a currency, but not in this economic climate," says Juckes in a regular currency briefing.

"For now, I think inflation fear is dollar positive and euro (or sterling) negative," says Juckes.

Foreign exchange performance over the past month - which incorporates rising fears for elevated inflationary levels - shows the Dollar to be an outperformer behind the Norwegian Krone and Canadian Dollar.

This outperformance by the Dollar comes largely on the back of investors bringing forward the date they expect the Federal Reserve to raise interest rates into 2022.

But that the NOK and CAD are the outright winners of the past month is in itself a story: these two currencies are clear beneficiaries given their status as 'petro' currencies. (See Canadian Dollar: Further Oil Price Gains to Prove Supportive).

Currencies belonging to energy producers are the obvious winners, but what is less obvious is which countries will be outright losers.